Agencies as Litigation Gatekeepers

abstract. A central challenge in the modern regulatory state is rationalizing and coordinating multiple, overlapping, and interdependent public and private enforcement mechanisms. To that end, recent years have seen mounting calls to vest administrative agencies with litigation “gatekeeper” authority across a range of regulatory areas, from environmental protection and civil rights to antitrust and securities. Agencies, it is said, can use their expertise and synoptic perspective to weigh costs and benefits and determine whether private rights of action should lie at all. Alternatively, agencies might be given the power to evaluate lawsuits on a case-by-case basis, blocking bad cases, aiding good ones, and otherwise husbanding available private enforcement capacity in ways that conserve scarce public resources for other uses. Yet despite the proliferation of such calls, there exists strikingly little theory or evidence on how agency gatekeeper authority either should or would work in practice. This Article aims to fill that gap by offering a systematic account of this often-invoked but under-theorized role for agencies. Drawing on theories of agency behavior and empirical analysis of the gatekeeper regimes currently in existence, this Article sketches the case for and against vesting agencies with litigation gatekeeper authority across a range of regulatory contexts and elaborates some functional design principles that policymakers can use to weigh competing models or determine whether agency gatekeeping makes sense at all. There are other payoffs as well. Anatomizing agency gatekeeping allows us to reimagine the agency role in some of our most consequential regulatory regimes, among them a system of job discrimination regulation that seems especially ripe for revision following the Supreme Court’s decision in Wal-Mart v. Dukes. More broadly, this Article makes a novel contribution to the otherwise oceanic literature on “litigation reforms” and reorients scholarly debate around optimal regulatory design and the contours and purposes of the administrative state itself by exploring the increasingly blurred boundary between administration and litigation.

author. Associate Professor, Stanford Law School. This Article, and the broader project of which it is part, has benefitted enormously from presentations at the Political Economy and Public Law Conference at Harvard Law School, the Conference on Empirical Legal Studies at Northwestern University School of Law, and the Administrative Law Roundtable at Columbia Law School, as well as workshops at Stanford, Georgetown, Minnesota, NYU, and University of Virginia law schools. Thanks to Peter Conti-Brown, Tino Cuéllar, Nora Freeman Engstrom, Barbara Fried, Dan Ho, Pam Karlan, Mark Kelman, Maggie Lemos, Anne O’Connell, Nick Parrillo, Bob Rabin, Bill Rubinstein, Shirin Sinnar, Norm Spaulding, and John Witt for helpful feedback. Thomas Fu, David Hausman, and Craig Lavoie provided outstanding research assistance.

Introduction

One of the most controversial developments in the American regulatory state in recent decades is a marked shift away from administrative regulation and enforcement and toward the use of private lawsuits as a regulatory tool.1 Champions of that trend assert that deputizing “private attorneys general” to enforce legal mandates is desirable and even necessary: private enforcement leverages private information, expertise, and resources while serving to check “capture” of public enforcement agencies by regulated parties.2 Critics, by contrast, cast private enforcement as overzealous, uncoordinated, and democratically unaccountable.3 Across a range of regulatory contexts, from environmental protection and civil rights to antitrust and securities, the resulting institutional design challenge is how to leverage private enforcement’s virtues while mitigating its vices. More broadly, how can we rationalize overlapping and interdependent public and private enforcement mechanisms?

In recent years, a growing chorus of commentators has offered an intriguing answer: vest administrative agencies with the power to oversee and manage private litigation efforts. Agencies, it is said, can use their expertise and synoptic perspective to weigh costs and benefits and determine whether private rights of action should lie at all.4 Alternatively, agencies might be given the power to evaluate private lawsuits on a case-by-case basis, blocking bad cases, aiding good ones, and otherwise husbanding private enforcement capacity in ways that conserve scarce public enforcement resources for other uses.5 While the specific institutional designs vary, these proposals share a common aim: regulating private litigation efforts by granting agencies what I call litigation “gatekeeper” authority.6

Yet despite such calls, we lack a synthetic account of how agencies should or would exercise litigation gatekeeper powers and, by extension, how best to structure such authority.7 This is surprising. A number of federal and state agencies already wield gatekeeper powers, offering critical but mostly untapped opportunities for empirical assessment.8 Calls to grant agencies gatekeeper powers also raise significant but underexplored questions about whether agencies can or will deploy such powers in ways that serve rather than undermine the public good. Agencies may simply lack the capacity to accurately gauge case merits, or they may privilege pursuit of political rewards over welfare-maximizing regulation of private enforcement efforts. The latter possibility is especially concerning. Given that private enforcement is designed at least in part to counter possible agency capture, bringing agencies back into the picture risks returning the fox to the henhouse. Addressing these and other concerns is essential to any clear-eyed assessment of an expanded agency gatekeeper role. We cannot evaluate competing institutional designs—or, indeed, whether agencies should be given litigation gatekeeper authority at all—without doing so. And yet, existing scholarship offers strikingly little theory or evidence that might serve as a guide.

This Article aims to fill that gap by providing a systematic account of this under-theorized role for administrative agencies in the modern American regulatory state. My most basic aim is to develop a vocabulary for describing the many flavors of agency gatekeeping and, drawing on theory and empirical analysis of the agency gatekeeper regimes already in existence, to elaborate a set of functional design principles that policymakers working across a range of regulatory contexts can use to weigh competing approaches or assess whether granting gatekeeper authority makes sense at all. In so doing, I hope to place mounting calls to vest agencies with gatekeeper powers on a sounder analytic footing.

Anatomizing agency gatekeeping is also freeing. Armed with a better understanding of how gatekeeper authority could and would work, we can reimagine some of our most consequential regulatory regimes while recasting debate over some others in a fuller and more clarifying light. Thus, this Article provides a theoretical and empirical baseline against which to evaluate recurrent, but largely unanalyzed, calls to vest the Securities and Exchange Commission (SEC) with gatekeeper power over securities class actions.9 It also offers insights into what to do about job discrimination regulation, where the Supreme Court’s recent decision in Wal-Mart Stores. v. Dukes10 has, by limitingthe availability of class actions, rendered the regime’s already dysfunctional mix of private enforcement and limited public oversight especially ripe for revision.11 A final example is federal agency preemption of state-law causes of action, or “regulatory preemption.” This growing practice has prompted several recent Supreme Court cases, as well as substantial scholarly commentary focused on the pros and cons of exclusively administrative regulation on the one hand and unbridled private enforcement on the other.12 A systematic accounting of agency gatekeeping helps us to see these two choices not as either/or options, but rather the outer poles of a rich continuum of institutional designs that tap agencies’ unique position and capacity to engage with and rationalize private litigation efforts.13

Beyond illuminating these more concrete issues of regulatory design, my account stands at the intersection of three broader scholarly literatures and makes a contribution to each. First, this Article contributes to the decades-long search for ways to heel litigation’s excesses by bringing agency oversight mechanisms more squarely onto the menu of available litigation reforms. An oceanic literature identifies and evaluates a wide array of mechanisms for rationalizing litigation, from the usual suite of tort reforms (e.g., damages caps) to heightened pleading and liability standards, reverse fee shifts, and other options.14 My analysis adds a new and often overlooked approach to this standard line-up of options and shows that, in many ways, agency gatekeeping is a more promising reform avenue.

Second, this Article aims to reorient a long and venerable literature on the choice between public and private enforcement of law.15 That literature, much of it coming out of the law and economics tradition, has generated a stream of valuable insights.16 But it has also grown increasingly divorced from regulatory reality. Indeed, many of our most consequential regulatory regimes have evolved in recent decades into hybrids of public and private enforcement in which multiple enforcers—including federal and state administrative agencies, private litigants, and state attorneys general—operate and interact within complex ecologies of enforcement.17 The institutional design challenge in this new regulatory landscape is not choosing between public and private enforcement. Rather, it is how to coordinate multiple, overlapping, and interdependent enforcement mechanisms. This Article thus joins the ranks of legal scholarship that has moved away from a binary conception of the choice between public and private enforcement and is instead exploring their intersections.18

Finally, and relatedly, this analysis joins a growing scholarly literature that aims to re-think the contours and work of the administrative state by training attention on the increasingly blurred boundary between administration and litigation. As the American regulatory state has shifted away from pure administrative enforcement and toward private litigation as a regulatory tool, an increasing portion of agency action has come to operate in the shadow of private enforcement efforts or otherwise involve a subtle public-private coordinating role.19 Other tectonic shifts in the regulatory landscape have likewise moved agencies to take on new roles and develop novel regulatory tools. Thus, the “ossification” of rulemaking has moved agencies to use serial litigation rather than onerous rulemaking procedures to achieve regulatory ends—a trend critics have dubbed “regulation by litigation.”20 Similarly, judicial constriction of class actions and punitive damages helps explain the rising use of so-called agency restitution actions, in which agencies litigate and secure large monetary judgments against regulatory targets and then distribute the proceeds to private individuals or entities who have suffered harm.21 Just as an earlier generation of administrative law scholars surfaced critically important trends in the privatization of administrative authority,22 this Article attempts to bring the administration-litigation nexus more fully into our conception of what the administrative state is and does.

The remainder of this Article proceeds in four parts. Part I frames the problem agency gatekeeping purports to solve. It first situates private enforcement’s rise in a broader legal, political, and policy context, and then reduces the vast debate about its merits and demerits to three core concerns: (i) zealousness; (ii) coordination; and (iii) legislative fidelity. It closes by surveying existing litigation reform approaches, particularly ex ante legislative fixes along the “tort reform” model, and exposing their inherent limitations in addressing each of these core concerns.

Parts II and III, the Article’s analytic core, consider the case for and against vesting agencies with litigation gatekeeper authority as an alternative to the usual litigation reforms. Part II offers a typology of litigation gatekeeper powers by characterizing existing and proposed gatekeeper designs along multiple dimensions. This is key prefatory work, as one cannot evaluate any particular gatekeeper approach without first surveying the landscape of design options.

Part III then elaborates the basic case for and against agency gatekeeping. Section III.A begins by sketching a number of discrete gatekeeper tasks that, taken together, constitute an ideal model of how well designed agency gatekeeper authority could curb private enforcement’s excesses while at the same time alleviating problems of private underenforcement of socially valuable claims. Section III.B then uses a mix of theoretical and empirical insights drawn from the public bureaucracy literature and elsewhere to show how agencies vested with litigation gatekeeper powers are likely to deviate from that ideal. Along the way, I find much to recommend in agency gatekeeping. Well designed gatekeeper structures can mitigate many of the zealousness, coordination, and legislative fidelity concerns at the core of critiques of private litigation as a regulatory tool. And they add unique value in this regard, countering many of private enforcement’s pathologies in ways that standard “litigation reforms” cannot. Yet I also uncover some underappreciated challenges in the design of gatekeeper structures, including, among others, the difficulty of inducing politically sensitive agencies to make optimal use of their power to terminate private enforcement efforts and of countering agency capture concerns without distorting other aspects of the agency’s gatekeeper decision-making. Section III.C concludes the analysis by taking a comparative analytic tack: assuming that vesting agencies with litigation gatekeeper authority is desirable, how can policymakers choose among competing designs?

Lastly, Part IV concretizes the collected insights from the first three Parts by asking, albeit briefly, how gatekeeping might be usefully applied in rethinking one of the most maligned regimes in the modern American regulatory state: job discrimination regulation under Title VII and cognate federal antidiscrimination statutes. In particular, I propose a radical overhaul of the role of the Equal Employment Opportunity Commission (EEOC) by rendering its gatekeeper powers both more and less expansive than at present, dismantling the EEOC’s current system of charge processing but granting the agency substantial new gatekeeper power over class actions and other “systemic” private lawsuits. My analysis thus offers a focused and empirically grounded illustration of how agency gatekeeping, while hardly a panacea, can add unique value in rationalizing and optimizing litigation regimes.

I. the trouble with private enforcement and the challenge of regulatory design

Any evaluation of agency litigation gatekeeper authority must begin by defining the problem—or set of problems—such authority is designed to solve. To be sure, this is well tilled ground: a vast scholarly literature maps the choice between public and private enforcement of legal mandates and the merits and demerits of private enforcement in particular. Rarely, however, has a full treatment of the resulting institutional dynamics appeared in one place. Nor have scholars fully assimilated the insights of political science, economics, and more traditional legal scholarship in ways that attend to both the political-institutional origins of private enforcement’s relatively recent rise and the actual, on-the-ground design challenges facing regulatory architects.23 The trouble with private enforcement, it turns out, is often invoked yet surprisingly underspecified.

This Part seeks to remedy these shortcomings and paves the way for the assessment of agency gatekeeping to come by: (i) describing the relatively recent rise of private enforcement, particularly as a means of enforcing statutory law; (ii) surveying the regulatory design challenges that attend the use of private litigation as a regulatory tool; and (iii) exposing the limits of common “litigation reforms” designed to mitigate private enforcement’s principal pathologies. Along the way, I sketch a broader and critically important point. The optimal structure of law enforcement cannot be determined by answering first-order questions about whether private enforcement is systematically more or less socially efficient than public enforcement. Nor, for that matter, is social efficiency the sole or even primary concern. Rather, private enforcement poses a mix of zealousness, coordination, and democratic accountability challenges that are only imperfectly subject to ex ante legislative fixes. Thus, as I take up in subsequent Parts, deployment of private enforcement as a regulatory tool presents a set of micro-level delegation problems—problems that administrative agencies vested with gatekeeper powers may be ideally positioned to solve.

A. The Rise of the “Litigation State”

Litigation seems perennially under attack.24 Yet the rise of private enforcement as a regulatory tool—particularly as a way to enforce statutory law—is a relatively recent phenomenon. Throughout much of the twentieth century, both before and after the New Deal, the archetypal enforcer, particularly in American public law, was a centralized bureaucratic apparatus.25

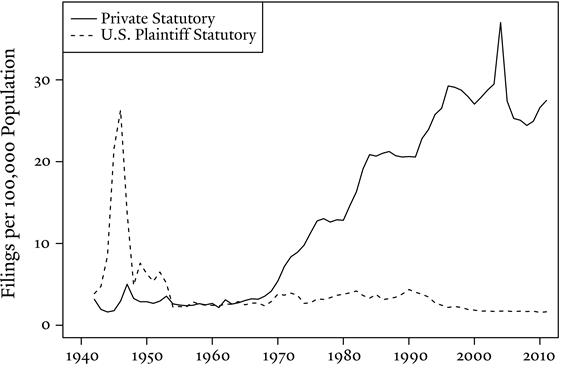

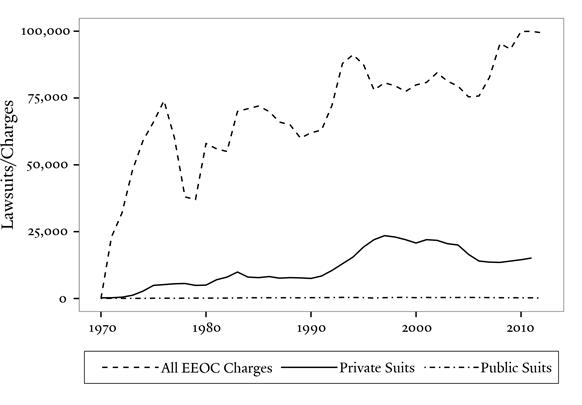

Then something dramatic happened: across a range of regulatory areas, private enforcement took off. As Figure 1 reflects, government enforcement of federal statutes mostly outstripped private enforcement efforts between 1942 and the mid-1950s. Since the early 1960s, however, private enforcement efforts

have come to dwarf government-initiated ones.26 In 2011 alone, federal courts saw more than 40,000 new filings asserting claims under federal laws governing securities, antitrust, and job discrimination as well as the Fair Labor Standards Act, the Racketeer Influenced and Corrupt Organizations (RICO) Act, the False Claims Act (FCA), the Federal Debt Collection Practices Act, and Section 1983. In 1960, by contrast, private enforcement in most of these areas was either virtually or entirely unknown.27

Figure 1.

private and u.s. plaintiff statutory litigation rates in federal district court, 1942-2011

To be sure, these statistics paint a stylized portrait of current regulatory realities. For instance, the trend from public to private enforcement has not always proceeded in straight-line fashion.28 Nor do Figure 1’s trendlines take account of purely administrative (i.e., “in-house”) agency enforcement actions and adjudications;29 litigation in state courts, where tort cases are concentrated and filing-trend debates have been most heated;30 or differences across litigation types—e.g., big-ticket “structural reform” litigation or large-scale class actions as against smaller-bore lawsuits—despite their very different impact.31 And simple filing rates tell us little about why private enforcement has grown as a regulatory choice—a question that has attracted substantial academic commentary but admits of few determinate answers.32

Most important for present purposes, bare filing statistics gloss over a critical part of the story: private enforcement has seen some of its most rapid growth in areas like securities, antitrust, and job discrimination, where public actors already possess substantial regulatory and enforcement authority. The result is a many-layered and distinctively American regulatory approach in which multiple public and private parties—including federal and state administrative agencies, private litigants, and state attorneys general—operate and interact within complex ecologies of enforcement.33 The primary institutional design challenge in this pluralistic regulatory landscape is not choosing among enforcement modes or deciding which should be given primary or exclusive domain. Rather, it is optimal coordination of multiple, overlapping, and interdependent enforcement mechanisms—of which private enforcement is often the most important.

B. Refining the Critique of Private Enforcement

Is private enforcement’s rise a good or a bad thing? An avalanche of scholarly work stakes out the poles of a rich debate. Private enforcement, we are told, taps private information, expertise, and resources.34 It also operates, the argument continues, as a “failsafe” mode of enforcement when public agencies facing resource or political constraints are unable or unwilling to enforce.35 But there are costs. Critics cast private enforcement as overzealous, uncoordinated, and democratically unaccountable.36 A full understanding of the contours of each of these concerns is essential to any effort to gauge the merits and demerits of giving agencies an expansive litigation oversight role.

1. The Zealousness Critique

The zealousness critique of private enforcement takes many forms, but most versions proceed from a stylized comparison of profit-motivated private enforcers and idealized public enforcers. In theory, at least, public enforcement is a more efficient means of achieving optimal deterrence of undesirable conduct.37 Public enforcers can exercise prosecutorial discretion, enforcing only where the social cost of doing so (e.g., transaction costs, including costs imposed on affected communities and judicial resources) is less than the social benefit (e.g., the value of deterred misconduct). In contrast, a private enforcer will litigate whenever her expected return exceeds her expected cost, even where the social cost of litigating outstrips all benefits.38 Worse, private enforcers may in fact exploit litigation costs, filing in terrorem lawsuits—or, in the securities context, “strike” suits—that use the threat of massive discovery costs to extract settlements in cases where the social cost of adjudication would exceed any benefit, or even where culpability is entirely absent.39 The result, the theory goes, is systematic overexpenditure of social resources and costly overdeterrence.40

As a first-order generalization, there is much truth here. In other ways, however, the standard zealousness critique substantially overstates the case or simply misses key dimensions of the problem. Most significant is the failure to acknowledge the complex ways in which the socially optimal choice of enforcer will turn not just on the public and private propensity to enforce but also on the relative cost of competing enforcement modes.41 On one hand, private enforcement might be more costly: relative to decentralized private enforcement efforts, centralized public enforcement enjoys economies of scale, fewer wasteful redundancies, and more efficient information processing across cases.42 But in many regulatory areas, the opposite is far more likely true: private enforcement is vastly cheaper than public, either because of greater organizational dexterity, or because private enforcers can tap individuals, particularly organizational “insiders,” to ferret out hidden information about misconduct.43 This is a powerful point. In regulatory regimes where information about wrongdoing remains hidden—and so is prohibitively costly for public enforcers to discover or dislodge—there will be little or no enforcement at all unless private parties can be induced to surface information about wrongdoing.44 To that extent, even overzealous private enforcement efforts may minimize social loss relative to a world in which harmful conduct is not controlled at all.

One could go on.45 For now, the key point is that the zealousness critique of private enforcement is, at least in its full-throated form, overblown and indeterminate. Indeed, from a regulatory design perspective, the question is not whether private enforcement is systematically more or less socially efficient than public enforcement. Rather, socially efficient deployment of private enforcement presents regulatory architects with a far subtler set of second-order, micro-level calibrationchallenges.

One such challenge arises from the fact that private enforcers vary, often substantially, in their motives and means. This complicates efforts to set payouts across the full enforcer pool to achieve desired enforcement levels.46 As a concrete example, critics have long argued that antitrust law overdeters socially valuable business activity because certain plaintiff types (e.g., business competitors) are already well incentivized to detect and prosecute violations compared to others (e.g., end consumers) and yet still reap statutory treble damages.47

A second calibration challenge stems from what might be labeled “scaling” problems. Private enforcement may be suboptimal where the targeted harm is large and so exceeds the malefactor’s ability to pay out fines or damages,48 or where especially well resourced regulatory targets (e.g., Fortune 500 companies) are able and willing to mount a vigorous defense.49 Scaling problems complicate optimal calibration at the other end of the harm spectrum as well: profit-minded private enforcers may not enforce at all where the cost of initiating enforcement is high and the harm (and, thus, the expected payout) is low, even if enforcement would improve social welfare.50 All of this turns the standard zealousness critique on its head: the problem is not that profit-obsessed private enforcers will target only large-scale harms in search of big payouts or overdeter small-scale harms that do not warrant expenditure of social resources. Rather, private enforcement may not deter either type of harm enough.

To be sure, these calibration challenges may not be insuperable. One can imagine an endlessly variegated statutory schedule of payouts pegged to particular enforcer or claim types that raise or lower enforcement activity to desired levels.51 Legislators can also specify the types of enforcers who have standing to sue or denominate certain claims as eligible or ineligible for private enforcement.52 But ex ante calibration is also informationally demanding: legislators must know who within the pool of would-be enforcers will initiate enforcement actions and of what types—and must continually monitor the situation.53 As a result, legislative calibration efforts will necessarily be a blunt instrument of control. Despite legislators’ best efforts, a substantial number of bad cases will enter the system, and a substantial number of good cases will not.

2. The Coordination Critique

Coordination problems are no less vexing for regulatory designers. The standard version of the coordination critique takes one of two forms. First, profit-chasing private enforcers will yield wasteful duplication of effort and socially costly overdeterrence by “piggybacking” on public enforcement efforts and also on each other.54 Second, the piecemeal and unyielding nature of profit-motivated private enforcement will deprive regulatory regimes of needed “coherence” by, among other things, disrupting the subtle cooperative relationships that arise between regulators and regulatory targets.55

As with the zealousness critique, there is substantial truth here.56 Yet in other ways, the standard coordination critique, like its zealousness cousin, simply misses key dimensions of the problem. For instance, legislators who opt to establish hybrid public-private enforcement regimes are hardly without tools for eliminating costly piggyback actions. They can legislatively bar private actions that mirror an earlier-filed private suit or government enforcement effort.57 Or, as noted previously, they can denominate certain claim types as eligible or ineligible for private enforcement, thus constructing a clear public-private division of labor.58 But these approaches come at a substantial cost, exposing once again the limits of ex ante legislative fixes. “First-to-file” provisions create perverse incentives for private enforcers to file premature claims in the race to the courthouse door.59 More importantly, categorically barring piggyback suits deprives public enforcers of the ability to craft a flexible enforcement strategy that optimally leverages available public and private enforcement capacity.60 The problem, then, is not piggyback actions per se.61 Rather, it is that legislators cannot know beforehand which piggyback actions are part of a coherent regulatory strategy and which are not.

Worse, the standard version of the coordination critique, with its overriding focus on regulatory coherence and duplicative litigation efforts, tends to obscure a host of significant but smaller-scale coordination challenges. One type of coordination problem occurs when distortions in the market for the retention and referral of legal services yield mismatches in plaintiff- and defense-side resources and sophistication. This may result from so-called “queuing” effects, in which the best counsel sit atop referral networks and take the very best cases, thus matching themselves with the cases to which they add the least value.62 Alternatively, plaintiffs’ counsel at the top of the queue may erroneously pass on a high-quality case, leaving it to lower-order counsel, and the defendant, with full information about the extent of illegality, may respond by investing heavily in defense.63 Whatever the cause, the resulting “adversarial asymmetries” can impair the system’s ability to fully vindicate the public interest by permitting lawyer skill and resources, not underlying case merit, to drive litigation outcomes.

Another type of micro-level coordination problem arises from repeat-play dynamics. It is well known that repeat litigants enjoy advantages because they can “play for rules,” settling bad cases and pursuing only good ones at trial or on appeal, thus bending doctrine—and, more importantly, judicial solicitude64—in their favor.65 In a regime with only public enforcement, government is the ultimate repeat player. Inclusion of a private enforcement mechanism, however, adds one-shotters to the mix who, lacking a strategic perspective beyond the case at hand, can generate bad precedent which hamstrings public and private enforcers alike.66

A final coordination problem is unique to the situation where a government pays private enforcers a bounty to collect fines on the government’s behalf67—say, as a sanction for violations of environmental law or fraud in connection with government contracting. One version of the problem has been well articulated elsewhere: regulatory designers who seek to reduce private enforcement levels by constraining private enforcers to earn only a portion of any fine collected will incentivize the litigants to negotiate collusive settlements for an amount that is greater than the expected bounty but less than the full sanction, thus eroding deterrence value.68 A broader, but often overlooked, version of the problem extends from preclusion principles: because a private enforcer collecting regulatory fines stands in the government’s shoes and sues on its behalf, any judgment will have preclusive effect on the government’s later assertion of transactionally related claims. This creates powerful incentives for private enforcers and regulatory targets to trade a larger settlement pot for an unduly wide liability release, compromising future enforcement efforts, whether public or private.69

One could continue in this vein. For now, however, a unifying point can once more be ventured: many of the most pressing coordination problems that afflict private enforcement—from piggybacking and adversarial asymmetries to repeat-play dynamics and collusive settlements—are either imperfectly remediable by way of ex ante legislative fixes or, worse, entirely immune from them. As with the calibration challenges that extend from the zealousness critique, there are hard limits on legislators’ ability to solve coordination problems from afar.

3. The Legislative Fidelity Critique

If the zealousness and coordination critiques rest on assumptions about private profit motivation, then a third and final critique of private enforcement proceeds from a more basic pair of observations: public enforcers are politically accountable actors. Private enforcers are not.

The resulting legislative fidelity critique roughly tracks zealousness concerns: if profit-motivated private enforcers initiate suit whenever the expected value of doing so exceeds expected cost, they may develop and press novel applications of legal mandates that public enforcers, exercising sound prosecutorial discretion, would forgo as inconsistent with the original legislative design.70 Relentless pursuit of profit thus yields a form of statutory drift and mission creep as private enforcers drive law enforcement efforts in new and democratically unaccountable directions.71

To be sure, it is not hard to see possible limits to this logic. Recall that deployment of private enforcement is a legislative choice. To that extent, one can argue that regulatory drift will already have been factored into the legislative decision to delegate enforcement authority to private litigants rather than or in addition to public prosecutors in the first place, conferring democratic legitimacy, though at a higher level of generality, on any and all deviations that result.72 More importantly, the simple legislative fidelity critique assumes that courts will be unable to police deviations from legislative purposes, or that a sitting legislature or administrative agency vested with rulemaking authority cannot amend legal mandates whenever private enforcement efforts stray beyond legislative preferences.73 Why can’t these institutional actors, one might ask, solve the problem via rigorous judicial enforcement of the legislative bargain or via statutory and regulatory amendments when private enforcement efforts stray beyond their legislative warrant?

While these objections carry some force, theory and evidence suggest that legislative fidelity concerns remain substantial. As to the former concern, legislative awareness of the possibility of statutory drift, or even a determination that delegation to private rather than public enforcers will produce less of it, hardly forecloses fidelity concerns. Ample room remains for institutional designs that can further mitigate the problem. As to the latter concern, solutions predicated on judicial enforcement of the legislative bargain seem particularly vulnerable on simple institutional capacity grounds. Courts may lack not just the will—judges may, after all, have policy preferences of their own—but also expertise and an encompassing view of the enforcement landscape, sharply limiting their ability to gauge how a novel liability theory maps onto legislative purposes.74

More fundamentally, even where private enforcers are brought to heel by legislators, agencies, or courts, the process is not costless. Indeed, private enforcement efforts can impose substantial transitional costs in the meantime, before a legislative, administrative, or judicial fix is in place. Regulatory targets must still defend against private enforcement actions and, because fixes cannot be made retroactive, may suffer costly adverse judgments despite subsequent amendment or override.75

There are also reasons to believe that these transitional costs will be large in many regulatory contexts. First, profit-motivated private enforcers will, in response to adaptation by regulatory targets, drive enforcement efforts into the interstices of legal mandates in their effort to exploit interpretive gaps left by legislators and regulators.76 This is important: interstitial private enforcement efforts are far less likely to draw swift political correction or override, as the interest-group cleavages that produced interpretive gaps are often no more easily bridged later than they were initially.77

Second, modern governance is largely administrative in form, with legislatures enacting broad and even deliberately ambiguous statutes where issues are too complex or politically fractious to resolve and then delegating to administrative agencies the task of filling in the messy details using cumbersome administrative procedures.78 Onerous procedures help reduce the “democratic deficit” when unelected bureaucrats make policy.79 But they also ensure that bubble periods, during which regulatory mandates remain unsettled and transitional costs accrue, will often be protracted.

Beyond the problem of transitional costs, a final reason to credit legislative fidelity concerns is that privately driven deviations from legislative purposes will be incremental in ways that can frustrate democratic control efforts. Legal innovations are not just the end products of litigation struggles; they can also reshape the identities, interests, and capacities of potential political actors.80 Thus, large paydays arm the plaintiffs’ bar with a war chest with which to protect its hard-fought litigation gains through the political process.81 At the same time, a final judgment against a large industry actor may insulate that actor from further legal attack, either because the judgment has preclusive effect or because it leads the entity to alter its organizational routines to avoid further legal entanglement in ways that are not easily reversed.82This can dampen the actor’s incentives to join industry lobbying efforts to reverse a given legal innovation—and, indeed, may create contrary incentives to actively disrupt such opposition as a way to narrow the competitive advantages of industry actors who have not yet faced litigation. By incrementally remaking the political landscape, privately driven legal innovations may, in the jargon of political science, produce feedback effects and path dependencies that render them more robust than one might predict ex ante.83Over time, private enforcement may thus drive legal mandates in very different directions than we might expect if enforcement authority remained in purely public hands.

C. The False Promise of “Litigation Reforms”

Given litigation’s centrality in the American regulatory state and the multiple zealousness, coordination, and legislative fidelity concerns that it raises, how might regulatory designers seek to constrain or otherwise rationalize private enforcement efforts?

A number of common “litigation reforms” have already received passing mention above. First, legislators can manipulate litigant incentives by raising or lowering payouts (as with multiple or punitive damages, attorney fee-shifts, or damages caps) to achieve desired enforcement levels, or they can erect procedural and remedial barriers, such as limits on discovery, heightened pleading standards, or modification or elimination of joint-and-several-liability rules.84 State-level tort reform efforts in recent decades showcase many of these possibilities,85 and some have surfaced at the federal level as well.86 Second, legislators can shape private enforcement efforts by activating or deactivating certain enforcer or claim types, or by barring “piggyback” or second-filed actions.87 A third family of options seeks to reform litigation from within by empowering trial judges to exercise greater “managerial” control over the litigation process or by vesting them with greater pretrial adjudicatory authority.88 The Supreme Court’s recent and controversial decisions in Twombly89 and Iqbal,90 which arm trial judges with a more exacting pleading standard, offer an apt and highly controversial example.91

Many of these litigation reforms have been deeply controversial, sparking heated debate about the extent to which they reduce litigation levels or costs;92 disproportionately impact particular claim93 or plaintiff94 types; or achieve various regime-specific goals, such as, in the medical malpractice area, reducing health care costs or improving health care quality.95

Yet viewing this standard menu of litigation reforms through the lens of the zealousness, coordination, and legislative fidelity critiques reveals far larger problems as well. In particular, most existing reforms are blunt calibration devices. Indeed, reducing payouts to plaintiffs or their counsel or raising pleading requirements impairs the “remedial machinery”96 across the board and so risks screening out meritorious and unmeritorious claims alike.97 Worse, the usual litigation reforms do even less to facilitate better coordination of public and private enforcement efforts, whether by limiting duplicative enforcement efforts, narrowing adversarial asymmetries, policing collusive and overbroad private settlements, or leveling a litigation playing field sloped by repeat players preying upon one-shot enforcers. And they do little or nothing to police private enforcement efforts that drift beyond legislative purposes or to mitigate the transitional costs that accrue when such efforts are only belatedly subject to legislative or administrative override. Indeed, the usual menu of litigation reforms is distressingly orthogonal to many or most such concerns.

What, then, might prove the better reform avenue? The balance of this Article pushes past the current state of play by identifying and assessing an alternative approach to mitigating the zealousness, coordination, and legislative fidelity problems that afflict private litigation when used as a regulatory tool: vesting administrative agencies with litigation “gatekeeper” powers.

II. the gatekeeper alternative: flavors of agency gatekeeping

Part I traced private enforcement’s rise as a regulatory tool, sketched three types of problems—zealousness, coordination, and legislative fidelity—that afflict private enforcement regimes, and trained a skeptical eye on the standard suite of “litigation reforms” that purport to solve those problems. This Part and the next develop the case for and against an alternative approach to rationalizing and optimizing regulatory regimes that deploy private lawsuits as an enforcement tool: vesting administrative agencies with litigation “gatekeeper” powers. The first step in that process is to construct a taxonomy that identifies and categorizes the rich diversity of gatekeeper designs that populate the present-day administrative landscape. This is important, as it is not possible to perform a rigorous assessment of the merits and demerits of granting agencies gatekeeper powers—Part III’s task—without first understanding the various institutional forms agency gatekeeper authority might take and the precise regulatory tasks each entails.

A. Taxonomy: Agency Gatekeeping in Five Dimensions

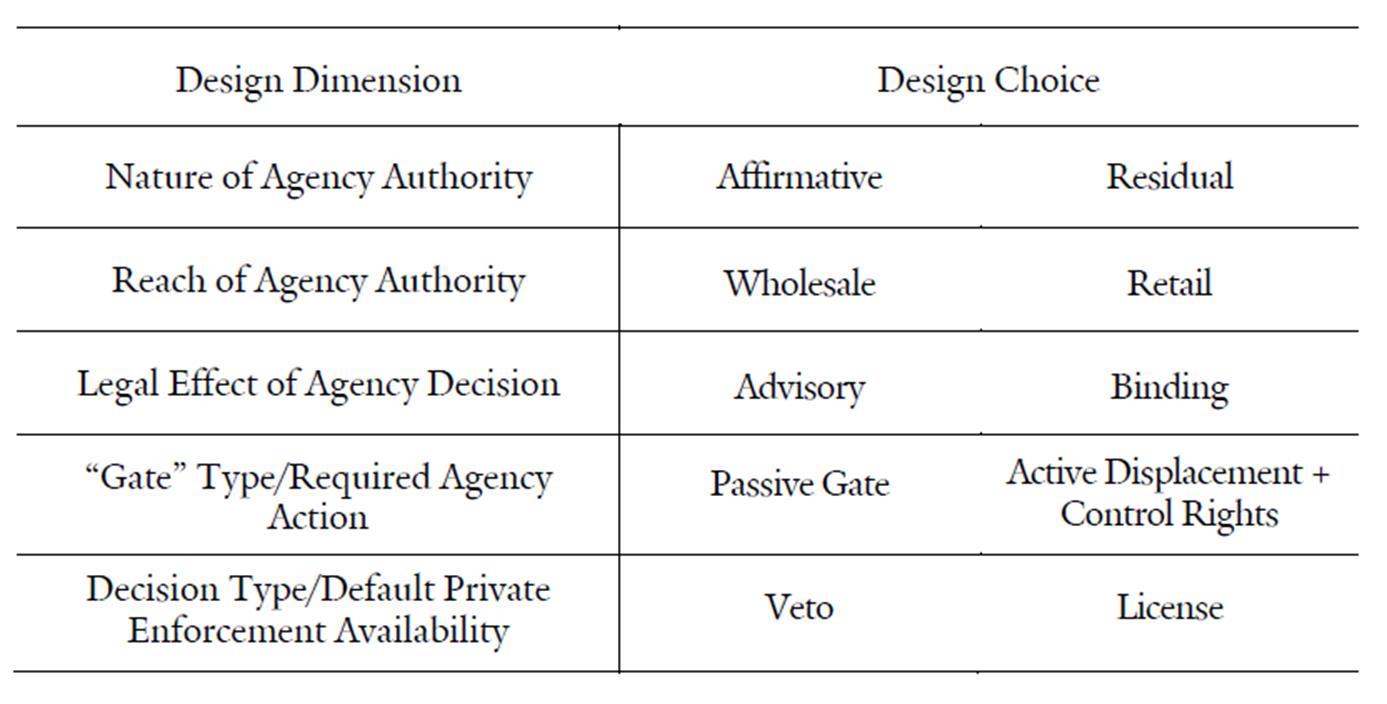

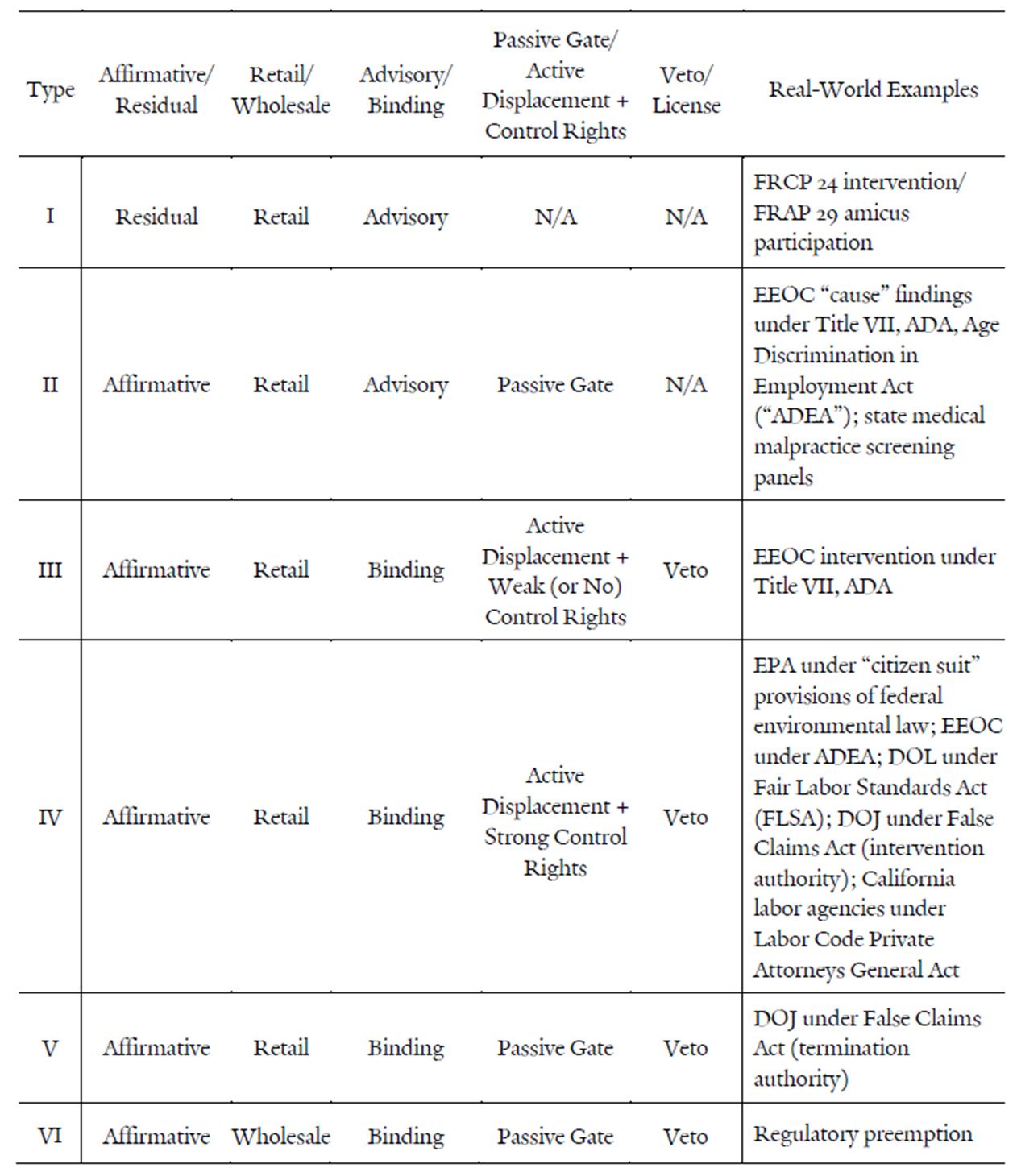

If legislators wanted to vest an agency with litigation gatekeeper authority, what would it look like? Tables 1 and 2 offer an initial cut at a taxonomy of agency gatekeeping. Table 1 begins by characterizing gatekeeper designs, both real and proposed, along five dimensions: (i) whether the agency wields affirmative or residual litigation oversight authority; (ii) whether agency gatekeeper authority is retail or wholesale in its reach; (iii) whether the agency’s gatekeeper decisions are legally binding or merely advisory; (iv) whether the agency passively occupies a “gate,” allowing litigation to proceed or not, or whether it instead exercises its gatekeeper authority only by actively displacing litigation via intervention or by initiating a public enforcement action of its own; and (v) whether an agency’s gatekeeper decisions operate as a “veto” or a “license.” Table 2 provides further shape and order by clustering design choices into six distinct gatekeeper types and mapping each type to one or more real-world examples.

Table 1.

taxonomy (i): agency gatekeeper design dimensions

Table 2. taxonomy (ii): classification of existing agency gatekeeper regimes

While many of the design dimensions and components presented in Tables 1 and 2 are self-explanatory, some are not. The remainder of this Section briefly steps through each design dimension and offers relevant elaboration of each to anchor the discussion to come.

1. Affirmative/Residual

As reflected in Tables 1 and 2, a regulatory designer who wishes to vest an agency with litigation gatekeeper authority must first decide if the agency will wield affirmative authority to control or terminate private enforcement efforts via statutory authorization. Importantly, a regulatory architect who declines to grant the agency formal gatekeeper powers does not thereby deprive the agency of any ability to shape private enforcement efforts. Most agencies possess residual oversight powers within the regulatory regimes they administer via the procedural rights accorded them under the Federal Rules of Civil and Appellate Procedure to intervene in cases as an interested party or to submit amicus briefs presenting the government’s position.98 Note, however, that these residual oversight powers are generally quite limited: agency intervenors or amici shape private enforcement efforts only to the extent they can convince the judge of the rightness of their position. They cannot subject private litigants to prefiling review, control the course of litigation, or deprive the real parties in interest of procedural or other rights. To that extent, and looking ahead to other parts of the typology, an agency’s residual oversight powers under the federal rules tend to be advisory rather than legally binding.

2. Retail/Wholesale

Assuming an agency is to be vested with affirmative gatekeeper powers, a second and critically important design decision is whether those powers will be exercised at a retail or wholesale level. Retail gatekeeper authority entails case-by-case agency oversight of private enforcement efforts. Real-world examples include: (i) the authority given the Department of Justice under the False Claims Act (FCA) to oversee individual qui tam actions;99 (ii) the authority granted to the EPA to oversee individual lawsuits brought under the various “citizen suit” provisions in federal environmental statutes; and (iii) the state medical malpractice review boards and screening panels that over thirty states put into place as a component of tort-reform efforts throughout the 1970s, 1980s, and 1990s to provide merits-screening of individual medical malpractice tort cases.100

Wholesale gatekeeper authority, by contrast, empowers an agency to create or destroy private rights of action across the board as to one or more denominated claims. Importantly, the agency’s ability to initiate its own enforcement actions asserting those claims remains unaffected, thus distinguishing wholesale gatekeeper authority from the more general authority enjoyed by many agencies to promulgate legislative rules that are applicable to public and private enforcement efforts alike.101 As Table 2 reflects, a real-world example is so-called regulatory preemption, in which agencies such as the Food and Drug Administration promulgate rules that purport to displace state tort law entirely.102 Beyond its use in the regulatory preemption context, wholesale gatekeeper authority has also been the subject of myriad scholarly proposals. Thus, some have called for granting the Securities and Exchange Commission the power to “disimply” private rights of action under the Securities and Exchange Act.103 Others have suggested that the DOJ should be granted the authority to “denominate” certain types of FCA claims as eligible or ineligible for qui tam enforcement across the board.104

3. Advisory/Binding

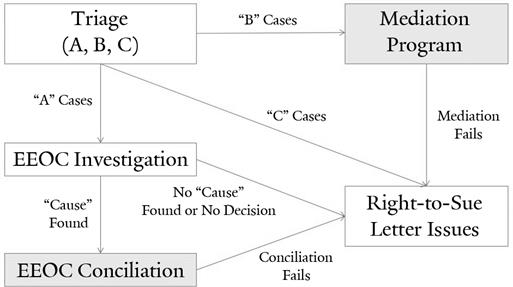

A third core design choice concerns whether an agency’s gatekeeper decisions are merely advisory or fully binding in their legal effect. On the former, consider the powers given to the EEOC to oversee job discrimination claims brought under Title VII of the Civil Rights Act of 1964. Title VII requires that all claims first be filed with and processed by the EEOC; a claimant can mount a private enforcement effort in court only once she has obtained a “right to sue” letter from the agency.105 But the EEOC possesses only nonbinding gatekeeper authority in such cases. As explained in more detail in Part IV’s case study, the EEOC may not decline to provide a “right to sue” letter, and its “cause” determination, though often admissible into evidence in an eventual civil action, lacks legal effect apart from its persuasive power before judge or jury.106

Compare this to the DOJ’s gatekeeper powers under the FCA, which vests the Attorney General—and, by further delegation, the DOJ’s Civil Fraud Division—with binding authority to oversee and control private qui tam litigation.107 Indeed, the DOJ may dismiss or settle a qui tam case out from under a private qui tam relator entirely, subject only to a basic fairness hearing.108 It also possesses the statutory right to veto private dismissals or settlements in cases it has not joined.109 Finally, the FCA grants the DOJ the authority to intervene in and take “primary” control over the litigation, including depriving the relator of any further procedural rights where her participation is seen as impairing the government’s prosecution of the case.110

Occupying a space somewhere in the middle are state medical malpractice screening panels. Conventionally understood, these administrative bodies wield only advisory authority, holding on the merits of a case and sending a nonbinding merits signal to litigants and courts without entering judgment.111 Some liken the resulting gatekeeper role to early neutral evaluation or mediation.112 Some states, however, have vested review boards with harder-edged powers by imposing sanctions upon parties who proceed to trial and lose following an unfavorable board screening decision.113 In such states, board decisions are not legally binding but nevertheless exert a powerful effect on the parties’ litigation calculus.

4. Passive Gate/Active Displacement + Control Rights

A fourth key design decision concerns the action an agency must take in order to exercise gatekeeper power. Some gatekeeper designs permit the agency to exercise its gatekeeper authority passively, by simply expressing its determination that a private enforcement action should or should not proceed. The FCA once more provides a real-world example: as noted previously, the DOJ may at any stage in the proceedings move to dismiss or settle a case out from under a private plaintiff-relator, subject only to a basic fairness hearing.114 To accomplish this, the DOJ need do no more than register its view with the court and request dismissal.

Alternatively, legislative designers might mandate a more active agency role in which the agency may terminate a private enforcement effort only by taking over control of the private enforcement action or displacing it with a public enforcement proceeding of its own. An example is found in the “citizen suit” provisions contained in most major federal environmental statutes authorizing the EPA to veto a private enforcement effort only by initiating a public enforcement action in its stead.115 Similarly, California’s Labor Code Private Attorney General Act (“LCPAGA”) bars private enforcement actions only where the relevant labor enforcement agency116 decides, after investigation of a violation raised by a would-be private enforcer, to cite the violator.117 As with EPA oversight of “citizen suits,” the agency can displace private enforcement only by bringing an enforcement action itself. As a final example, and at risk of confusing matters, the FCA grants the DOJ the authority—in addition to the power to dismiss cases outright—to intervene in and take control of private qui tam enforcement efforts.118 The FCA thus gives the DOJ two distinct gatekeeper options: passive dismissal (via the DOJ’s termination authority) and active displacement (via the DOJ’s intervention authority).

Importantly, existing gatekeeper designs also vary substantially in the extent of the control rights that accompany an agency’s decision to displace or otherwise take over control of a private enforcement action. For instance, Title VII formally empowers the EEOC to displace private job discrimination claims by initiating its own civil action, giving it what amounts to a right of first refusal in initiating litigation.119 But the resulting “displacement” is nominal, as the statute specifically grants the claimant full and unconditional intervention rights, limiting the EEOC’s ability to control the litigation.120 More importantly, even where the EEOC files and successfully settles its own enforcement action, the claimant retains the right to sue for further remediation not achieved in the public-side enforcement action.121

Things look different, however, elsewhere within federal employment and labor law. Thus, the Age Discrimination in Employment Act (ADEA) grants the EEOC a fuller set of control rights than it enjoys in the Title VII context: an EEOC-filed action under the ADEA formally terminates the private claimant’s right to bring a subsequent private action, and the ADEA also precludes a claimant from intervening in a public action brought on her behalf.122 The Fair Labor Standards Act offers a similarly potent set of exclusion and control rights, with a DOL action terminating an employee’s right to initiate her own suit following the DOL’s filing or serve as a “party plaintiff” in the government’s case.123 So long as either agency files its public enforcement action before the private plaintiff does so, the government retains near-total control over the conduct of enforcement efforts. Finally, the EPA and the DOJ possess strong, and even absolute, control rights regarding citizen suits and qui tam suits, respectively. A citizen suit plaintiff can intervene as a matter of right in a government enforcement proceeding that has displaced her.124 But she wields separate enforcement authority—whether as an intervenor or as a plaintiff in a subsequently filed action—only if she can convince a court that the government’s action is or was not “diligent[]” in its prosecution of the matter, a difficult burden absent an obviously deficient public enforcement effort or evident collusion between the enforcement agency and a regulatory target.125 Similarly, and as noted previously, where the DOJ elects to intervene in a qui tam lawsuit, it exercises “primary” control over the litigation.126 To that end, the FCA instructs the courts to “impose limitations on [a relator-plaintiff’s] participation” where necessary to safeguard “the Government’s prosecution of the case,”127 and any government settlement has preclusive effect on further private enforcement efforts.128 As in the citizen suit context, a qui tam relator enjoys little in the way of control rights even if she remains fully active in the case.

5. Veto/License

Fifth and finally, affirmative and binding agency gatekeeper authority can take the form of a veto or a license.129 Where an agency is vested with veto authority, as in the FCA context, its failure to terminate or take control of a private enforcement action does not prevent the private enforcer from proceeding alone. Rather, a veto-based scheme instantiates what some would call a “French” rule: private enforcement actions not specifically vetoed by the agency are permitted. By contrast, an agency with licensing gatekeeper authority makes its decision against a background assumption that private rights of action will not lie unless the agency joins the case or otherwise offers its stamp of approval. Here, the gatekeeper structure instantiates a “German” rule: private enforcement efforts not specifically licensed by the agency are forbidden.130

Note that none of Table 2’s gatekeeper “types” deploys a license approach, reflecting the fact that no real-world gatekeeper regime of which I am aware incorporates such an option. Even so, it is noteworthy that some of the more fervent calls for reform of the DOJ’s oversight of qui tam litigation under the FCA, for instance, would preclude plaintiff-relators from pursuing a case in the absence of DOJ intervention, thus transforming the current regime into a license approach.131

B. Using the Taxonomy and the Road Ahead

The above survey offers an initial glimpse of the myriad forms agency gatekeeper authority can take. But it is hardly comprehensive. Tables 1 and 2 are silent regarding the structure of the agency itself, including whether gatekeeper powers are vested in already-existing, “standing” agencies (e.g., the SEC or EEOC), or instead in ad hoc, purpose-built administrative bodies specifically convened to wield gatekeeper powers. Omitting this design feature avoids cluttered exposition, as the only real-world gatekeeper examples that take the latter, ad hoc form are the state medical malpractice review panels.132 Also unmentioned in Tables 1 and 2 are the procedures that govern agency gatekeeper decision-making, from the relatively thick procedure requirements that govern rulemaking and adjudication under the Administrative Procedure Act (APA) to a range of far thinner ones that Congress or another legislature could specify instead.133 These procedural options, while an important component of gatekeeper designs, are better left to Part III’s discussion of the ways regulatory architects can shape agency incentives or counter bureaucratic inertia in their performance of core gatekeeper tasks.134 Future work may reveal still other design dimensions that are salient to regulatory architects and should be included in any comprehensive survey.

Yet Table 2 in particular offers more than just a taxonomic overview. The gatekeeper types presented therein are also arguably organized from least to most interventionist. To that extent, the typology is designed to be a useful tool, as regulatory designers who desire relatively greater or lesser agency control over private litigation efforts can simply move up or down the taxonomic ladder. The next Part begins the process of sketching an analytic framework that can guide regulatory designers as they do so—or as they decide whether to install gatekeeper powers at all.

III. the optimal design of agency gatekeeper regimes

Having defined terms and surveyed a range of possible gatekeeper approaches, this Part turns to an evaluation of the merits and demerits of competing designs and the wisdom of vesting agencies with gatekeeper authority in the first place. The analysis proceeds in three discrete steps. Section III.A takes the form of a thought exercise: how would an ideal agency exercising a full complement of wholesale or retail gatekeeper powers use its authority to mitigate the zealousness, coordination, and legislative fidelity costs outlined in Part I? Section III.B stays (mostly) in the domain of theory but moves from the ideal to the positive, offering a more skeptical view as to how agencies wielding gatekeeper authority in the real world are likely to deviate from Section III.A’s normative ideal. Section III.C then steps back and, comparing leading gatekeeper designs, identifies a set of functional design principles and tradeoffs that can help guide policymakers in choosing among competing models. The resulting analysis is necessarily abstract and far from the last word on the matter. Nor, it should be noted, is the goal to generate a trans-substantive, all-things-considered judgment as to the merits of agency gatekeeping in general. To the contrary, an important theme in what follows is that optimal gatekeeper design is likely to be highly contextual and grounded in the realities of a given regulatory regime. To that extent, the more limited aim in what follows is to map some preliminary lines of analysis and offer some mid-level generalizations about optimal gatekeeper design that can guide institutional designers working within discrete regulatory areas, while setting the stage for Part IV’s case study of job discrimination regulation as a concrete application of the gatekeeper idea.

A. The Ideal Gatekeeper Role

One way to begin to take the measure of agency gatekeeping is to ask what tasks an ideal agency armed with a full complement of gatekeeper powers would perform. Put another way, if an ideal agency were vested with the power to delimit, terminate, or control private litigation efforts, what would it do?

1. The Ideal Wholesale Gatekeeper

For agencies vested with wholesale gatekeeper authority (e.g., Type VI from Table 2), that inquiry is straightforward. First and foremost, such an agency will use its expertise and global perspective to weigh aggregate costs and benefits and determine whether whole categories of private enforcement efforts are, on balance, welfare-maximizing and so should be allowed at all. In performing this inquiry, an ideal agency will also consider whether a particular claim or set of claims advancing a novel statutory or regulatory interpretation strays beyond the core legislative design by, for instance, imposing liability for conduct that does not arguably fall within legislative purposes.135 As a concrete example, the SEC might determine after study that the social costs of frivolous “strike” suits have come to outstrip the social benefits of meritorious cases, or that private lawsuits targeting a particular alleged violation of proxy rules lack fidelity to the congressional design. When the agency makes such a determination, it will flip its gatekeeper switch, terminating private rights of action as to the offending claim types.136

Second, an ideal agency wielding wholesale gatekeeper authority can use its powers to solve certain coordination challenges in hybrid public-private enforcement regimes by establishing an optimal division of labor between public and private enforcement efforts. For instance, an agency vested with wholesale powers can switch private enforcement “on” as to some claims and “off” as to others, carving up enforcement duties on either side of the public-private divide in ways that reflect the comparative advantages of each type of enforcer.137 By doing so, an agency can also actively husband private enforcement capacity by signaling to private enforcers, particularly plaintiff-side law firms, where they should invest in regime-specific expertise and enforcement infrastructure.138

Finally, recall from Part I’s discussion that a principal concern raised by the legislative fidelity critique is that, even when private enforcement efforts that stray beyond legislative purposes are ultimately brought to heel, they can impose substantial “transitional” costs in the interim, before a definitive legislative or administrative interpretation of an ambiguous legal mandate is in place. Here, too, an ideal agency vested with wholesale gatekeeper authority can offer a salve to good-faith regulatory targets who find themselves in the crosshairs of novel applications of a statute or regulation by holding in abeyance all private enforcement actions asserting the claims in question, pending legislative or administrative clarification of the liability standard.139 Importantly, an ideal agency might choose abeyance even if it is likely to go on to endorse the new liability theory. Indeed, securities law scholars have long advocated agency-controlled “phase-in” periods during which private enforcers are precluded from bringing suits alleging fraud under new disclosure requirements until the agency determines that compliance standards are sufficiently clear to warrant exposure to private liability.140

2. The Ideal Retail Gatekeeper

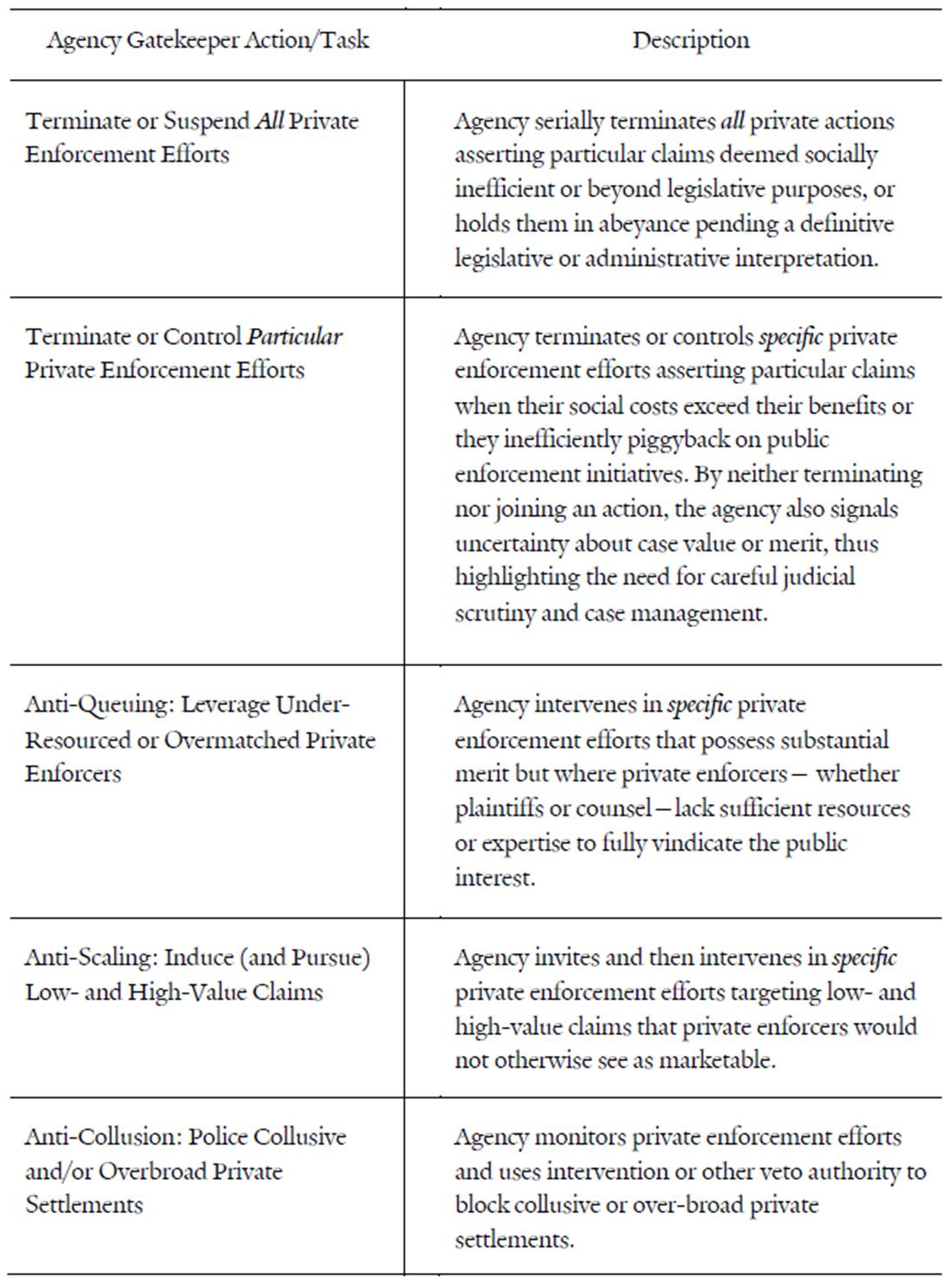

Turning from the wholesale to the retail gatekeeper context requires us first to revisit some of the wholesale gatekeeper tasks described above. Indeed, as Table 3’s first entry reflects, an ideal agency vested with a full complement of retail gatekeeper powers (e.g., Types IV and V from Table 2) can just as easily achieve the same ends as an agency with only wholesale gatekeeper powers. Thus, an agency could use its retail oversight powers to serially terminate all private enforcement efforts asserting particular claims in order to give effect to its policy judgment that such claims are on net socially costly or stray beyond legislative purposes, or to establish and maintain an optimal public-private division of labor. Similarly, an ideal agency with a full slate of retail gatekeeper powers could use those powers to mitigate transitional costs, taking control of all cases asserting a novel claim pending legislative or administrative action and either relinquishing that control or terminating those actions once it (or the legislature) has installed a definitive statutory or regulatory interpretation. In each of these ways, retail gatekeeper efforts merely retread the ideal wholesale gatekeeper role.

Table 3. ideal retail litigation gatekeeper tasks

Yet retail gatekeeping powers can also be put to a variety of uses beyond across-the-board elimination or abeyance of private enforcement efforts. The remainder of Table 3 sets forth four additional optimization tasks that a gatekeeper agency armed with retail gatekeeper powers will perform in an effort to mitigate the more micro-level calibration, coordination, and legislative fidelity problems associated with private enforcement detailed in Part I.

First, an ideal agency will use its retail gatekeeper authority to cull or cabin specific private enforcement efforts asserting a particular kind of claim because their social costs outweigh their social benefits, while permitting similar, but welfare-enhancing, claims to proceed. As noted previously, private enforcers may bring socially undesirable actions for any number of reasons, such as indifference to social cost, erroneous calculation of case merit, pursuit of noneconomic litigation goals, or opportunistic piggybacking on public enforcement actions.141 Where such cases arise, an ideal agency armed with retail gatekeeper powers will terminate them before substantial costs have accrued, or take control over those cases and steer them in more public-interested directions. An agency can likewise use its case-specific termination or control authority to remove from contestation private actions that will make especially poor appellate vehicles and thus will advantage repeat-player regulated entities seeking to “play for rules.”142 Finally, even when a gatekeeper agency neither terminates nor joins a private enforcement action, it can still play a valuable epistemic role. Indeed, an ideal retail gatekeeper in such a situation serves a gatekeeping function of sorts by signaling to courts that its case assessment is less certain, thus highlighting the need for closer judicial scrutiny and more careful case management.

The next pair of Table 3’s ideal tasks for retail gatekeepers is more subtle. In general, an ideal agency vested with retail gatekeeper powers will maximally rely on fully competent and well incentivized private enforcers to perform enforcement tasks, conserving scarce public enforcement resources for other uses.143 Yet, as Part I noted, private enforcement efforts may sometimes prove deficient. For instance, failures in the market for the retention and referral of legal services can generate disparities in plaintiff- and defense-side resources or sophistication that render enforcement suboptimal. Where private enforcement efforts are impaired by “adversarial asymmetries,” as Part I termed them,144 an ideal gatekeeper agency focused on optimal deterrence will join and leverage the enforcement efforts of overmatched private enforcers who will not otherwise fully vindicate the public interest. Here, retail gatekeeper efforts can solve coordination problems resulting from what amounts to suboptimal matching of private enforcers with regulatory targets.

The other main reason private enforcement efforts may prove deficient is, to use Part I’s terminology, “scaling” problems.145 As noted above, private enforcers may suboptimally enforce against low-harm misconduct where the private cost of initiating enforcement (whether psycho-emotional or otherwise) is high, even where the social benefit of enforcement would clearly exceed its cost.146 High-harm misconduct may likewise attract suboptimal private enforcement efforts, either because regulatory targets are judgment-proof (e.g., damages are so large they exceed the target’s ability to pay), or because they possess substantial resources and so are seen as able and likely to mount a vigorous defense.147 Here, the ideal gatekeeper role is to secure optimal deterrence across the full spectrum of misconduct by committing to assist such claims, thus inducing skittish or reluctant private enforcers with privately held information about misconduct to come forward.148

Table 3’s final ideal gatekeeper task is unique to the situation in which private enforcers are deputized to collect fines on the government’s behalf rather than damages. As Part I noted, when the bounty a plaintiff-enforcer earns is less than the full fine, she and the regulatory target will face powerful incentives to enter into collusive settlements for an amount greater than the bounty but less than the full fine.149 Enforcers and targets will likewise face powerful incentives to swap an overbroad liability release for a somewhat larger settlement pot, thus preventing future regulators (or other private enforcers) from forcing full internalization of the costs of misconduct.150 Because of the threat of either type of collusion, an ideal gatekeeper agency will continually monitor private settlements and thwart those that threaten to dilute deterrence or are otherwise inconsistent with government goals.

B. Deviations from the Gatekeeper Ideal

The analysis above paints a rosy portrait of the myriad ways an ideal agency vested with a full set of wholesale or retail gatekeeper powers can rationalize and optimize private enforcement efforts. But there is also good reason to be skeptical about the ability or willingness of agencies to perform these tasks. Consider three broad classes of problems that may generate deviations from the ideal gatekeeper role.

1. Institutional Competence and Capacity

A threshold question raised by calls to vest agencies with expansive gatekeeper powers is whether agencies have the technical competence and capacity to regulate private enforcement efforts in welfare-maximizing ways.

Turning first to the wholesale gatekeeper context helps lay bare a key aspect of the inquiry: any assessment of the institutional competence and capacity of agencies to perform gatekeeper tasks will necessarily be comparative.151 The question is not whether agencies can make socially optimal decisions about, say, whether private rights of action should lie at all. In fact, one should be skeptical about the ability of any institutional actor to generate a perfectly accurate bottom-line social-welfare accounting of competing modes of enforcement in a complex regulatory regime. Instead, the question is whether agencies can by and large make better judgments along those lines, or do so more quickly or cheaply, than other institutional actors.152

Framed this way, the question in the wholesale gatekeeper context is an easy one, as there is little reason to believe that agencies are less capable or efficient than legislators or courts at making regime-wide judgments about the optimal scope of private enforcement—and plenty of reason to believe they are more so. Part of this flows from the usual observations about the superior expertise, synopticism, and fact-finding capacity of agencies.153 Along these dimensions, agencies plainly dominate generalist courts passively adjudicating a stream of atomized and often idiosyncratic disputes.154

The same is likely true of legislatures as well, though the proliferation of legislative committees at the federal and state levels makes the institutional comparison a closer one.155 In particular, wholesale gatekeeper decision-making will often involve an interconnected mix of ground-level factual questions about the enforcement landscape and higher-level, synthetic questions about the overall “coherence” of the regulatory regime. How costly is private enforcement relative to public enforcement? Do private enforcers tend to target misconduct that public enforcers miss, or are they more likely to piggyback on public enforcement initiatives? What combination of enforcement modes will best achieve long-term regulatory goals by, for instance, facilitating collaborative problem-solving between regulators and regulated? Agencies operating within their assigned regulatory bailiwicks are not just likely to have defter command of these high- and low-level issues than legislators. They will also be better suited to perform ongoing monitoring, ensuring timelier updating of prior wholesale gatekeeper decisions about whether and which claims should be private-enforcement-eligible.156

While the superior competence and capacity of agencies are thus mostly settled in the wholesale context, this is plainly less true in the retail context. The difference lies in the nature of retail gatekeeping: the principal retail-level gatekeeper task is not forming broad-scale, “legislative” judgments about the net social costs or benefits of competing regulatory approaches but rather a far more quotidian, “adjudicative” sorting of more and less meritorious cases. One implication is that the nature of retail gatekeeping shifts the primary institutional comparison to be performed. The competence and capacity inquiry in the wholesale gatekeeper context mostly distills to a comparison of agencies and legislatures. In the retail context, however, the primary comparison is between agencies and courts.

A second implication is that our judgment as to which of these institutions—agencies or courts—is better situated to assess case merit will turn, at least in part, on how merit is conceptualized in the first instance. American legal culture trades in at least three distinct conceptions of case merit. The first is probabilistic and comparative: a case is more meritorious than another if the defendant is more likely to be held liable for some remedy.157 A second is pegged to social value: a case is meritorious if its successful prosecution would, on balance, enhance social welfare.158 A third is legalistic: a case has merit if it is true that the defendant has violated a valid legal injunction.159

At one level, this menu of options offers little analytic traction. After all, a gatekeeper agency will likely make judgments tracking all three merit conceptions in performing the full slate of ideal retail gatekeeper tasks. As concrete examples, an ideal retail gatekeeper agency might terminate a case based on its determination that the social cost of enforcement would outstrip its social benefit (the second conception) or, alternatively, that the plaintiff’s factual allegations, even if true, do not add up to a violation of a legal prohibition or injunction (the third conception). Similarly, an ideal retail gatekeeper agency deciding whether to allocate scarce public enforcement resources toward a case that features an under-resourced or overmatched private enforcer will almost certainly consider both the case’s social value (the second conception) and also its probability of success with and without the benefit of government participation (the first conception). Judges, too, make similar assessments in adjudicating pretrial motions.160

Given that agencies and courts will deploy multiple and competing conceptions of merit in making gatekeeper decisions, it does not make sense to commit to one or another conception in rendering a comparative judgment about institutional capacity. Even so, it should be clear that systematic judgments about the relative competence and capacity of agencies and courts to perform retail gatekeeping will heavily depend on the weight accorded to particular gatekeeper tasks. Thus, where an agency is mainly using its retail, case-by-case gatekeeper powers to implement broad-scale judgments about which types of cases are welfare-enhancing and which welfare-decreasing, or where the agency is using those same powers to solve coordination problems or police fidelity to legislative purpose, its panoramic view of the regulatory landscape confers a clear advantage in the same way it does in the wholesale gatekeeper context.161 But this advantage narrows and may even disappear entirely when the task at hand is merits-screening of the narrow, probabilistic sort. Indeed, both institutional actors have at their disposal substantial evidentiary tools—subpoenas and civil investigative demands on the one hand and civil discovery tools, as wielded by litigant-adversaries, on the other—that are unlikely to differ substantially in their probability-estimating utility.162 As a result, there is little reason to believe that agencies wielding gatekeeper powers or courts will systematically vary in their capacity to judge a claim’s factual sufficiency based on collected evidence or the weight to be accorded specific evidentiary showings, except perhaps in the most technical of areas.163

The inquiry’s comparative nature and the contingency introduced by competing definitions of merit are not just important for deciding who decides in the retail context; they also expose critical tensions in the gatekeeper idea itself. If “merit” is understood in narrow probabilistic terms as the likelihood that a court will find liability, then retail gatekeeper authority will merely duplicate—though possibly more efficiently—the outcomes the judicial system would produce absent gatekeeper intervention. Here, the ideal agency gatekeeper is at best an efficiency-enhancing, adjudicatory “adjunct” to the courts that is not so different in concept from the “specialized” courts that dot the American regulatory landscape.164 If, however, “merit” is understood more broadly to include a social welfare or legislative fidelity component, then agency gatekeeping takes on a fundamentally different and more “regulatory” character. Rather than serving as an adjudicatory adjunct, the agency is interposed between private enforcers and the courts to implement a conception of merit that is different from what judges or juries would otherwise deliver.165