Fifty Shades of Gray: Sentencing Trends in Major White-Collar Cases

abstract. Between 1987 and 2005, federal judges sentenced defendants pursuant to binding Sentencing Guidelines that severely curtailed their discretion. In United States v. Booker, the Supreme Court held the mandatory Guidelines sentencing scheme unconstitutional and rendered the Guidelines advisory. This Note offers a picture of white-collar sentencing in “shades of gray.” It conducts an empirical analysis of sentencing decisions after Booker to assess the consequences of the return to judicial discretion. In particular, the Note examines major white-collar cases in the Southern District of New York, where many such cases of national and international significance are prosecuted. The Guidelines instruct judges in white-collar cases to calculate the amount of economic loss attributable to the defendant and apply a sentencing enhancement—often a sizable one—on the basis of that loss. The findings reveal that a significant majority of defendants in these cases receive sentences of imprisonment shorter than those recommended by the Guidelines. Moreover, when judges impose sentences below the Guidelines range, the resulting sentences are often dramatically shorter than those produced under the Guidelines. Based on these findings, this Note argues that the U.S. Sentencing Commission should revise its approach to white-collar cases in three ways. The Commission should amend the Guidelines to reduce the severity of the economic loss table; calculate economic “loss” differently; and add additional, though less severe, enhancements to punish pecuniary gain and intended loss. Absent such changes, judges will—and should—continue imposing sentences far below the Guidelines range. These proposed changes better capture the seriousness of the offense and the culpability of the offender, even if they do not resolve the fundamental tension between individualized sentencing and the rigid quantification that characterizes the Guidelines system.

author.Yale Law School, J.D. 2015. Princeton University, A.B. 2011. Special thanks to Kate Stith for her expert guidance. Additional thanks to Denny Curtis and Sarah Russell, and to the Honorable Jed Rakoff and the Honorable Richard Sullivan for their insight and generosity. For thoughtful feedback and invaluable editorial assistance, I thank Grace Hart, Rebecca Lee, Michael Clemente, Elizabeth Ingriselli, Charlie Bridge, and the editors of the Yale Law Journal.

Introduction

Between 2000 and 2002, Jamie Olis, his boss Gene Foster, and his colleague Helen Sharkey orchestrated an illegal transaction at Dynegy Corporation.1 The transaction would appear to Dynegy’s auditors and investors as if it produced income, but it was actually a loan in disguise.2 All three were indicted on charges of mail fraud, wire fraud, and securities fraud, as well as conspiracy to commit those offenses.3 Olis was convicted on all counts and sentenced to 292 months, or more than twenty-four years in prison.4 In contrast, Foster and Sharkey cooperated with the government, testified at Olis’s trial, and pleaded guilty to the conspiracy count in exchange for maximum sentences of five years.5

The conspiracy, titled “Project Alpha,” sought to increase the value of Dynegy’s stock; it was “not [meant] to defraud Dynegy or to enrich Olis,” and Olis was not meaningfully enriched as a result.6 Although Olis helped plan the conspiracy, he did not have the authority to approve the project and did not draft the key documents.7

So why did Olis receive such a long sentence? Prior to the Sentencing Reform Act of 1984 (SRA), judges exercised discretion in sentencing. But at the time of Olis’s original sentencing, the federal Sentencing Guidelines (Guidelines) required judges to impose a sentence within a particular range.8 To determine the Guidelines range in white-collar cases, judges considered a set of enhancements that are commonly referred to as the economic loss table, which forms part of the Guidelines for white-collar crimes.9 The loss table increases a defendant’s “Offense Level” based on the amount of economic “loss” attributed to the scheme in which he participated. The Guidelines define what constitutes “loss”—for instance, clarifying that “loss” means the greater of actual or intended loss, and that “actual loss” means “the reasonably foreseeable pecuniary harm that resulted from the offense.”10 The Guidelines then establish the sentencing range based on a combination of the offense level and the defendant’s criminal history.11

In Olis’s case, the loss table provided for a 26-level increase in Olis’s offense level, which transformed a 15-21 month sentence into a sentence of 292-365 months.12 Olis appealed his original sentence.13 While his appeal was pending, the Supreme Court decided United States v. Booker.14 The landmark case held unconstitutional the two provisions in the SRA that made the Guidelines mandatory.15 In a remedial opinion, the Court severed and excised those two provisions, rendering the Guidelines effectively advisory.16 On remand in Olis’s case, the judge calculated a Guidelines range of 151-188 months,17 or about twelve to sixteen years.18 Twenty-four points of Olis’s 34-point offense level derived from the “Intended Loss” to the United States Treasury of $79 million, the entirety of which was attributed to him for sentencing purposes.19

Were it not for the Supreme Court’s decision in Booker—which returned significant discretion in sentencing to federal judges—Olis would have received a sentence of between twelve and sixteen years. But instead, the judge imposed a “non-Guidelines sentence” of seventy-two months in prison.20 Using his newly authorized discretion, the judge took several factors into account: (1) Olis did not have the authority to approve Project Alpha, (2) Olis did not defraud Dynegy and was not enriched in any significant way by the scheme, (3) Dynegy was not forced to file for bankruptcy, and (4) Olis was born in Korea, was raised by a single mother in the United States, and had no criminal history.21 To Olis, the discretion afforded to his sentencing judge by Booker meant the difference between a six-year sentence and a twelve- to sixteen-year sentence.

Olis’s story is noteworthy for two reasons. First, his caseillustrates—in dramatic fashion—how the loss table severely punishes even low-level white-collar offenders by ratcheting up defendants’ offense levels based on the amount of loss attributed to them. Second, the casedemonstrates how Booker freed up sentencing judges to use their discretion to consider the appropriateness of applying such severe enhancements where those enhancements do not serve as accurate proxies for culpability.

Although Booker rendered the Guidelines advisory, they remain “the starting point and the initial benchmark” in federal sentencing.22 Judges must “begin all sentencing proceedings by correctly calculating the applicable Guidelines range.”23 So getting the Guidelines right still matters. Although judges may refuse to impose that Guidelines-range sentence, a significant body of scholarship suggests that the Guidelines act as an “anchor” for federal judges in that “[c]omputing the advisory Guideline range so early in the sentencing process strongly anchors a judge’s sentence to that range, or close to it.”24 Moreover, studies suggest that “the ‘anchor’ produces an effect on judgment or assessment even when the anchor is incomplete, inaccurate, irrelevant, implausible, or random.”25 Beginning the sentencing inquiry by calculating the Guidelines range “creates a kind of psychological presumption from which most judges are hesitant to deviate too far.”26 This presumption “operates with particular vengeance in white-collar cases because, at the behest of Congress, the Sentencing Commission (Commission) has steadily increased the severity of the white-collar Guidelines . . . .”27 Judge Jed Rakoff further explains why judges might still follow the Guidelines or deviate only modestly from them: “[F]irst, it is the path of least resistance: the parties come with a stipulated Guidelines range, the judge can adopt the presentence report’s factual findings, and if the judge gives a Guidelines sentence, it is virtually immune from any reversal on appeal—it’s the easier way to proceed.”28 Second, imposing a Guidelines sentence “permits the judge to avoid the difficult moral questions that sentencing inevitably presents.”29 Finally, there are “increasingly few judges who have ever had any sentencing experience except under a Guidelines regime.”30

As such, if the white-collar Guidelines are arbitrary or too severe, many defendants will receive sentences that are arbitrary or too severe. The federal statute governing sentencing, 18 U.S.C. § 3553(a), requires district judges to “impose a sentence sufficient, but not greater than necessary, to comply with the purposes of” sentencing, which include the “nature and circumstances of the offense and the history and characteristics of the defendant” and “the need for the sentence imposed . . . to reflect the seriousness of the offense,” and to promote general and specific deterrence.31 To the extent that the Guidelines counsel a sentencing judge to impose a sentence that is “greater than necessary” to comply with the purposes of sentencing, those Guidelines run counter to Congress’s directive—even if they are no longer binding.32 It remains essential, then, that the Commission amend the ill-conceived Guidelines.

Although the existing scholarship on the Guidelines acknowledges that the loss table often produces overly harsh sentences in white-collar cases,33 it provides no answer to the crucial empirical question: in the post-Booker era, what sentences do judges actually imposein cases where loss table enhancements dramatically increase the Guidelines sentencing range? More specifically, how frequently and to what extent do judges depart from the sentencing ranges recommended by the Guidelines in high-loss white-collar cases? The Commission publishes data on aggregate trends in white-collar sentencing, including the frequency with which judges vary from the Guidelines sentencing range. At present, however, no one has aggregated and analyzed that data to determine the extent to which judges’ sentences fall below the Guidelines range. This Note begins to fill that gap.

Part I describes how the Guidelines work, and how the Supreme Court’s decision in Booker changed the sentencing landscape. Post-Booker, sentencing judges must still begin by correctly calculating the Guidelines sentencing range, but may, in their discretion, ultimately impose a sentence longer or shorter than that range.

Against this backdrop, Part II and Part III present my methodology and empirical results. The empirical analysis considers the frequency with which judges depart from the Guidelines, and the extent of those departures, in major white-collar cases in the Southern District of New York (S.D.N.Y.). I also suggest possible explanations for the trends I identify. Those explanations consider the role and behavior not only of defendants and judges, but also of the U.S. Attorney’s Office for S.D.N.Y.

First, I analyze how frequently judges depart from the Guidelines-calculated sentencing range before and after Booker in major white-collar cases—in other words, how often they impose “below-range sentences.” I examine how frequently different kinds of downward departures occur, and how the frequency of non-Guidelines sentences depends upon the loss amount attributed to the defendant. I consider two types of departures. Government-sponsored departures, which are based on cooperation with the government, were available before Booker and produce what I refer to as “government-sponsored below-range sentences.”34 In contrast, non-government-sponsored departures became far more common after Booker and produce what I refer to as “non-government-sponsored below-range sentences.” I find that, following Booker, the rate at which judges impose government-sponsored below-range sentences has remained about the same. Strikingly, however, the rate at which judges impose non-government-sponsored below-range sentences has increased dramatically. As a result, a significant majority of defendants in major white-collar cases today receive sentences shorter than the Guidelines range.

Second, I analyze the extent of the downward departures received by defendants in major white-collar cases. I use data provided by the Commission to calculate how great a departure defendants received, if they received one. As above, I analyze these patterns over time and across departure type. I find that when defendants receive sentences below the Guidelines range, the sentences received are, for the most part, significantlyshorter than the Guidelines range.

Building on the empirical findings presented in Part III, Part IV of this Note presents several interrelated normative claims. First, my findings empirically corroborate scholarly criticism that the loss table often vastly overstates the seriousness of an offense. This critique is neither unique to a small number of cases nor embraced by only a few judges. That judges in S.D.N.Y., who have significant sentencing experience in major white-collar cases, find the Guidelines sentencing range inappropriate in the significant majority of such cases suggests that the white-collar Guidelines are flawed. Second, I argue that because the Guidelines remain the starting point in every sentencing and may create an “anchoring effect,” it is essential to amend the flawed Guidelines. Amendments to the white-collar Guidelines that took effect in November 2015 (the 2015 Amendments) improve on the status quo, but they do not go far enough in changing the means of assessing culpability.35

Accordingly, I argue that the Commission should amend the Guidelines for white-collar crimes to deemphasize the amount of paper loss and consider more heavily the defendant’s role in the offense, including any pecuniary gain received. The Commission should reduce the severity of the loss table and define loss to cover only actual, as opposed to intended, financial losses. The Commission should propose additional enhancements to capture culpable conduct that the current Guidelines do not adequately reflect. Unless the Guidelines accurately capture the culpability of defendants in major white-collar cases, judges will and should continue to give little weight to the often-too-severe sentencing ranges produced by those Guidelines. I conclude that white-collar cases are not amenable to the kind of rigid quantification that characterizes the entire Guidelines system—a critique that is not confined to white-collar crime.

I. from judicial discretion to mandatory guidelines and back again: a brief history of the sentencing guidelines

A. The Advent of the Sentencing Guidelines and the Mandatory Regime

Before 1984, federal sentencing was simultaneously simple and opaque. A judge could impose a sentence of any length—or none at all—“up to the maximums established in the statute defining the crime.”36 Judges were not required to consider any particular circumstances, nor were they required to explain their reasons for imposing a particular sentence.37

The SRA radically altered this system by establishing binding Guidelines that greatly reduced judicial discretion. In enacting the SRA, Congress sought to reduce “unwarranted” disparities in sentencing.38 Congress passed the statute on the heels of a short yet influential book by Judge Marvin Frankel, Criminal Sentences: Law Without Order, published in 1973. Judge Frankel argued that unfettered judicial discretion in sentencing produced arbitrary outcomes whereby defendants who committed similar crimes received vastly different sentences. Frankel argued for the establishment of “an administrative sentencing commission ‘of prestige and credibility,’”39 which could create a “detailed chart or calculus” that would weigh the “many elements that go into the sentence”40 and provide the judge with a narrow sentencing range from which the judge would choose a specific sentence.41

The SRA amended the federal sentencing process in several ways. Among other changes, it created the United States Sentencing Commission, an independent agency in the judicial branch. The SRA instructed the Commission to promulgate the Guidelines, which would become binding on sentencing judges with very few exceptions.42 And the SRA provided the government and defendants the right to appeal a sentence on the basis that the judge did not comply with the Guidelines.43

The first iteration of the Guidelines promulgated by the Commission went into effect on November 1, 1987. The centerpiece of the Guidelines is the Sentencing Table, a grid consisting of 258 different sentencing ranges.44 The Sentencing Table’s horizontal axis tracks the defendant’s “Criminal History Category,” which is adjusted based on his criminal history as defined in the Guidelines.45 A defendant’s criminal history category can range from I to VI.46 The vertical axis tracks “Offense Level,” which is determined by starting with a “base offense level” for the crime committed and then adjusting for a variety of “specific offense characteristics” that the Guidelines deems relevant, and may be between one and forty-three points.47 The portion of the Sentencing Table where the defendant’s criminal history category and offense level intersect represents the defendant’s Guidelines sentencing range.48 That range is quite narrow: its maximum “cannot exceed the minimum by more than the greater of” either twenty-five percent or six months.49

Under the pre-Booker Guidelines, the vast majority of sentences imposed fell within the Guidelines range.50 But even before Booker, there were two means by which a judge could impose a sentence outside that range.51 First, a court could impose a non-Guidelines sentence if “the court finds that there exists an aggravating or mitigating circumstance of a kind, or to a degree, not adequately taken into consideration by the Sentencing Commission . . . .”52 I refer to these sentences as “Guidelines-sanctioned departures.” Before Booker, Guidelines-sanctioned departures were almost always departures below the Guidelines range, and they “occurred in fewer than 10 percent of cases” nationwide.53 The second, more common route of departure occurred when prosecutors filed a “substantial assistance motion” pursuant to section 5K1.1 of the Guidelines. The government may file such a motion, which “stat[es] that the defendant has provided substantial assistance in the investigation or prosecution of another person who has committed an offense,” and which authorizes judges to depart from the Guidelines sentencing range.54 During the period when the Guidelines were “mandatory,” courts imposed such departures in fifteen to twenty percent of cases nationwide.55

While some prominent scholars argue that Congress did notintend for the SRA to eliminate judges’ discretion to impose individualized sentences,56 the Supreme Court disagreed. This more restrictive reading of the SRA contemplated a “mandatory” sentencing regime with minimal judicial discretion to depart from the Guidelines. In 1992, the Supreme Court held in Williams v. United States that a court’s use of a ground for departure that was prohibited by the Guidelines’ “policy statements” was an incorrect application of the Guidelines and constituted reversible error.57 One year later, the Court held that the Guidelines’ policy statements were binding on federal courts, and that the Commission’s commentary must be “given controlling weight unless it is plainly erroneous or inconsistent with the [statute].”58 Thus, before Booker, sentencing judges’ ability to depart from the Guidelines-calculated sentence was quite limited.59

B. Booker and Its Progeny: A Return to Judicial Discretion in Sentencing

A series of decisions on the constitutionality of the Guidelines culminated in 2005 with Booker.60 In Booker, the Court invalidated the provisions of the SRA that made the Guidelines mandatory.61 The Court found the binding Guidelines scheme unconstitutional because it increased sentences on the basis of judicial fact finding rather than fact finding by a jury. The fix, the Court concluded, was simply to render the Guidelines advisory.

Since Booker, federal judges must begin by accurately calculating the Guidelines sentencing range, but may choose to depart from that range. The Court later clarified in Gall v. United States that the standard of review for such sentences is reasonableness, meaning abuse of discretion, regardless of whether the sentence falls within or outside the Guidelines range.62 If the judge imposes a non-Guidelines sentence, the reasonableness standard applies regardless of the extent to which that sentence departs from the Guidelines range.63 Appellate courts may apply a rebuttable presumption of reasonableness to Guidelines sentences,64 but may not apply a presumption of unreasonableness to non-Guidelines sentences.65

While the sentencing judge must always use the correctly calculated Guidelines range as her starting point, she may impose a non-Guidelines sentence if she finds that deviating is necessary to “impose a sentence sufficient, but not greater than necessary” to comply with the sentencing factors set out in 18 U.S.C. § 3553(a), discussed in Section I.A.66 The Court’s “resounding overall message [post-Booker]is clear: Booker did indeed transform the Federal Sentencing Guidelines from ‘law’ to a lesser species, a form of quasi-law. Using the Court’s terminology, the Guidelines are ‘advice’ that yield sentences that . . . can in most cases be judged ‘reasonable.’”67

Perhaps unsurprisingly, the percentage of non-Guidelines sentences imposed has increased in the wake of Booker and its progeny.

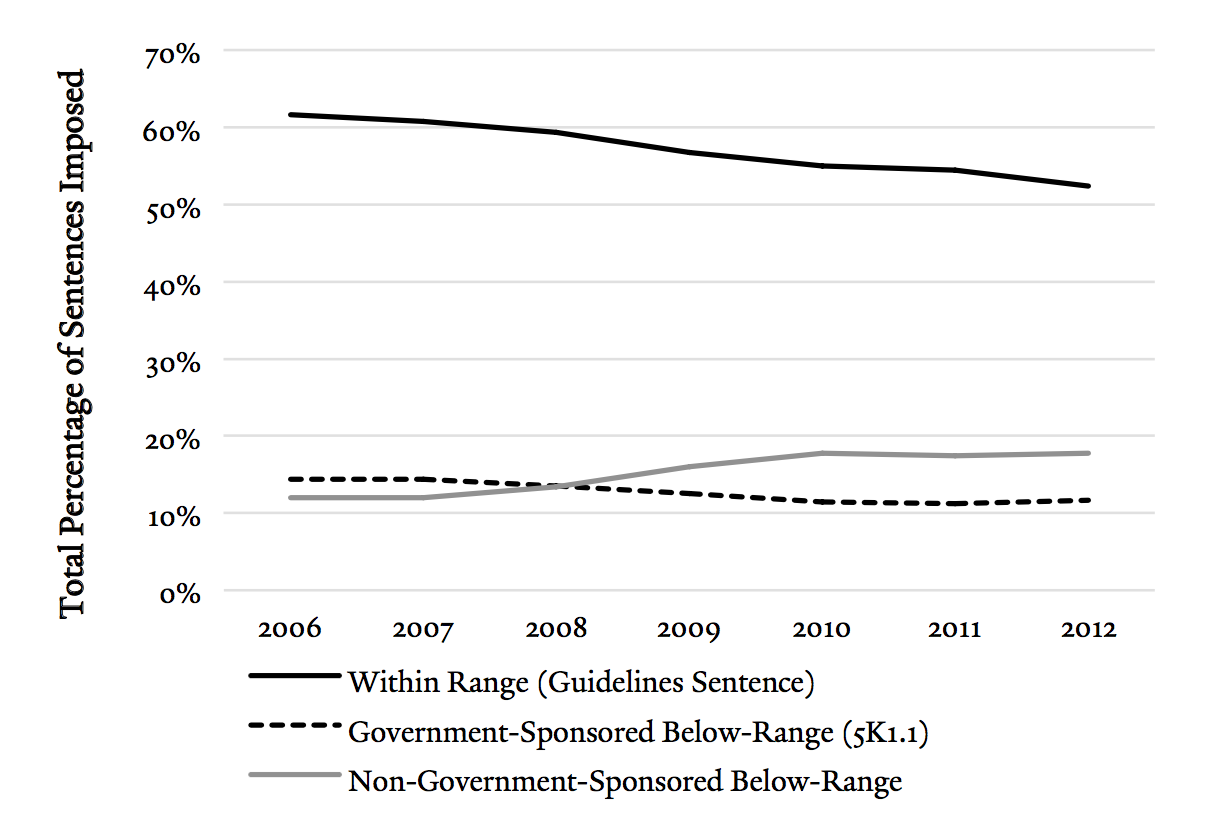

Figure 1.

types of sentences imposed for all crimes

As depicted in Figure 1, after Booker, the percentage of cases in which judges imposed a Guidelines sentence fell consistently, while the percentage of non-government-sponsored below-range sentences steadily increased. By 2012, the percentage of “within-range” Guidelines sentences had fallen to just over 52%.68

C. The Economic Loss Table

As discussed in Section I.A, judges calculate a defendant’s Guidelines sentencing range by first determining the defendant’s criminal history category and the applicable offense level, and then identifying the relevant sentencing range from the Sentencing Table.69 The base offense level for most economic crimes, such as larceny and fraud, is either six or seven levels.70 The Guidelines include a multitude of factors that can result in enhancements to the offense level for these crimes. For instance, if the offense involved ten or more victims, two levels are added; if the offense involved receiving stolen property, and the defendant was a person in the business of receiving and selling stolen property, two levels are added; if the offense involved “a misrepresentation that the defendant was acting on behalf of a [religious] organization,” two levels are added.71

Still other enhancements are transsubstantive in that they apply across all types of offenses—not just the financial crimes covered by section 2B1.1. For instance, if the defendant was an “organizer or leader of criminal activity that involved five or more participants,” four levels are added.72 The most significant of these transsubstantive enhancements is the concept of “relevant conduct,” explained in the commentary of section 1B1.1 of the Guidelines. The definition of “offense” includes “the offense of conviction and all relevant conduct under section 1B1.3.”73 Under section 1B1.3, “relevant conduct” includes not just the defendant’s offense of conviction, but all criminal activity that “occurred during the commission of the offense of conviction, in preparation for that offense, or in the course of attempting to avoid detection or responsibility for that offense.”74 When a judge determines whether a particular enhancement should apply, then, she must consider not only conduct related to the defendant’s offense of conviction, but also any criminal conduct not charged—even criminal conduct of which the defendant was acquitted—if she determines by a preponderance of the evidence that such conduct occurred.75 The Guidelines also import the Pinkerton doctrine for sentencing purposes76: the relevant conduct provision makes the defendant responsible for all crimes of his coconspirators if those acts were “reasonably foreseeable” to him.77

By far the most severe enhancement applicable to white-collar offenders is section 2B1.1(b), also known as the loss table, which provides offense level enhancements on the basis of the amount of loss attributed to the defendant. For example, if the loss exceeded $30,000, six levels are added; if the loss exceeded $2,500,000, eighteen levels are added.78 The rationale behind the loss table enhancements is simple: as the amount of economic loss caused by the defendant’s crime increases, so does the seriousness of the crime and the defendant’s culpability.

But the loss table frequently produces arbitrary and unduly severe sentences for two related reasons. First, the loss attributable to the defendant is defined so broadly that it can produce lifelong sentencing ranges for defendants who neither cause much economic harm nor derive much economic benefit from their crimes. Amendments made to the Guidelines in 200179 modified the relevant definition of “loss,” which is now defined as the “reasonably foreseeable pecuniary harm that resulted from the offense.”80 Pecuniary harm, in turn, is the greater of the “actual loss” or the “intended loss” (the harm that was intended to result from the offense).81

Consider a defendant who intended to cause a loss of $1.5 million, but whose conduct did not cause any loss at all. He could receive the same enhancement—sixteen levels—as a defendant whose conduct actually resulted in a loss of $1.5 million.82 The actual loss includes all “reasonably foreseeable pecuniary harm,” or the harm “that the defendant knew or, under the circumstances, reasonably should have known, was a potential result of the offense.”83 So the amount of loss attributed to the defendant could either be a real amount (the actual loss) or a hypothetical amount (the intended loss), and may or may not have been foreseen by the defendant. Finally, the relevant loss could accrue to almost any individual or entity, or any group of individuals or entities, including the government and financial institutions.84 For example, the amount ultimately attributed to Olis was $79 million, which was the loss in tax revenue to the United States Treasury that he intended to cause.85 The way that “loss” is calculated under the Guidelines—by aggregating the total amount of loss caused (or intended to be caused) to any victim of the offense, and attributing that entire loss amount to the defendant and any co-conspirators—ensures that many defendants subject to loss table enhancements will receive extremely harsh Guidelines sentences. As the Second Circuit noted, “[I]t may well be that all but the most trivial frauds in publicly traded companies may trigger [Guidelines] sentences amounting to life imprisonment.”86

Second, the loss table’s enhancements are so large that, in practice, they dwarf other potentially more relevant considerations. The loss table provides for enhancements ranging from two levels (for a loss of more than $5,000) to thirty levels (for a loss of more than $400 million).87 In contrast, an “organizer or leader of a criminal activity involving five or more participants” receives only a four-level enhancement and a “manager or supervisor” of the criminal activity receives a three-level enhancement, while a “minimal” participant receives a four-level reduction and a “minor” participant receives a two-level reduction.88 The loss table enhancements can overwhelm other factors that are arguably more relevant to the defendant’s culpability, including his role in the offense, his criminal history, and the economic benefit he received.

D. The 2015 Amendments

In addition to promulgating the Guidelines, policy statements, and official commentary, the Commission periodically reviews and proposes amendments to the Guidelines to Congress. On November 1, 2015, a new round of amendments took effect, several of which implicate white-collar sentencing.89

One change clarified the term “intended loss” by changing the definition from “the pecuniary harm that was intended to result from the offense” to “the pecuniary harm that the defendant purposely sought to inflict.”90 This amendment settled a circuit split over whether a subjective or objective test should be applied when calculating intended loss,91 favoring the subjective test.92 The Commission explained that this amendment “recognizes that sentencing enhancements predicated on intended loss, rather than losses that have actually accrued, should focus more specifically on the defendant’s culpability.”93 Note, however, that this amendment does not affect how severely intended loss, as opposed to actual loss, is punished. As long as the defendant purposely sought to inflict a particular amount of pecuniary harm, he will receive the same enhancement under the loss table as a defendant who actually caused such losses to accrue. And intended loss still “includes intended pecuniary harm that would have been impossible or unlikely to occur.”94

E. Gaps in the Literature on White-Collar Sentencing

The existing literature acknowledges that the Guidelines can produce extraordinarily high sentences for white-collar offenders. In particular, scholars have criticized the Guidelines’s emphasis on economic loss for producing sentences that fail to capture a defendant’s true culpability.95 In criticizing the Guidelines, authors tend to focus on particular high-profile white-collar cases in which defendants received extraordinary sentences as examples “that should cause the Sentencing Commission and Congress to rethink the fraud Guidelines.”96 As Daniel Richman noted, “[P]erhaps because finding a useful quantitative metric is difficult, or because stable patterns have yet to emerge, assessments of the new regime have largely been driven by anecdote and rhetoric.”97 Moreover, much of the criticism of the white-collar Guidelines regime assumes that Guidelines sentences are actually imposed in most cases.98 To the extent that the literature recognizes the discretion afforded by Booker,99 some scholars assume this discretion will have a limited effect in the area of white-collar crime; others see increased discretion as particularly well-suited to white-collar cases.100 While some scholarship considers whether judges should use their post-Booker discretion to impose below-range sentences in major white-collar cases, the literature thus far has not considered the extent to which judges actually mitigate the effects of the Guidelines in major white-collar cases by imposing below-range sentences. In particular, no empirical study has explained (1) how often judges impose below-range sentences in major white-collar cases; or (2) when such sentences are imposed, the extent to which those sentences are shorter than the Guidelines sentencing range. This Note seeks to fill that gap.

II. methodology

This Part describes the sentencing trend reports published by the Commission, explains why those reports are insufficient for identifying trends in major white-collar sentencing, and describes the methodology for my empirical analysis.

A. The Sentencing Commission’s Trend Reports

The Commission releases a limited amount of information on trends in sentencing.101 This includes annual sentencing “trend reports” organized by federal judicial district and circuit that note, for example, the average length of sentences in that district by crime type compared to national trends.102

The trend reports, however, are insufficient to analyze meaningfully the frequency and extent of departures from the Guidelines in major white-collar cases. First, because the Commission organizes the trend reports by individual offense types, one must aggregate data for several offense types to analyze, for example, all white-collar crimes.103 Second, in cases where the defendant received a non-Guidelines sentence, the trend reports do not identify the corresponding Guidelines sentencing range. As a result, the reports do not indicate how far judges depart from the Guidelines sentencing range when they impose non-Guidelines sentences.104 And the Commission’s district-by-district analysis offers no information on the influence of the loss table on sentences. Although the Commission recently published data on sentencing trends for white-collar offenders nationwide, that data does not show how the amount of loss attributed to defendants affected their sentences.105

B. White-Collar Crimes Dataset

The Commission provides raw sentencing data on its website.106 The raw data includes information about each defendant sentenced in a particular district in a given fiscal year. The data includes, for instance, the primary offense charged, the applicable Guidelines sentencing range, the actual sentence imposed, and the type of departure imposed, if any.107

To identify changes in white-collar sentencing trends after Booker, which was decided in 2005, I reviewed sentencing data for the years 2002 through 2012.108 Because I focus on sentencing in major white-collar cases—and in particular, sentences imposed in cases with very high loss amounts—I used sentencing data from S.D.N.Y.

By using this data sample, I could ensure that the dataset would include enough high-loss white-collar cases in each year to analyze reliably.109 Moreover, because New York is home to many major financial institutions, many of the biggest white-collar cases are prosecuted in S.D.N.Y. Lastly, because the behavior of judges and prosecutors varies widely from district to district, it would be difficult, if not impossible, to explain national trends.110 By analyzing data only from S.D.N.Y., I am thus able to offer more reliable possible explanations for my findings. Although below-range sentences are imposed in a higher percentage of all criminal cases in S.D.N.Y. than the national average,111 this distinction is irrelevant for purposes of my analysis; my research focuses on the kinds of sentences imposed in a specific type of case, and does not address sentencing disparities across jurisdictions. Accordingly, my results and analysis apply only to major white-collar cases in S.D.N.Y.

I analyzed the raw data using SPSS software to isolate and evaluate “major white-collar cases.” To identify the subset of cases I classify as “major white-collar cases,” I eliminated the sentencing data for all non-white-collar crimes. This left sentences imposed for fraud, embezzlement, bribery, tax offenses, and antitrust violations.112 Second, to exclude offenses related to drug or organized crime from my dataset, I eliminated any sentences in which the defendant was also convicted of a weapons-related offense. Finally, to focus on only “major” white-collar cases, I eliminated all sentencing data for offenses where the loss amount attributed to the defendant was $30,000 or less. Accordingly, I use the term “major white-collar cases” to refer to this particular subset of offenses.113

Examining a very particular subset of offenses offers a more nuanced view of how judges have utilized the discretion afforded by Booker. It yields a picture of major white-collar sentencing that considers “shades of gray.” Whereas the Commission’s trend reports paint in broad strokes, my findings provide as-yet-unavailable information about sentencing trends in high-loss white-collar cases in particular. My findings supplement the information provided by the Commission by filling the gaps identified inSection I.E.

III. results and analysis: sentencing in major white- collar cases in s.d.n.y.

Section I.B described how the loss table affects sentences in major white-collar cases by providing for significant enhancements on the basis of broadly defined economic loss attributed to the defendant. This Part provides a step-by-step analysis of sentencing trends in these major white-collar cases. Section III.A illustrates that defendants in these cases often receive a departure from their Guidelines-calculated sentencing range, and considers how the frequency of departures changed after Booker. Next, in Section III.B, I consider whether the likelihood of a defendant receiving such a departure is affected by the amount of loss attributed to him via the loss table. In Section III.C, I probe further and determine that the magnitude of such downward departures is quite sizable. Finally, in Section III.D, I consider whether these results might be unique to major white-collar cases and determine that they probably are not.

A. The Decline of Guidelines Sentences: Trends in White-Collar Cases in S.D.N.Y. and Nationally

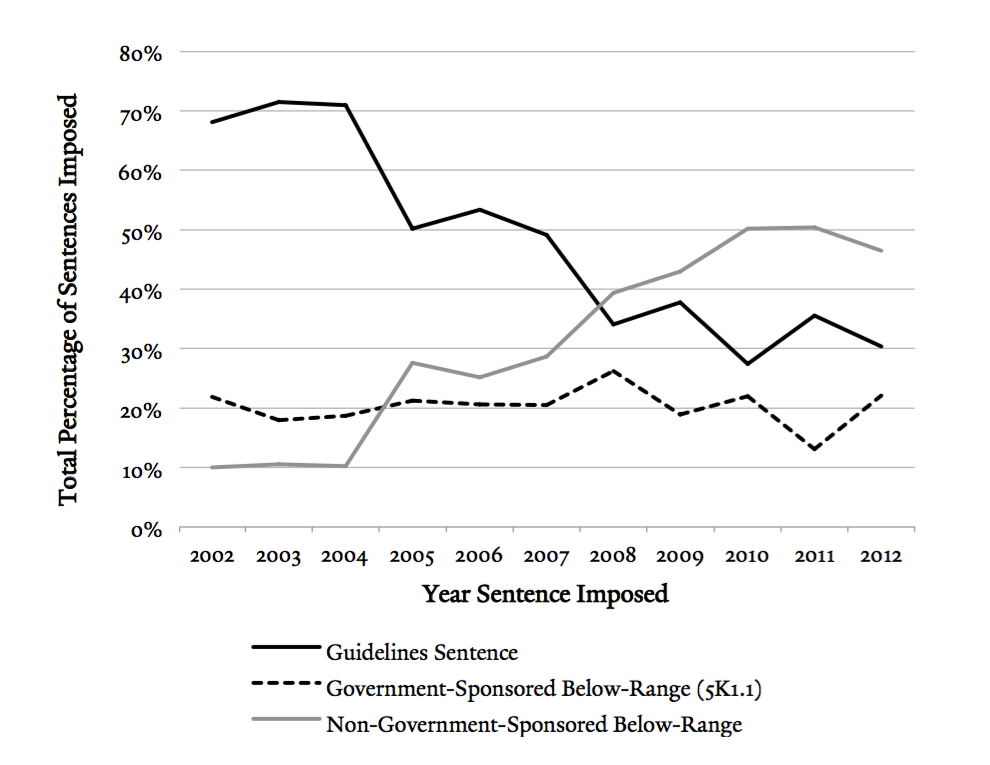

Before considering the particular effects of the loss table, I analyze how white-collar sentencing practices have changed in general since Booker. Figure 2 shows general sentencing trends for major white-collar cases in S.D.N.Y. over time. Before Booker, Guidelines sentences constituted about seventy percent of all major white-collar sentences. From 2009 to 2012, however, only about thirty to forty percent of such sentences fell within the Guidelines range.114 In comparison—based on information provided by the Commission—Guidelines sentences for all economic crimes tied to the loss table nationwide decreased from more than eighty percent of sentences before Booker to only 50.6% of sentences in 2012.115 In other words, judges in S.D.N.Y. apply Guidelines sentences in major white-collar cases at a rate much lower than the national average for similar economic crimes (30.4%, compared to 50.6% nationally, in 2012).116

Figure 2.

types of sentences imposed in major white-collar cases in s.d.n.y.

Figure 2117 also reflects the significant increase in the imposition of non-government-sponsored below-range sentences in S.D.N.Y. The percentage of cases in which such sentences were imposed increased from around ten percent before Booker, to thirty percent just after Booker, to around fifty percent by 2010.118 Note the dramatic combined result: by 2012, nearly seventy percent of defendants in major white-collar cases in S.D.N.Y. received a government-sponsored or non-government-sponsored below-range sentence.119

Nationally, about forty-seven percent of white-collar offenders received below-range sentences, and about twenty-five percent received non-government-sponsored below-range sentences.120 Comparing S.D.N.Y. with national trends, judges in S.D.N.Y. imposed non-government-sponsored below-range sentences at a much higher rate (forty-six percent) than the national average (twenty-five percent). This result is not particularly surprising given that judges in S.D.N.Y. have consistently departed from the Guidelines at rates higher than the national average when one considers all crimes, not just economic ones.121 Finally, Figure 2 demonstrates that Booker apparently had little, if any, effect on the rate at which the government sponsored departures, which hovered around twenty percent for most years.122

In the wake of Booker, the frequency with which below-range sentences have been imposed has increased steadily such that, by 2012, a significant majority of defendants in major white-collar cases in S.D.N.Y. received below-range sentences. This tells us that judges in S.D.N.Y. are frequently dissatisfied with the sentencing ranges produced by the Guidelines in major white-collar cases, as they impose sentences below the Guidelines range in nearly seven in ten cases. As described further inPart IV, the fact that sentencing judges in S.D.N.Y.—who have significant experience sentencing in white-collar cases—depart with such frequency suggests that the white-collar Guidelines fail to provide tools sufficient to capture defendants’ true culpability.

B. Departures Become More Frequent as Loss Amount Increases, Largely Due to Changes in the Rate of Government-Sponsored Departures

This Section considers whether the loss amount attributed to the defendant affects his likelihood of receiving a below-range sentence. As described inSection I.C, the loss table provides for significant enhancements—up to thirty levels—in the defendant’s offense level. As the loss amount increases, so does the severity of these enhancements. For example, a defendant who receives a four-level enhancement under the loss table (for a loss amount greater than $10,000) might end up with a sentencing range of six to twelve months instead of zero to six months, whereas one who receives a twenty-four-level enhancement (for a loss amount greater than $50 million)—as Olis did—may receive a sentencing range of fifteen to twenty years instead of ten to sixteen months.123

Moreover, the enhancements might not reflect the defendant’s actual culpability or the true seriousness of the offense. Recall that, under the loss table, a defendant who intends—but does not actually cause—a particular amount of loss receives the same enhancement as one who actually causes that amount of loss. Judges might impose non-government-sponsored below-range sentences more often in higher-loss cases, where the loss table provides for severe enhancements.124 My results demonstrate, however, that below-range sentences are more common in higher-loss cases, but only because the government is more likely to have sponsored a below-range sentence in higher-loss cases. I present and explain these results below, and follow with a discussion of potential explanations.

To analyze departure rates by loss amount, I analyzed the types of sentences imposed over several different loss categories. I divided sentences into four categories based on loss amount: (1) between $30,001 and $200,000; (2) between $200,001 and $1 million; (3) between $1 million and $20 million; and (4) greater than $20 million.125

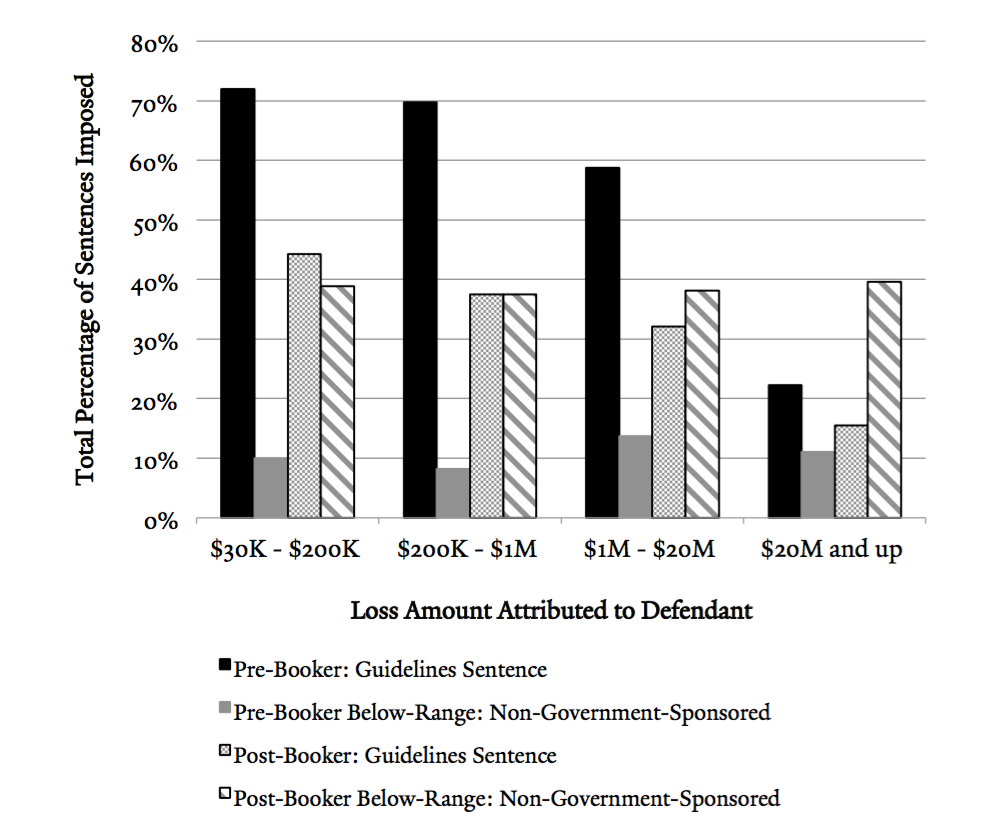

Figure 3.

comparison of guidelines sentences and non-government-sponsored below-range sentences imposed by loss amount

Figure 3 depicts data for Guidelines sentences and non-government-sponsored below-range sentences over time and by loss amount.126 Figure 3 shows that, both before and after Booker, the rate at which judges imposed Guidelines sentences decreased as the loss amount attributed to defendants increased. The findings illustrate another, perhaps more intuitive trend: the percentage of Guidelines sentences imposed in major white-collar cases decreased after Booker regardless of the size of the loss amount.127

Yet Figure 3 shows that the discrepancy in the percentage of Guidelines sentences imposed in relatively high-loss cases versus lower-loss cases is not explained by the rate at which non-government-sponsored below-range sentences are imposed. Although a defendant was much more likely to receive a non-government-sponsored below-range sentence after Booker than before, within each time period, the likelihood that a defendant received such a sentence was not affected by loss amount. Before Booker, a defendant was about as likely to receive a non-government-sponsored below-range sentence in a relatively lower-loss case as he was in a higher-loss case. The same holds true for sentences imposed after Booker.128 In other words, although defendants were more likely to receive non-Guidelines sentences in high-loss cases, it is not because judges were more likely to grant non-government-sponsored departures.

Rather, as shown in Figure 4, the rate of government-sponsored below-range sentences explains the change in rates of Guidelines sentences as loss amount increases. Both before and after Booker, the government was markedly more likely to sponsor a below-range sentence based on cooperation in cases with relatively more loss attributed to the defendant than in cases with relatively less loss.

Figure 4.

government-sponsored (5k1.1) below-range sentences imposed (by loss amount)

The government may be more likely to sponsor a below-range sentence in cases with high loss amounts for several reasons. First, cases with extremely high loss amounts could be more complicated, and may involve more defendants, than relatively low-loss cases. So the government might be more likely to need the assistance of one or more defendants, and thus seek cooperation at higher rates.129 But even assuming that the government is more likely to benefit from the assistance of a cooperator in cases with higher loss amounts, it does not necessarily follow that the statistical chance of a defendant receiving a government-sponsored below-range sentence in those cases should be higher than a defendant’s chance of receiving one in a relatively lower-loss case.

Second, defendants in higher-loss cases may be more likely to have better attorneys, particularly ones who have experience interacting with the U.S. Attorney’s Office and who are more effective in securing government-sponsored departures for their clients.130

Third, in higher-loss cases, the government might actually agree—implicitly or explicitly—that the loss table enhancements overstate a defendant’s culpability. On this view, the government may be more likely to sponsor a departure based on cooperation in higher-loss cases not because defendants provide substantial assistance at higher rates, but because the government is more likely to consider the Guidelines sentencing ranges in those cases unacceptably high. That is, the government might be filing “false” section 5K1.1 letters—or at least be more liberal in their assessment of who provides “substantial assistance”—in order to ensure that the defendant receives a sentence much shorter than the Guidelines range.131

I find this last explanation exceedingly unlikely. If the government believes the loss table enhancements produce a Guidelines sentencing range that is unreasonable or otherwise unfairly represents the defendant’s culpability, the government has several options other than filing a “false” section 5K1.1. First, the prosecutor could engage in “sentencing bargaining” with the defendant, such that the loss amount included in the presentence report—which is produced by the probation officer and relied upon by the judge in determining the Guidelines sentencing range—is lower, thereby resulting in a lower Guidelines range.132

The government could also explicitly or implicitly convey that it supports a non-Guidelines sentence to the judge during sentencing. The policy of the U.S. Attorney’s Office for S.D.N.Y. apparently requires an Assistant U.S. Attorney (AUSA) to seek permission from the Chief of the Criminal Division if she wishes to either seek a particular sentence in a given case or request a sentence above or below the Guidelines-calculated range.133 Based on admittedly anecdotal information, it seems that this specific permission is only infrequently requested, though almost always granted when requested.134

AUSAs might also indicate implicitly to the court—without official permission from their Office—that a below-range sentence is warranted. For example, in United States v. Adelson,135 the defendant would have received an effective life sentence under the Guidelines due to a twenty-four-point loss table enhancement. While the government argued officially—in accordance with Justice Department policy—that the Guidelines sentence should be imposed, at the sentencing hearing the AUSA “refused to answer the question [of whether the government was asking for a Guidelines sentence] directly”:

The Court: So you want Mr. Adelson to spend the rest of his life in prison. That’s your position, yes?

The Government: Your Honor, I think our position is slightly more nuanced than that. . . . [W]e respectfully submit that a sentence that is consistent with the terms of the applicable [G]uidelines . . . [a]nd consistent with other sentences in other similar cases [would be suitable]. We think that by coupling those two together, that would be an appropriate reasonable—

The Court: So you think I should impose a non-[G]uideline sentence?

The Government: Your Honor, as the Court is well aware, our policy is that the [G]uidelines sentence is—

The Court: I don’t think you can have it both ways. I think you either have to take this position that you seem to be taking in your papers, that this defendant should be sentenced to life imprisonment, or not. I don’t think you can wiggle out of that with this what you call “nuanced” equivocation.136

Predictably, judges do not appreciate this kind of hedging by the government.137 AUSAs act on behalf of the government and should prioritize transparency.138 This is all to say that, when the government believes the Guidelines range is too high, it has multiple means to secure a below-range sentence other than filing unwarranted section 5K1.1 letters.

The final potential explanation for the high rate of government-sponsored departures in higher-loss cases turns the presumed causal relationship on its head. Rather than assuming that the government sponsors departures at higher rates because the loss amount in those cases is higher, this explanation suggests that the loss amount may actually be higher because the government sponsored a departure. The U.S. Attorney’s Office for S.D.N.Y. appears to require cooperators to pay a “cooperation penalty” by expecting them to reveal, and in most cases plead guilty to, all criminal conduct to receive the benefits of cooperation—regardless of whether that conduct was known to the government prior to the proffer.139 Moreover, the defendant must disclose the full extent of the charged scheme, including conduct or loss that the government may not have been able to identify or prove.140 As such, it is possible that government-sponsored below-range sentences are common in very high-loss cases precisely because the loss amount—and thus the Guidelines sentencing range—is “inflated” beyond what it would have been had the defendant not cooperated. This theory is described in more detail inSection III.C, where I provide empirical support for the notion that this cooperation penalty exists and inflates cooperating defendants’ Guidelines sentencing ranges.

C. Extent of Departures by Departure Type: Defendants Who Receive Below-Range Sentences Derive Significant Benefits

The findings presented thus far demonstrate that judges (and prosecutors, to the extent that they sponsor departures) frequently determine that the Guidelines sentencing range produced in major white-collar cases is inappropriate. But how inappropriate? It is one thing to determine that judges find the Guidelines range too severe in many cases, but it is quite another to determine that judges find the Guidelines range significantly too severe in many cases. This Section considers how far“below-range” those sentences actually are. That is, when judges impose such sentences, by how much do they depart from the bottom end of the Guidelines sentencing range (minimum Guidelines range)? The Commission has not released data on this point, and scholars have yet to address this question. Empirical data concerning this issue, however, is essential in assessing just how broken the white-collar Guidelines are—at least in the eyes of judges who must consult them.

I evaluate two kinds of below-range sentences: (1) below-range sentences based on cooperation with the government; and (2) non-government-sponsored below-range sentences, imposed by the court without sponsorship by the government. I consider them separately because these two types of sentences are imposed for different reasons. Judges impose government-sponsored below-range sentences to incentivize cooperation. Cooperating defendants should receive significant departures because white-collar defendants are exceedingly unlikely to have significant criminal histories or to have committed violent crimes. Non-government-sponsored below-range sentences, meanwhile, are imposed when the judge independently determines that the Guidelines sentencing range is inappropriately high relative to the defendant’s culpability. Non-government-sponsored below-range sentences thus reflect the judge’s determination that the Guidelines-calculated sentencing range does not accurately capture the defendant’s culpability.

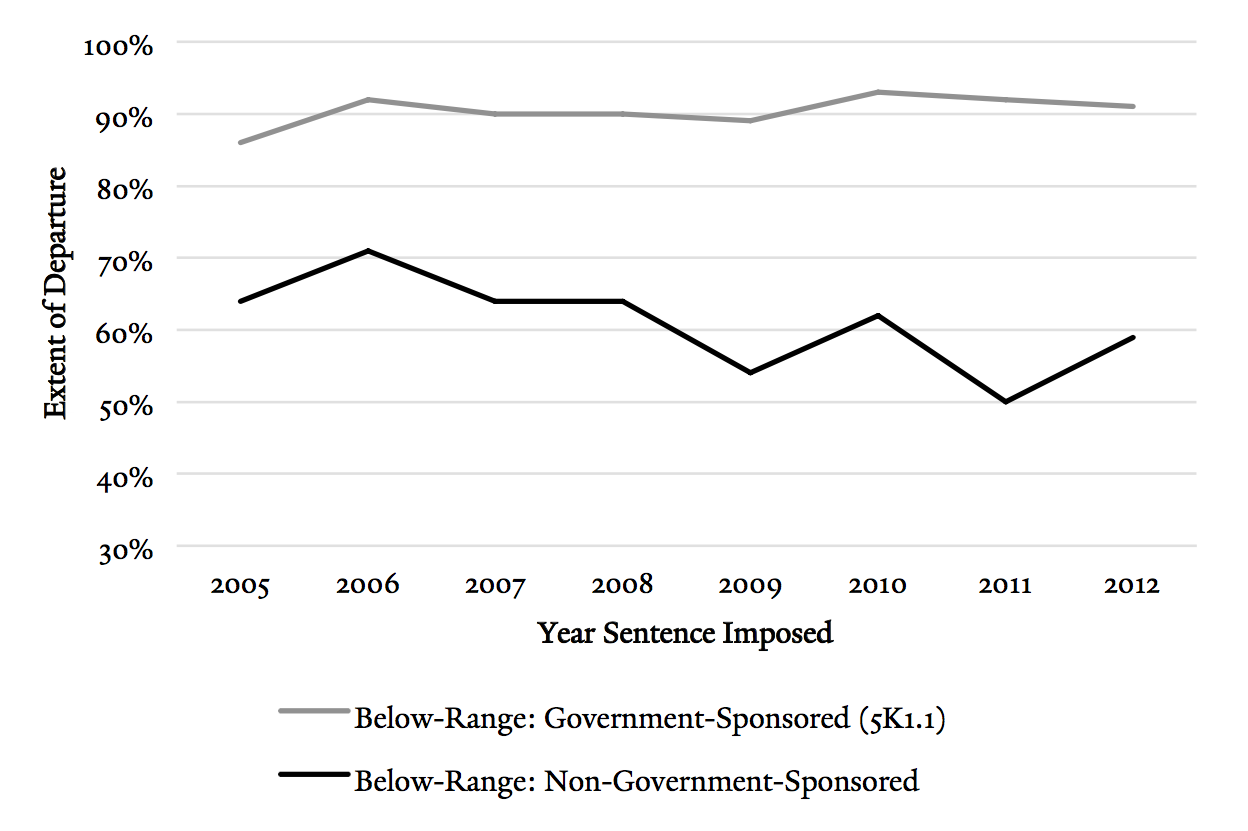

I reviewed and analyzed each individual government-sponsored below-range sentence and each non-government-sponsored below-range sentence in my dataset, and I compared the sentence that the defendant actually received with the minimum Guidelines range. Figure 5 demonstrates that defendants receiving either kind of departure derive great benefits.

Figure 5.

extent of departure (in percentages) by departure type

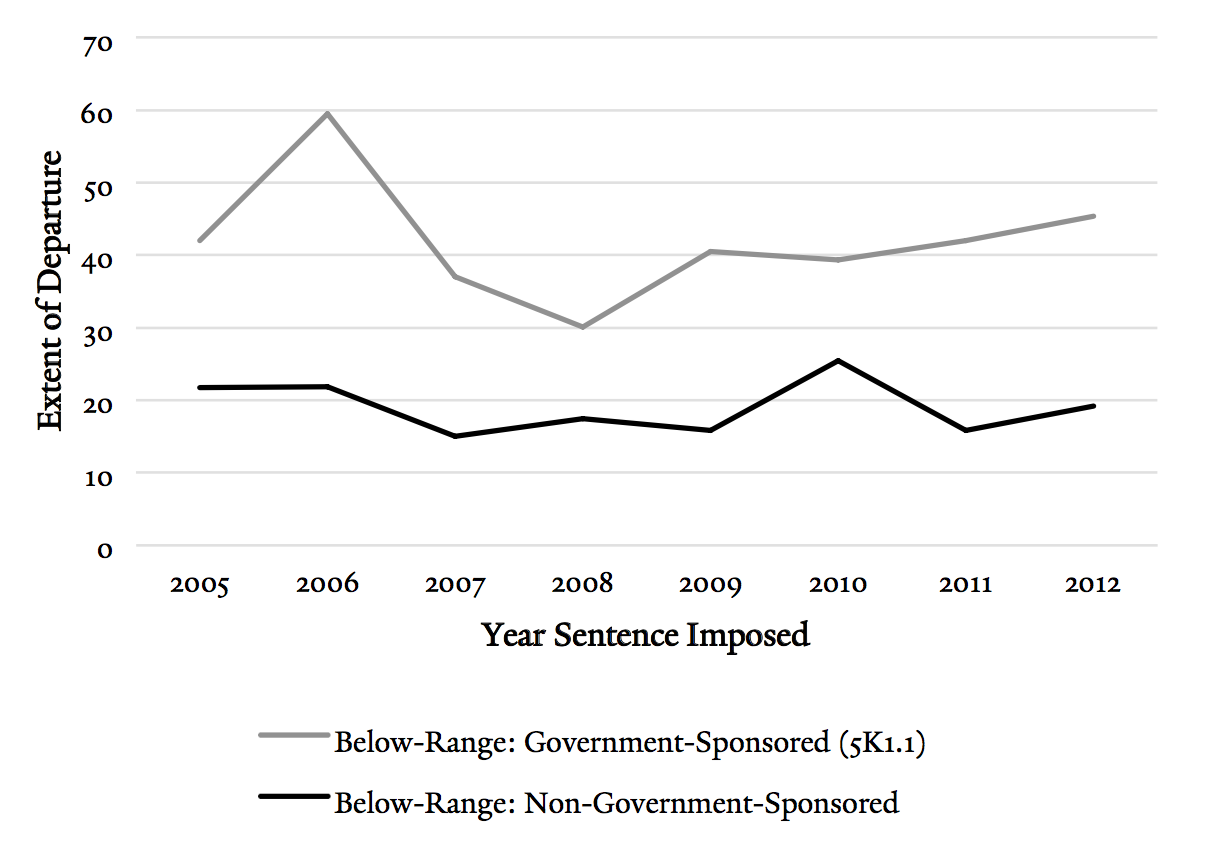

Government-sponsored below-range sentences were consistently 90% shorter than the minimum Guidelines range. The extent of departure for non-government-sponsored below-range sentences was smaller, but still significant: defendants received sentences that were, on average, fifty to seventy percent shorter than the minimum Guidelines sentence. Figure 6 shows the same data, but with departures expressed in months rather than as a percentage of the minimum Guidelines range.141

Figure 6.

extent of departure (in months) by departure type

These results suggest that judges in S.D.N.Y. frequently determine that a departure is appropriate and, when imposing such departures, provide defendants with significant sentencing benefits.

Consider cases in which judges imposed non-government-sponsored below-range sentences. On average, defendants received at least a fifty-percent departure, or more than eighteen months off their sentences. While the average minimum Guidelines sentence in such cases ranged from about thirty to fifty months, the average sentence actually received ranged from about fourteen months to about twenty-six months.142 Recall that non-government-sponsored below-range sentences have become increasingly common in major white-collar cases, constituting about fifty percent of sentences in the past few years,143 while government-sponsored below-range sentences routinely comprise twenty percent of such cases. In recent years, roughly seventy percent of defendants in major white-collar cases received a downward departure from their Guidelines-calculated sentencing range, and those departures were, for the most part, quite large. My findings thus demonstrate that sentencing judges in S.D.N.Y. have not shied away from using the discretion afforded by Booker to impose sentences significantly shorter than those produced by the Guidelines.

Unsurprisingly, as shown in Figure 5 and Figure 6, the departures given to defendants who provide substantial assistance to the government are generally greater than those given to defendants who do not. The sentence actually received by cooperators is on average about ninety percent shorter than the minimum Guidelines range, or between thirty and sixty months shorter.

There are two plausible explanations for these dramatic findings. First, some judges may simply operate under a rebuttable presumption that a white-collar offender who provides substantial assistance to the government should not serve much (if any) time in prison. Judges understand that the assistance provided by cooperating defendants is invaluable to the government, and no doubt take into consideration the fact that the vast majority of white-collar offenders have no significant criminal history. As such, it is possible that at least some judges nearly always impose sentences of probation, which amount to one-hundred-percent departures, for white-collar cooperators.

The second explanation draws on the theory posited inSection III.B: that Guidelines sentencing ranges are actually “inflated”144 in cases in which the defendant receives a government-sponsored below-range sentence. If this is the case, then judges must depart significantly from the minimum Guidelines range to ensure that the defendant benefits from cooperating.145 If the judge does not depart far enough below the “inflated” Guidelines range, then the defendant may be better off simply pleading guilty and disputing the loss amount.

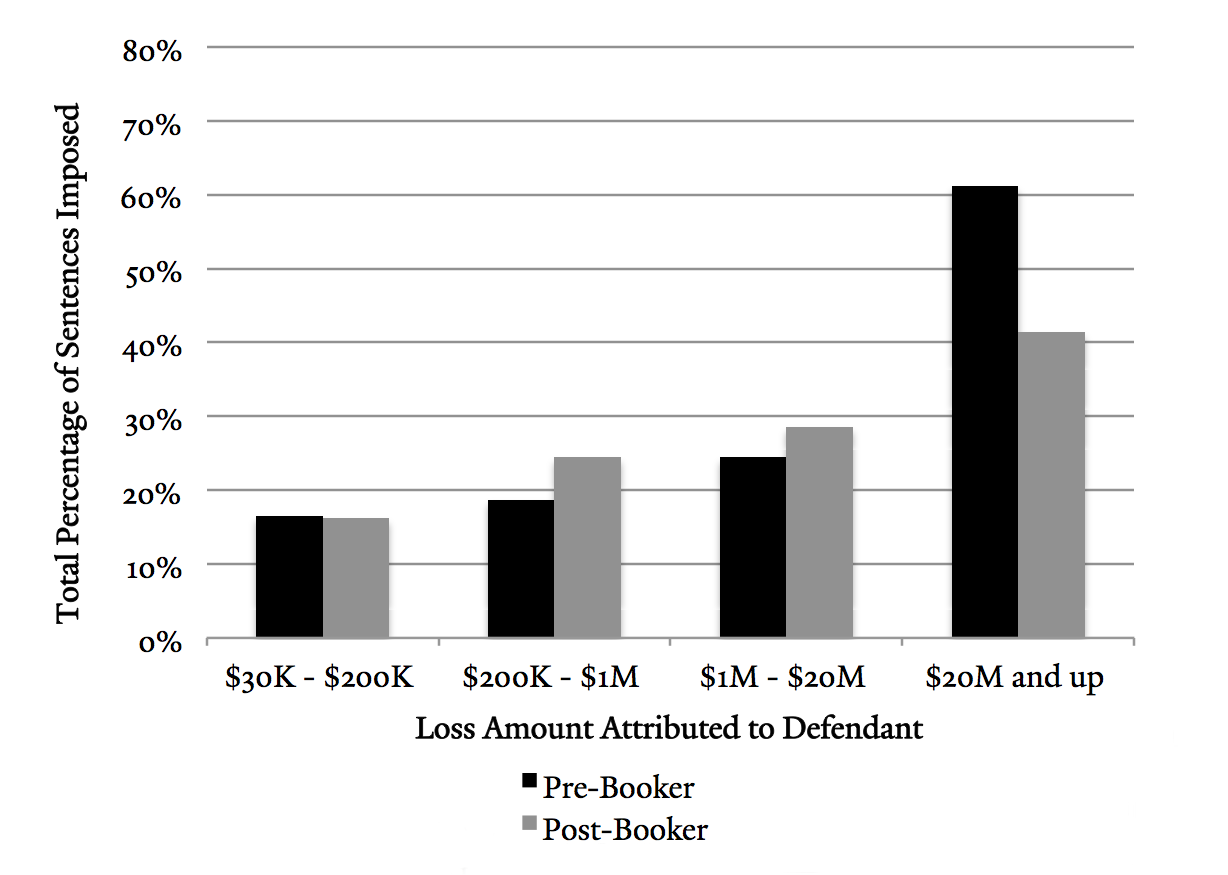

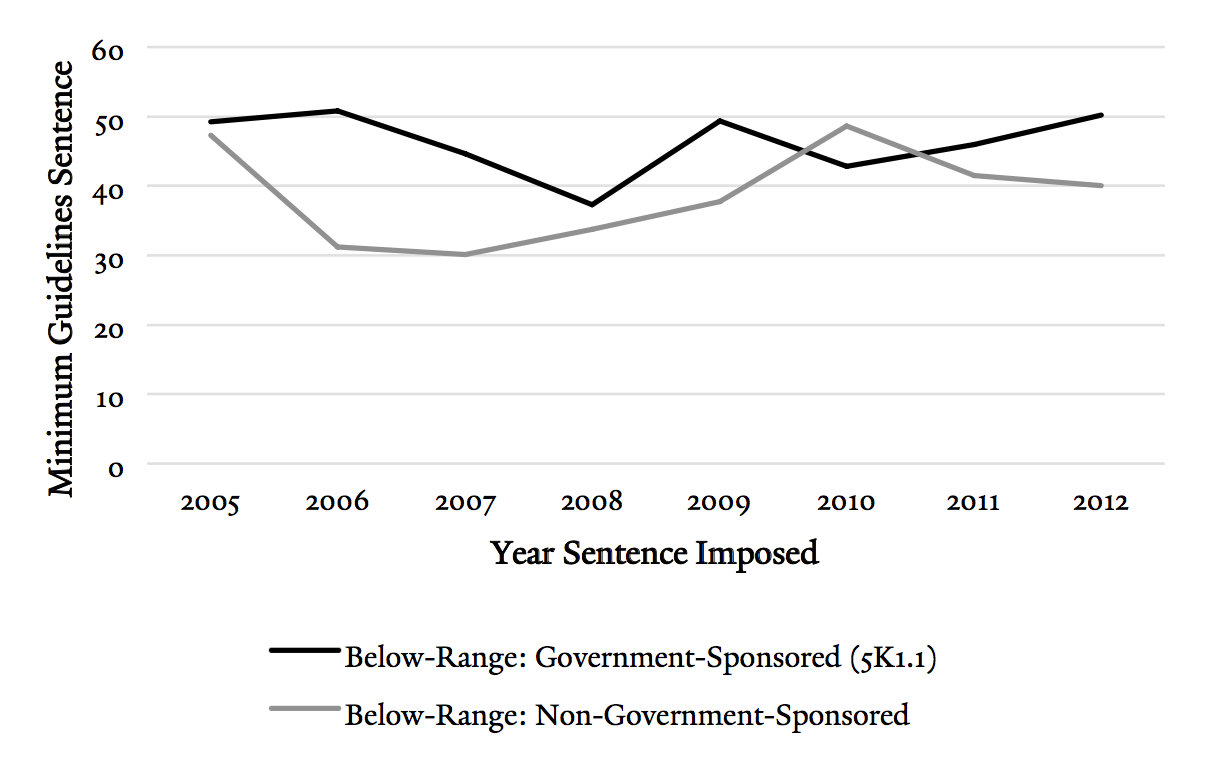

This theory is plausible only if the Guidelines ranges are in fact “inflated” compared to ranges for noncooperators. To test this theory, I calculated the average minimum Guidelines range produced in both kinds of cases: (1) cases where the defendant cooperated, and (2) cases where the defendant did not cooperate but still received a below-range sentence. As shown in Figure 7, I found that the average minimum Guidelines ranges in cases where the defendant cooperated were consistently longer than the minimum Guidelines ranges in cases where the defendant received a non-government-sponsored below-range sentence.

Figure 7.

average minimum guidelines sentence (in months) by departure type

The minimum Guidelines sentencing range in cases involving cooperators generally exceeded the range in cases with non-government-sponsored departures.146 Although it is possible that cases in which the defendant receives a government-sponsored below-range sentence are, on average, more serious than cases where the defendant receives a non-government-sponsored below-range sentence, it seems unlikely for the reasons described in Section III.B. In fact, given that the government often seeks cooperation from less culpable players in order to get at the “higher-ups,” we might expect defendants who cooperate to be charged with less serious offenses than their noncooperating counterparts. On this view, we would expect cooperators to receive shorter Guidelines sentencing ranges. My findings thus suggest that the U.S. Attorney’s Office for S.D.N.Y. implements a “cooperation penalty,” which results in the “inflation” of Guidelines sentencing ranges for cooperating defendants. Assuming that at least some judges know of and understand this policy,147 even a relatively harsh sentencing judge should impose sentences that depart significantly downward from the Guidelines range in these cases to incentivize cooperation.148 My findings demonstrate this trend: defendants who cooperate with the government pay the “penalty” of receiving higher Guidelines sentencing ranges than defendants who receive non-government-sponsored departures, but in turn obtain a massivereduction of their final sentence—receiving sentences that average around just four to nine months.149

So far, my results show two significant trends: (1) the frequency with which below-range sentences are imposed in major white-collar cases has continued to increase steadily, post-Booker; and (2) below-range sentences imposed in major white-collar cases tend to be significantly shorter than the Guidelines range. As discussed inPart IV, these results suggest that the white-collar Guidelines in general, and the loss table in particular, are insufficient tools for assessing defendants’ culpability.

D. The Trouble with the Guidelines Is Not Unique to the Loss Table: Comparing Major White-Collar Cases with All Cases in S.D.N.Y.

Since Booker, judges across the country have imposed non-Guidelines sentences with increasing frequency.150 But judges may be more likely to impose non-Guidelines sentences in major white-collar cases governed by the loss table than they are in the average case. White-collar sentencing may be less amenable to the sort of rigid quantification embodied by the Guidelines in general and the loss table in particular. White-collar cases are particularly heterogeneous. Scholars have noted that “[i]t is harder to speak of a typical bribery or securities fraud than of a typical drug deal or mail theft.”151 Moreover, in white-collar cases more than in others, “the very existence of a crime may be in dispute, and matters of intent and motivation are often ambiguous.”152 In addition, white-collar cases “more often are subject to the adversarial efforts of defense attorneys,” which “tends to complicate rather than simplify the classification of a case.”153 And in white-collar cases “judges are usually deprived of two of the primary qualities that help the judge decide on a sentence: a violent act and a prior record.”154 These characteristics of white-collar sentencing may make judges more likely to use the discretion returned to them by Booker to impose sentences shorter than the Guidelines range.

To test whether defendants in major white-collar cases are more likely to receive below-range sentences than other defendants, I compared sentencing trends for major white-collar cases in S.D.N.Y. with trends for all criminal cases in S.D.N.Y. I examined the percentage of Guidelines sentences imposed, the percentage of government-sponsored below-range sentences imposed, and the percentage of non-government-sponsored below-range sentences imposed for both categories of crimes.

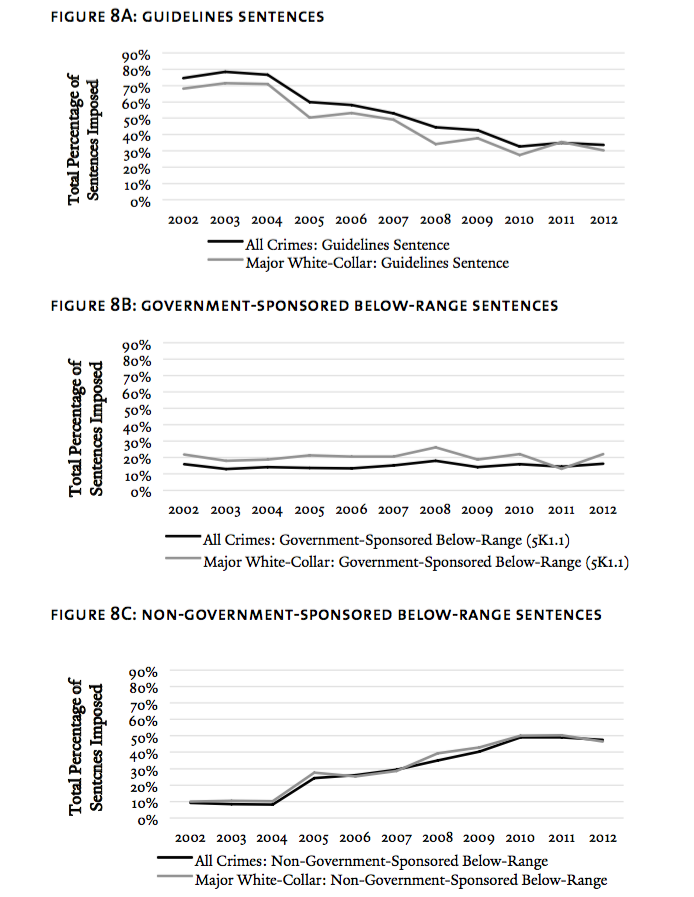

Figure 8.

comparison of sentencing trends in s.d.n.y.

Figure 8 shows that, over time, the percentage of Guidelines sentences imposed fell dramatically, both for all crimes and for major white-collar crimes, in S.D.N.Y. Correspondingly, the percentage of non-government-sponsored below-range sentences increased significantly after the Court decided Booker in 2005. For almost all years, the percentage of Guidelines sentences imposed in major white-collar cases was slightly lower than the percentage of Guidelines sentences imposed in all crimes combined. That is, it was slightly more likely that a defendant would receive a non-Guidelines sentence in a major white-collar case than in the average case. However, there is no major difference between the percentage of non-Guidelines sentences imposed in major white-collar cases and in cases generally.

The explanation for this difference is not that major white-collar offenders were more likely to receive non-government-sponsored below-range sentences. They were not: those kinds of sentences were imposed in nearly the exact same percentage of major white-collar cases as cases generally. Instead, the difference in rates of non-Guidelines sentences appears to correspond to the difference in government-sponsored below-range sentences: defendants in major white-collar cases were slightly more likely than the average defendant to receive a government-sponsored below-range sentence. But the difference is slight—only a few percentage points per year.155

The government’s tendency to sponsor departures based on cooperation more often in major white-collar cases relative to all criminal cases is likely the result of several factors. First, major white-collar cases are more likely to involve multidefendant conspiracies than, say, immigration offenses.156 As such, the government may be more likely to needa cooperator to prove its case. Second, the government might be more comfortable offering the benefits of cooperation to defendants who are unlikely to have significant criminal histories and even less likely to have committed violent crimes. Third, defendants themselves might be more likely to cooperate in major white-collar cases than than in other kinds of cases. After all, a defendant who cooperates in a major white-collar case is probably less likely to be killed for cooperating than a defendant who cooperates in a gang-related drug conspiracy.

The frequency with which non-government-sponsored below-range sentences are imposed—up to roughly fifty percent of both groups of cases by 2010—suggests that judges in S.D.N.Y. often determine that sentences produced by the Guidelines are inappropriately high. But my findings suggest that judges do not consider the Guidelines ranges objectionable in major white-collar cases much more frequently than they find the Guidelines ranges objectionable in other kinds of cases.157 Judges often disagree with Guidelines-calculated sentences in major white-collar cases, but there remains little difference between trends for these crimes and for crimes generally, because judges alsofrequently disagree with the Guidelines-calculated sentences in other kinds of cases.

Consider drug crimes, which make up a significant proportion of the docket in S.D.N.Y.158 The Guidelines sentencing ranges for these crimes are calculated based largely on the weight of drugs attributed to the defendant under the drug quantity table.159 This calculation may overstate a drug defendant’s culpability, just as calculations under the loss table do for white-collar defendants. Moreover, some judges believe that the Guidelines’s sentencing structure for crack cocaine is fundamentally flawed, and therefore they routinely depart from the Guidelines in crack cases.160 As a result, my criticisms of the loss table—that it relies too heavily on numbers and produces sentences that are too harsh—are likely generalizable to other aspects of the Guidelines.

IV. where do we go from here?

In 2008, Stith predicted that “[t]he pendulum of sentencing practice may increasingly swing back toward the exercise of informed discretion as newly appointed local decision makers are able to see beyond the narrow and arbitrary ‘frame’ of the Federal Sentencing Guidelines.”161 My findings suggest that, at least in the realm of major white-collar cases in one of the most prominent judicial districts in the country, Stith’s prediction was correct. Defendants in major white-collar cases in S.D.N.Y. are more likely than not to receive a sentence below the Guidelines range. Moreover, when a below-range sentence is imposed, it is generally vastly shorter than the sentence recommended by the Guidelines. The lengthy sentences produced under the Guidelines are rarely actually imposed, at least in S.D.N.Y. Rather, both the government, by sponsoring below-range sentences on the basis of cooperation, and the court, by frequently imposing below-range sentences in cases not involving cooperation, behave in ways that mitigate the often harsh effects of the loss table.

These results suggest that many judges believe the loss table is an ineffective tool for measuring white-collar defendants’ culpability because it frequently and vastly overstates the seriousness of the offense. My results further demonstrate that this critique is neither unique to a small number of cases nor embraced by only a few judges. Prior scholarship relies on anecdotal evidence of extraordinarily long sentences imposed in specific white-collar cases to argue that the Commission should reconsider the white-collar Guidelines.162 My findings provide comprehensive empirical evidence that the white-collar Guidelines are broken: the results indicate widespread judicial refusal to impose the sentences produced under those Guidelines. The fact that my findings pertain to a district in which judges have significant experience sentencing in major white-collar cases reinforces the conclusion that these Guidelines are flawed.163

The Guidelines are merely advisory. But as long as they remain the “starting point” in every sentencing, the quality and fairness of the Guidelines still matters.164 Moreover, there is reason to believe that the Guidelines have an “anchoring effect” on judges such that—regardless of the Guidelines’s advisory status—many judges will continue to impose sentences within or close to the Guidelines range regardless of whether that range satisfies Congress’s directive to “impose a sentence sufficient, but not greater than necessary, to comply with” the purposes of sentencing.165 Even if this anchoring effect does not exert much influence on judges in S.D.N.Y. in high-loss white-collar cases, it may influence judges elsewhere.166 In particular, judges with less experience sentencing in these kinds of cases might reasonably rely more heavily on the Guidelines anchor. As such, it remains essential that the “anchor” not produce sentences that are arbitrary or too severe.

A. Proposal One: Reduce the Severity of the Loss Table’s Enhancements and Add an Enhancement to Section 2B1.1 Based on the Defendant’s Own Pecuniary Gain

Congress and the Commission should reconsider and amend the white-collar Guidelines. I propose a series of amendments that would provide a more nuanced and accurate assessment of white-collar defendants’ culpability. First, the Commission should propose an amendment167 reducing the severity of the loss table enhancements. The loss table currently provides for enhancements ranging between two and thirty levels. As a result, where the loss amount attributed to the defendant is even moderately high, that loss amount will be by farthe most significant contributor to the resulting Guidelines sentencing range, dwarfing other arguably more relevant factors including the defendant’s role in the offense, the effect of the defendant’s conduct on victims, and—for defendants sentenced on the basis of intended loss—the actual financial harm caused by the offense. Moreover, the pure severity of these enhancements is disproportionate to the harm caused by most white-collar crimes. Section 3553(a) requires the court to impose a sentence “sufficient, but not greater than necessary,”168 to comply with the goals of sentencing, yet the loss table can provide for what amounts to a sentence of life in prison where the loss amount is high enough—even for first-time offenders. As my results suggest, the sentencing ranges produced as a result of loss table enhancements are out of step with judicial, and likely societal, notions of justice. The Commission should thus reduce the enhancements such that they range from one to fifteen levels, rather than from two to thirty levels.169

Second, the Commission should add an enhancement increasing a defendant’s offense level based on the amount of pecuniary gainhe received as a result of the offense. To avoid the exact problem I identify throughout this Note with the current white-collar Guidelines—that they often produce sentencing ranges that are unduly harsh—this new enhancement should be less severe than those provided by the loss table. Likewise, the change should not be made unless in conjunction with an amendment reducing the severity of the loss table enhancements. The current Guidelines instruct the court to “use the gain that resulted from the offense as an alternative measure of loss only if there is a loss but it reasonably cannot be determined.”170 The Commission’s justification is that basing the sentence on gain rather than loss would ordinarily underestimate the loss and, consequently, the defendant’s culpability.171 Under my proposal, the enhancement based on gain would supplement the amount of loss attributed to the defendant under the less severe loss table. This enhancement, in conjunction with my first proposal, better captures the defendant’s true culpability. Defendants with significant roles in an offense are likely to have derived significant economic benefits, while low-level players are likely to have benefited only minimally. Accordingly, defendants with the greatest culpability—those whose conduct results in significant financial harm from which the defendant benefits directly—would be punished severely, since they would be subject to both the loss table enhancements and this separate enhancement.172 Meanwhile, defendants who gain little or nothing through minimal participation in a fraudulent scheme would be subject only to the loss table enhancements, which would be significantly less harsh under my first proposal.173

B. Proposal Two: Apply Loss Table Enhancements Only to Actual Loss

Finally, the loss table enhancements should apply only to losses that have actually accrued, and not to intended loss. In most other areas of criminal law, we punish those who merely attempt to cause a particular harm differently than those who actually accomplish that harm. For example, the Guidelines provide for a base offense level of forty-three for first-degree murder, while the base offense level for attempted first-degree murder is thirty-three.174 And in insider-trading cases, the Guidelines provide for sentencing enhancements on the basis of the gain resulting from the offense rather than losses caused or intended to be caused.175 While there is significant disagreement over how to calculate the gain resulting from the offense in the insider-trading context,176 defendants’ sentences are based on some measure of actualgain, not intended gain. In punishing attempted harm less harshly than actual harm, we recognize that the blameworthiness of the defendant’s frame of mind affects, but is not determinative of, how harshly he should be punished; we must also consider the harm caused to society and to the defendant’s victims.177 Intuitively, it makes little sense to apply the same enhancement to someone whose fraud results in the loss of a million dollars of victims’ savings as we would to someone who attempts (and fails) to sell the Brooklyn Bridge for a million dollars.178 Accordingly, loss table enhancements should apply only to actual losses: the reasonably foreseeable pecuniary harm that resulted from the offense. To capture the additional culpability of a defendant who intends more financial harm than he actually causes, the Commission should propose an additional—but less severe—enhancement that would apply to losses in excess of those that actually accrue.

In sum, my proposals would work together as follows. First, the Commission should amend the loss table to reduce the severity of its enhancements. Second, the Commission should redefine “loss” such that only actual losses qualify for loss table enhancements. Third, the Commission should propose two new enhancements to section 2B1.1—one based on the defendant’s own pecuniary gain, and another that applies when a defendant sought to inflict more loss than actually resulted.

The proposals outlined above are admittedly imperfect, since they still rely on the sort of quantification that makes the loss table—and the Guidelines more generally—suspect to begin with.179 In particular, even if enhancements are less severe, at the high end of the loss table those enhancements will still dwarf other relevant considerations, such as the defendant’s role in the offense. And although my proposals provide a more nuanced way to assess culpability, they still risk producing overly harsh sentences by increasing the number of enhancements that could apply in a given case. Still, reducing the severity of the enhancements, in conjunction with redefining the loss attributable to the defendant, could go a long way toward improving the white-collar Guidelines.

Conclusion

Judges should give little weight to the Guidelines ranges produced under the loss table in white-collar cases. It is true that disregard for the Guidelines could—and probably will—produce interjudge and interdistrict disparities in sentencing. But as Judge Robert Hinkle argued:

It is better to have five good sentences and five bad ones than to have ten bad but consistent sentences. And it would be better still to have ten good sentences—even if they could be explained only as the considered judgment of a good and honest and experienced district judge whose goal was to get it right, and even if that explanation could not be fit into the grids on a guideline chart.180

The fact of difference in sentencing trends between judges or between districts does not mean that unwarranted disparities exist. For instance, my results show that defendants who cooperate in major white-collar cases receive drastically shorter sentences than the range produced by the Guidelines. However, my results also suggest that this phenomenon can be explained at least in part by the fact that the U.S. Attorney’s Office imposes a “cooperation penalty” on defendants that artificially inflates the Guidelines sentencing range. If prosecutors in other districts do not impose such a “cooperation penalty,” we might find that departures for cooperating defendants in those districts are much smaller than they are in S.D.N.Y. This would constitute a “disparity,” but not necessarily an unwarrantedone: the difference would simply reflect differences in local prosecutorial practices.

To the extent we are concerned about unwarranted disparities in sentencing, this concern militates in favor of amending the white-collar Guidelines. Because the anchoring effect of the Guidelines may be stronger in districts where judges see major white-collar cases infrequently, sentences imposed there might be significantly longer on average. Anecdotal evidence suggests this is the case. Mark Harris and colleagues note that “one cannot shake the feeling that an invisible ceiling that formerly blocked off the upper reaches of the Guidelines table has now been breached.”181 “Sentences measured in multiple decades,” they explain, are now “dispensed on a daily basis.”182 But with one exception, the cases on which they rely come from judicial districts where major white-collar prosecutions are relatively rare.183 If the harsh sentences produced by the white-collar Guidelines are rarely imposed in practice, except on the unlucky offenders who are prosecuted in districts with few major white-collar cases, then reforming the Guidelines is even more urgent. To create a more comprehensive picture of post-Booker sentencing in major white-collar cases, and to probe the question of unwarranted disparities in sentencing, further empirical research should be conducted using data from other judicial districts throughout the country, including districts with relatively few such cases.

By chaining the defendant’s offense level to the amount of loss attributed to him—and by defining “loss” extraordinarilybroadly—the Guidelines can produce decades-long sentences even in cases where the defendant’s role was minor or the economic harm caused was minimal or nonexistent—as Olis’s original sentence made clear.184 The same characteristic that makes the loss table a bad tool for approximating culpability—its heavy reliance on a quantifiable metric as the primary proxy for seriousness of the offense—plagues other parts of the Guidelines system.185 Indeed, my results show that judges in S.D.N.Y. do not consider the white-collar Guidelines uniquely problematic.186

Using a detailed chart—no matter how complex—will not always produce sentences “sufficient, but not greater than necessary, to comply with” the purposes of sentencing.187 My findings suggest that the sentencing ranges produced by the Guidelines in major white-collar cases often conflict with this statutory directive. Although the Court in Booker and its progeny returned significant sentencing discretion to judges, the Guidelines remain the “starting point” in every sentencing. Until they are amended to capture more accurately the concept of culpability, Congress and the Commission should not be surprised that judges often conclude that the Guidelines’s “starting point” should not serve as the endpoint in sentencing.