The New Minimal Cities

abstract. Between 2007 and 2013, twenty-eight urban municipalities declared bankruptcy or entered a state receivership to manage fiscal insolvency. To cut costs and divert revenues to debt payments, these cities have taken dramatic austerity measures—an unwitting experiment with a shrinking public sector in cities hollowed by household poverty and physical deterioration. Eventually, these cuts raise a question that looms as large for insolvency law as it does on city streets: Is there a point where the city should no longer cut public services and sell public assets, even in the face of unmet obligations to creditors? If so, what is that point?

This Article looks closely at our insolvent cities—their residents, their physical and social conditions, their debts, their governments. It explores, as a descriptive matter, local adaptations to fiscal crisis. It surfaces, as a legal matter, the latent question that mayors, governors, state and local legislatures, bankruptcy judges, and state-appointed receivers must decide: What share of city revenues can a city preserve for its current residents? Unlike creditors, who have contracts and legal judgments to quantify a city’s obligations to them, residents have no monetized claim to draw on city revenues. Insolvency law itself provides no guidance on this challenging issue—it simply assumes some level of ongoing spending to preserve “health and welfare,” a concept that raises more questions than it answers. This Article explores residents’ interests, mapping out heuristics for decisionmakers and the public to use in thinking about essential public spending in the context of cities at risk of default on debt.

author. Assistant Professor of Law, UC Berkeley School of Law; Visiting Assistant Professor of Law, Stanford Law School (2012-2013). I was fortunate to work with the following students from UC Berkeley and Stanford Law Schools on researching this article and its companion works: Alex Bandza, Marlene Dehlinger, Hed Erlich, Michael Mestitz, Joel Minor, Adam Seiff, and Jonathan Smith. My great thanks to colleagues who read this article with care and insight, including Jed Borghei, Dick Craswell, Chris Elmendorf, Richard Thompson Ford, Jerry Frug, Mark Gergen, Jennifer Granholm, Mark Kelman, Ian Haney-López, Melissa Murray, David Sklansky, Steve Sugarman, George Triantis, the participants at the Stanford Law School and Berkeley Law School Faculty Workshops, and commenters at the Local Government Law Works-in-Progress Conference at Chapman Law School. Zachary Herz, my editor at the Yale Law Journal, proved to be as talented as he was tireless. Sade Borghei rode the roller coaster of this project with me—the awe and beauty of human perseverance, the intimidation and failure inherent in writing about it.

Introduction

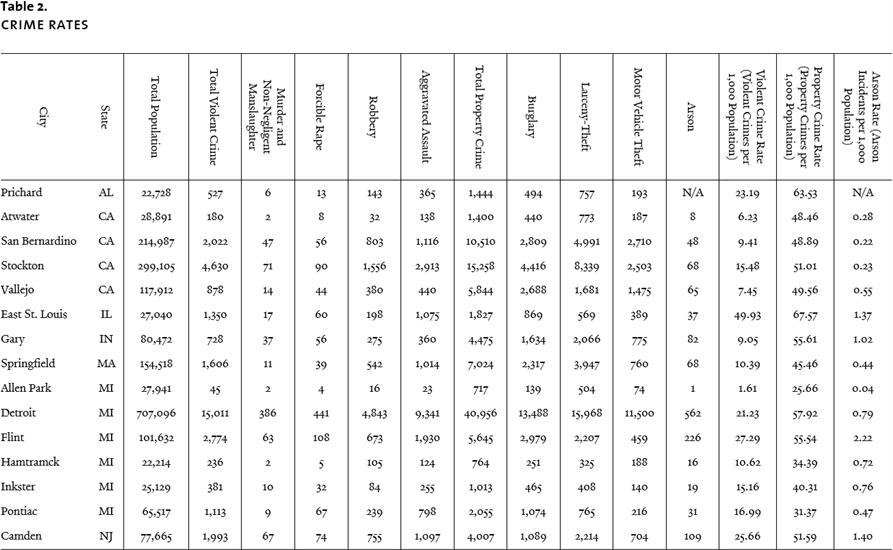

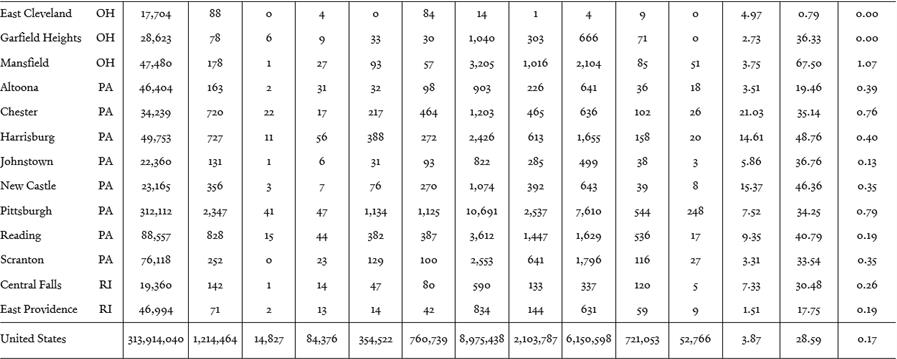

Unable to meet obligations to creditors while also keeping government services in operation, the City of Detroit entered a state receivership on March 14, 2013 and filed for bankruptcy on July 18. That makes Detroit the twenty-eighth city to declare municipal bankruptcy or to enter a receivership for fiscal crisis since late 2008, a window of time that has seen five of the six largest municipal bankruptcies in American history.1 In a long-term transformation of local finance that has accelerated in the recent recession, these cities and others are engaging in slash-and-burn budgeting to address falling revenues, rising expenses, and mounting debt. In San Bernardino, the third California city to declare bankruptcy in the recent recession,2 the City Attorney followed another round of deep cuts to the police department with solemn advice to residents: “Lock your doors and load your guns.”3 Such an announcement would be unsurprising to the residents of Cleveland and East Cleveland in Ohio, Flint and Inkster in Michigan, and other cities beset by rising crime and police layoffs, where 911 can rarely dispatch an officer for a call reporting a non-violent crime, such as car theft, drug dealing, or prostitution. Camden, New Jersey had over 2,100 incidents of homicide, forcible rape, robbery, or aggravated assault in 2011—an average of roughly one violent crime every four hours in a city of approximately 77,000 people, only slightly larger than suburban Palo Alto, California.4 Yet in January 2011, Camden cut its police force in half and eliminated its homicide and narcotics units.5

Where police departments are understaffed, other public services are unstaffed. Cities in California, Pennsylvania, New York, Michigan, Ohio, and elsewhere have terminated thirty to fifty percent of their employees. Following Vallejo, California’s bankruptcy, the city’s 2011-2012 budget explained that in addition to cutting forty-five percent of all public safety staff, “[a]ll funding for youth, library, arts, elderly, needy, education, and recreation programs, projects and positions previously provided by the General Fund were completely eliminated.”6 Decisions to scale government back in this way are distinct from contracting out for services; these cities are not purchasing private substitutes for public services. This is privatization in its purest form—government service shedding, on the unfunded hope that private or charitable alternatives will arise. Yet such cuts amplify the longstanding trend of outsourcing service provision to other public agencies (like counties) and private contractors, because the city government itself has fewer responsibilities, less authority, and a smaller staff.

Cities undertaking austerity measures also shed their property—public assets like parks, pools, and government office buildings. In Benton Harbor, Michigan, a city commission and a state receiver transferred possession of twenty-two acres of the city’s pristine lakeshore and dunes to a private golf course in exchange for critically needed annual income, even though the scattered, inland replacement parcels given to the city as substitute open space required industrial decontamination and the installation of exposure barriers prior to public use.7 In Newark, New Jersey, Mayor Cory Booker sold sixteen city buildings in active public use, including the city’s historic police and fire headquarters and Newark Symphony Hall, in a deal that plugged most of an $80 million deficit in the 2010 budget but will ultimately cost the city $125 million to lease back the buildings over the next twenty years.8

Local government is shrinking in these and other struggling cities. Years, if not decades, of budget cuts and asset sales have left little beyond a stripped-down version of core service functions like irregular police and fire protection, rudimentary sanitation, and water supply. School districts continue to manage education (albeit with budget woes of their own), but the city government itself is no longer pursuing a vision beyond public safety in true emergencies. How low can these cuts go? While laws provide an entitlement to a public education, and we have long struggled to interpret what constitutes a legally adequate education, there is little to nothing to indicate what other services the local public sector must provide. Beyond education, is there some minimum level of public services and public space needed to achieve neighborhood safety and habitability?

This is a humanitarian question, but it is also a doctrinal challenge. A system of state and federal laws governs cities that cannot pay their bills, and decisionmakers in this system (including mayors, governors, federal bankruptcy judges, and creditors) must determine whether a city’s finances require outside intervention, such as a state receivership or federal bankruptcy protection, and if so, how to budget for the city going forward. Decisionmakers must evaluate, in essence, whether a city could cut still more deeply into spending on current residents to pay off creditors, or whether it is creditors, rather than residents, who have to bear the next round of cuts.

Standards for local public services must necessarily inform this balancing of interests between creditors and current residents. Creditors such as bondholders, retired public employees, contractors, and tort plaintiffs have contracts and legal judgments that quantify a city’s obligations to them. Residents, by contrast, have no such legal instruments with which to monetize their share of a city’s revenues. They have no concrete legal entitlements to police and fire protection, no regulations governing emergency response times, no enforceable right to water and water infrastructure, and no mandate for sanitary services like solid waste or wastewater disposal. Municipal bankruptcy and receivership laws articulate a duty to protect “basic public safety” and minimum services “consistent with public health and safety,” but these laws lack guidance as to what those broad concepts mean as a practical matter. How long should a caller to 911 wait for a fire truck or an ambulance? Is there some point when a city’s violent crime rate tells us that the city needs more police officers, if not gang prevention efforts, afterschool programs for juveniles, and victim support programs? Is there a specific density at which neighborhoods are “entitled” to access a public water system? Where to set the floor under public service cuts is a critical legal issue in public insolvencies, but we are asking decisionmakers to reason through it alone, and we have failed to pay attention to their answers.

In this fog of opaque, discretionary reasoning, a curious political reality is nonetheless visible. In the context of municipal insolvency, everyone (liberal, conservative, and libertarian alike) assumes that residents have some claim to share in a city’s present and future revenues. When it comes to public fiscal crisis, everyone seems to agree that it is in the best interests of both creditors and society for a city to continue to provide for the “basic health and safety” of its residents—if not because they are simply people, then simply because they are the city’s taxpayers, the ones who can make creditors whole over the long run without a bailout. Everyone seems to agree, that is, with no public deliberation (let alone agreement) as to what those minimum levels of public services should be. This Article frames and advises that early stage deliberation.

My goal is not to assert that residents’ interests are the only ones urgently at stake in a bankruptcy. “Creditors” is a monolithic word that stands in for thousands of individuals as well as institutions. Among them are retirees who worked for decades in insolvent cities plagued by poverty, crime, and, in some cases, demoralizing working conditions. From the point of view of individual retirees, most pension commitments are not extravagant: the average annual police pension in Detroit, for example, is $30,000 a year, and general city workers (like librarians or sanitation workers) receive about $18,000 a year.9 If these payments fall through, there may be nothing except poverty programs to fall back on, because many of these retirees, including most former fire and law enforcement employees, are excluded by law from Social Security.10 The 10.8 million people (amounting to 64% of full-time civilian public employees nationwide) who work full-time for a local government are stricken with dread as they watch these insolvencies.11 What they see of the fate of public pensions, which are a form of deferred compensation, will affect the competitiveness of public sector jobs and thus the quality of local public services.

The word “creditor” also stands for investors who lent these cities money in good faith, believing loans to municipalities to be one of the most stable, predictable assets available in American financial markets. When a city defaults on its obligations to bondholders, it creates risk in municipal bond markets that may drive up borrowing costs for other cities in the future. Like it or not, the national economy is exposed to these risks. The American municipal bond market includes one million outstanding municipal bonds with a total aggregate principal of more than $3.7 trillion.12 A cascade of municipalities (beyond the twenty-eight cities to date) that paid less than the contracted price for debt would reverberate in the national economy. Individual investors’ exposure to any given municipal insolvency is likely to be proportionately minor as compared to that city’s retirees’ exposure, but default on municipal bonds nonetheless distributes individualized losses to investors, both large and small, most of whom had expressed little taste for (and perhaps tolerance of) risk.

I thus stand on the foundation that creditor perspectives on municipal insolvency are compelling from both a humanistic perspective and a policy one. I leave the full articulation of those perspectives, however, to other work where they are being widely and ably explored. Instead, I focus here on residents’ position in the struggle toward the “least bad” compromise that is the nature of insolvency.

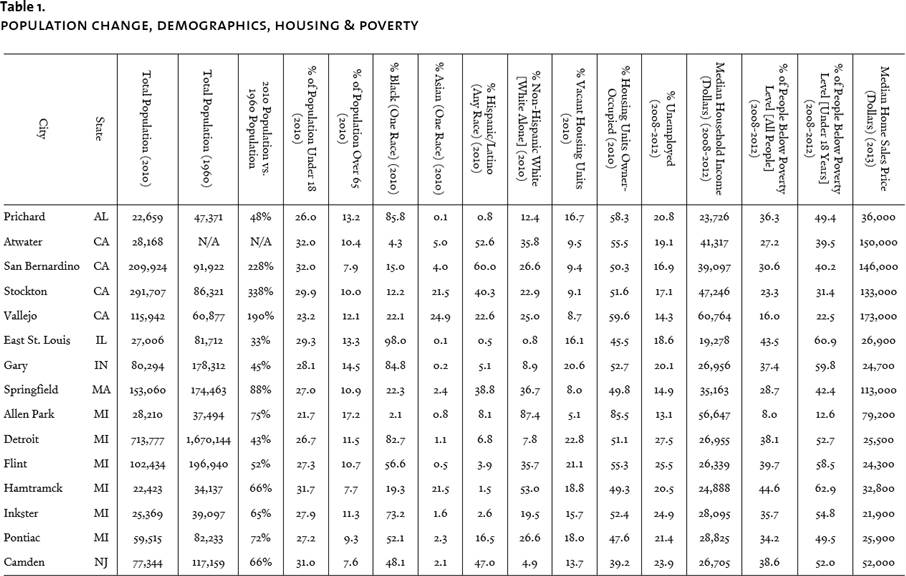

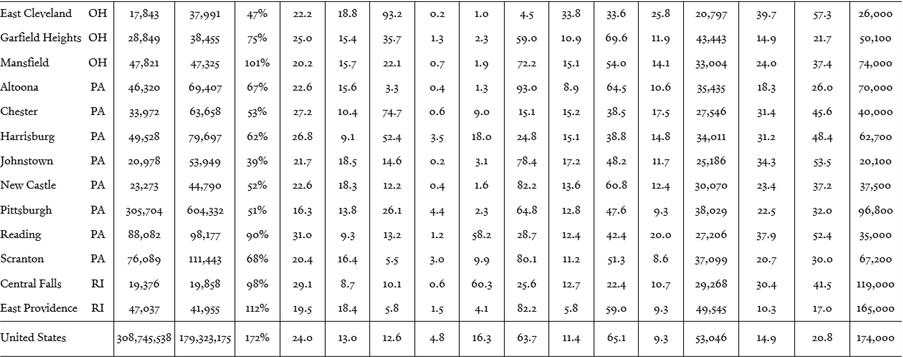

This story of residents’ interests must surely begin with a look at who lives in insolvent cities. Part I provides a comprehensive list of all twenty-eight cities with at least 15,000 residents that have declared bankruptcy or entered a formal state receivership for municipal insolvency during the five years following September 2008. Tables of data about these cities lay out their demographics, poverty rates, population change over time, median home values, crime rates, and other metrics.

Two commonalities are noticeable immediately in all these cities: their poverty rates are high and rising, while their populations are shrunken and shrinking. Poverty means less revenue despite growing expenses—more crime and fires, more children unprepared for school, and deeper needs for drug treatment, afterschool care, and homeless shelters. We might assume that population loss would bring down expenses to offset some rising costs (fewer people cost less to service, right?), but in fact, steep population loss is also dramatically bad for budgets. Cities that formerly had large populations consumed more extensive city services in the past, leaving a disproportionate pension and capital debt overhang. Spatially, such cities’ service territories are as large as they ever were, but the density of service consumers is down, resulting in costly inefficiencies. And people and businesses rarely clean up their mess13 when they exit a city, leaving behind vacant structures likely to be dilapidated or obsolete, if not sullied by contamination and waste. Those structures impose costs much deeper than the aesthetics of dereliction. It has been said that in shrinking cities, demolitions may be the major public works of the twenty-first century.14 Firemen are kept busy and endangered: When arson becomes entertainment, a city’s decay is as desperate as it is ordinary.15

Whatever the service demands of an impoverished shrinking city might be, in a time of state and federal deficits and redistributive intolerance, local fiscal crisis means that city governments must get smaller. What are these cities doing to shrink their governments? After introducing insolvent cities as well as insolvency law in Part I, including an overview of the main legal systems that apply to cities at risk of insolvency, Part II looks at the changes underway in insolvent cities. I consider these adaptations according to a three-part framework that describes the main purposes of local government spending, namely: to provide services (including economic development), to maintain land and equipment for public use, and to regulate for public safety. Because there is very little that insolvent cities can do to increase revenues, cities are cutting services, selling assets, and reconsidering their land-use regulations. This Part explores the nature of the transformative changes underway along each of these dimensions.

The result of these budget contractions is, as discussed in Part III, a generation of urban, high-poverty governments focused on little more than the control of fire and violent crime. These are our new minimal cities. I call them “new” because we have seen minimal local government before. Wealthy suburbs have experimented with a thin local public sector focused primarily on land-use and public safety, including police, fire, sanitation, and land-use control, often via contracts with counties and private contractors. The term “minimal cities” was coined by political scientist Gary Miller in 1981 to describe such places, where local government borders and land-use policies are organized to keep property taxes low and minimize the range of local public services.16 Beyond the fact that government spending is limited, however, the new minimal cities identified in this Article look nothing like Miller’s original minimal cities. Indeed, minimal government in wealthy areas is predicated on excluding the heterogeneous service needs associated with the residents and uses that inhabit our new minimal cities. This reflects an implicit bargain, or at least assumption, that residents who require more public services will live elsewhere. A councilmember of the prosperous, suburban city of Costa Mesa, California revealed candidly that the best way to keep service costs low and revenues high is to filter out residents who might commit crimes—for instance, by catering only to residents with a college degree.17 In a state where only 30% of people over twenty-five years old meet that criterion,18 where would the non-college-educated persons of the state live? The bankrupt city of San Bernardino (about an hour’s drive from Costa Mesa) might be one option, because the new minimal cities are not exclusive—cheaper land provides homes for people with weak buying power, including low-wage workers.

I take up the major normative questions for public law that emerge from the transformation of poor cities into minimal cities, including the question of essential minimum services. Joining the officials who are now struggling to figure out how to maintain basic health and safety, this Part works through the question of minimum standards for basic services by mapping out heuristics for bankruptcy judges, state receivers, state legislators, and the public to use in thinking about the shape of minimum standards. I draw ideas from social contract theory, economic efficiency, human rights and humanitarian exigency, property rights, anti-poverty policy, and land-use planning to assemble a set of normative approaches and sources of law that help reason through residents’ claims to city revenues.

Part IV, in conclusion, asks what it means for local governments to get smaller and do so responsibly. I try to look holistically and pragmatically at how to restructure local government finance and power in light of fiscal stress and concentrated poverty. If we must shrink the local public sector, that change should be intentionally created and internally consistent, not simply government weakness borne of disorganized decay. Like the land-use strategies of the “shrinking cities movement,” which work to restructure the way land is organized and used in post-industrial cities coping with substantial population losses, the concept of shrinking governance that I develop here recognizes that some cities are not on an inevitable, upward growth trajectory. Shrinking governance shifts focus from the context of land use and spatial organization to the broader governance context.

This Article explores what happens when inclusive and exclusive cities are both minimal cities, when a government model from suburban life ends up in populous cities with concentrated poverty. I grieve the conditions in our high-poverty shrinking cities. Yet this Article is neither an obituary nor a lament. It is forward-facing and functionalist. Local governments need ways to build, shrink, and, if desired, rebuild government responsibly and flexibly across economic cycles. They need tools to manage decline that go beyond the passive, injurious strategies of atrophy and attrition. Instead of extending long-running research and debate about why cities reach the point when they can’t pay their bills—a “whodunit” of urban fiscal crisis19—cities need work on what to do about it.

The fact that the broader American economy is thawing does not spell an end to the difficult questions the recession has surfaced. Every city identified in this study has been struggling with deindustrialization for decades, and their pre-recession fiscal prospects were dim. Widening inequality among individuals has imprinted itself in space, and these cities lie within the lowest strata of cities ranked by property values, crime rates, and educational outcomes. In addition, the housing market crash that began in 2006 means that this particular recession will continue to impact local budgets for years. For reasons explained herein, cities’ property tax revenues will lag any recovery of the local housing market by years, if not decades. This is ominous news for local budgets, because property taxes remain the single largest source of local revenues.

For purposes of this current piece, I stand in the current moment—along with the residents and local leaders who live in these cities—to think through the contraction of the local public sector. When cities face the compound threat of poverty, population loss, and fiscal crisis, what should they do? The imperative for research on these questions was captured by author and journalist Charlie LeDuff: “You better look at Detroit, because that’s what happens when you run out of money.”20 Needless to say, running out of money is a phenomenon not limited to cities. It is becoming business as usual for many higher-level governments, from sequestration in Washington, D.C. to serious deliberation about state bankruptcy. So too is it the current state of affairs for many school districts today, which lost 300,000 teachers between 2008 and 2011, resulting in changes like this one: in Texas in 2011, no less than 7,000 schools received waivers from the state’s maximum class size limits for grades K-4.21 A minimal state may thus come to describe the trajectory of the public sector, beyond city hall.

This Articleexplores, as a descriptive matter, the austerity experiment underway in American cities that have gone broke. It surfaces, as a legal matter, the latent question of minimum standards in the system of laws governing cities in crisis. And it investigates, as a normative project, sources of guidance to help fiscal overseers determine the point beyond which it should be legally, or at least politically, unacceptable to cut local public services and sell assets. In so doing, it is wrestling with two challenging issues for legal theory. First is the question of habitability for neighborhoods: Is habitability a scalable concept that ascends past individual dwellings and out into the collective space of neighborhoods and cities? How low can shared services go before we should consider a neighborhood uninhabitable? And second: What does urban life require of public life? What are the essential collective services that we will guarantee regardless of consumer buying power or access to private charity? Posing this question in terms of cities offers a smaller setting in which to explore the age-old debate about what we want from the public sector—what taxpayers expect for themselves, and what they are willing to guarantee for others.

I. cities in distress

“Distress” in a city takes many forms: the percentage of households that live below the federal threshold for poverty, the number of residents who suffer a crime of violence each year, the local unemployment rate, the per capita GDP for the local area, and so forth. Aspects of our federal and state legal systems, such as eligibility for certain grants and loans, hinge on these measures. Insolvency law does not. When a city can no longer pay its bills or is perilously close to that point, some states have shaped a special domain of law designed to prevent or manage the risk of default. These systems rely on signals of distress found in local budget numbers, such as the value and costs of a city’s assets, a city’s cash on hand, and payments due for city debt and contracts. In order to offer research of value to these special legal systems, I have defined “cities in distress” as the finite pool of cities governed by municipal insolvency programs and bankruptcy law.

Where are these insolvent cities, and who lives there? Section I.A introduces these places, their residents, and the causes of their fiscal stress. Section I.B describes the basic structure of the law of municipal insolvency, a legal regime that manages cities in distress as they try to “do more with less,” or simply do less, in their perilous fiscal straits.

A. In Fact

Twenty-eight “urban municipalities” in ten states entered or remained in a state or federal program for fiscal distress during the period extending from September 1, 2008, through September 30, 2013, a window of time that, in my view, effectively benchmarks the worst effects of the Great Recession in terms of local government finances.22 I have defined “urban municipalities” broadly to include all cities with more than 15,000 residents that during the 2008-2013 period: (1) declared municipal bankruptcy, whether or not that bankruptcy petition was accepted by the bankruptcy court; or (2) were officially covered by a formal state receivership to prevent or manage municipal insolvency. The first of these categories is the most straightforward—cities that have formally declared bankruptcy under Chapter 9 of the federal bankruptcy code, including five cities in California, Michigan, and Alabama. The second category captures cities that have formally declared a fiscal emergency under state law, or otherwise have been placed under the jurisdiction of a formal state receivership in which the state is not merely monitoring a vulnerable city’s finances, but has actually stepped in to manage or co-manage its finances. Notably, these two categories include all those debt-rated cities that I have been able to identify that have missed a contractually obligated payment on debt, whether interest or principal, or entered a “distressed exchange” in which the issuer restructures its debt to avoid imminent default or bankruptcy.23 There may well be additional cities in the country that faced insolvency without access to federal bankruptcy protection or a state receivership, leaving their creditors to take the city to court for contract violations. Such cities proved difficult to identify on a comprehensive basis, however, and thus this third method of managing fiscal distress is functionally excluded from analysis here.

The present analysis focuses on cities with at least 15,000 people—a population threshold that tries to capture governments responsible for urban or suburban territory.24 That cut excluded small cities from this analysis that lay in Arkansas, California, Illinois, Michigan, Minnesota, Missouri, New Jersey, Oklahoma, Pennsylvania, and Washington. It also excluded from analysis all counties and special districts. Prominent county insolvencies like Jefferson County, Alabama (which entered bankruptcy in 2011); Boise County, Idaho (which filed for bankruptcy in 2011, but was rejected by the court as ineligible); and Nassau County, New York (which was placed in a state receivership in 2011) warrant separate treatment, given the important distinctions between cities’ and counties’ institutional structures, authority, and political and fiscal autonomy.25 Comparative analysis of cities and counties with respect to fiscal conditions is therefore less productive, if not problematic. I have excluded special districts (including school districts) from analysis for similar reasons. These districts vary substantially from one another in terms of revenue sources, service obligations, and financial conditions; and in any event, they are different from general-purpose municipal governments.

Other than those limitations, the list of twenty-eight cities here includes every city to have declared bankruptcy or entered a receivership program. It is important to note, however, that these cities are not necessarily the only cities in comparably bad fiscal shape. As will be clearer after reading Section I.B below, a city cannot declare bankruptcy unless state law has authorized it to do so. Similarly, a city cannot enter a receivership program unless its state has such a program and the state has selected that city for participation. Other cities may be in comparably dire fiscal straits as the ones evaluated here, but for various reasons, they have not been permitted by their state to enter a special insolvency regime. States may choose to bail out their largest cities through grants and loans rather than let them reach or publicly admit insolvency.26 Even within states with insolvency laws, the choice of which cities to select for state intervention may reflect local or state politics in addition to objective criteria of fiscal crisis. And finally, some small-government states may stay out of the way when a city faces a major shortfall, simply allowing creditors to take that city to court and wrestle things out one debt at a time. In sum, the pool of cities here is not infected with my own selection bias, but it may well reflect elements of selection bias by the state itself, because state laws and decisionmaking determine which cities, if any, are governed by insolvency law.

The research cities, which are listed in full in the tables included in the Appendix, lie in the following ten states: Alabama, California, Illinois, Indiana, Massachusetts, Michigan, New Jersey, Ohio, Pennsylvania, and Rhode Island. All of these cities, including the ones in California, fall in one of two general categories. Each city was either a historic center of manufacturing or a historic suburb (generally associated with a manufacturing city) with an outmoded, deteriorating housing stock.

The first category of places, which have been recently dubbed “legacy cities” or “forgotten cities,”27 includes well-known industrial capitals like Detroit (approximately 714,000 people) and Pittsburgh (more than 300,000 people), as well as an array of smaller mill and manufacturing cities across the Northeast and Midwest: Gary, Indiana (80,000); Springfield, Massachusetts (153,000); Flint (102,000) and Hamtramck (22,000), Michigan; Camden, New Jersey (77,000); Reading (88,000 people), Scranton (76,000), Harrisburg (50,000), Altoona (46,000), New Castle (23,000), and Johnstown (21,000), Pennsylvania; Mansfield, Ohio (48,000); and Central Falls, Rhode Island (19,000).28

These post-industrial legacy cities share similar histories. They were leaders of American industry in the 1920s to 1940s, with “smokestacks reachin’ like the arms of God into a beautiful sky of soot and clay.”29 They weakened as the century wore on. Automation meant fewer manufacturing jobs, and corporate flight away from the union strongholds of older cities to the anti-labor South meant fewer jobs.30 Federal infrastructure investments moved south and west, laying new road and highway systems that facilitated urban ecosystems somewhere else.31 Each lost job took local disposable income and consumption with it.32 As residents and businesses closed up and moved on, they left behind their physical structures: thousands of working-class homes in “neighborhoods stacked like boxes”;33 shells for shops, restaurants, bars, and theaters; hulking, multistory factory buildings and warehouses. As manufacturing and other well-paid blue-collar jobs dried up, median household income fell for those who remained in these cities, reflecting unemployment and the lower wages of sectors like services and retail.34 Among the legacy cities facing insolvency, listed above, all except Pittsburgh and Scranton, Pennsylvania have higher rates of unemployment than the national average. In ten of these cities, at least one in five persons is unemployed. Whereas the median household income for the nation as a whole in 2010 was $53,046, the median household income in these manufacturing legacy cities is $29,26835—i.e., a citywide median income just above the poverty line for a household of four.36

Post-industrial economic restructuring and deindustrialization did not exclusively impact the Rustbelt. Those changes hit older cities across the country, including the military-industrial cities of the West that served not only as major commercial ports, but also as western capitals of military operations. Interestingly, three of the four California cities listed in Table 1 are post-industrial cities, and like many Rustbelt cities, all are the city equivalents of military veterans—they were capitals of World War II or other wartime operations. From 1941 to 1994, San Bernardino, for instance, was home to Norton Air Force Base, which was a major logistics center and freight transport facility for military aircraft, supplies, and equipment.37 The city also provided the main residential neighborhoods for workers at Kaiser Steel, one of the largest steel mills in the country between World War II and its closure in 1984.38 Stockton, which historically had one of California’s most important ports and shipping channels, housed a Naval Reserve Center on Rough and Ready Island, a strategic position in the Cold War. The installation was decommissioned in 1996.39 The city of Vallejo developed primarily around the Mare Island Naval base, which was founded in 1854 as the first Naval base on the Pacific coast and employed nearly 50,000 workers at its peak in World War II.40 Like the others, Mare Island closed in 1996, leaving behind a bedroom community for an employer that had closed shop.41 In all three of these cities, unemployment and poverty rates exceed national rates, and the numbers are staggering: nearly one-third of residents live below the poverty line in San Bernardino, and about one in six adults are unemployed in Stockton and Vallejo.42

Several other listed cities are distressed older suburbs, some of which have historic roots as independent cities but merged with metropolitan areas anchored in a larger central city. These places include Pritchard, Alabama (a suburb of Mobile); East St. Louis, Illinois (a historic city and suburb of St. Louis); Allen Park and Inkster, Michigan (suburbs of Detroit); Pontiac, Michigan (a smaller city nestled in Metro Detroit and its automotive economy); East Cleveland and Garfield Heights, Ohio (suburbs of Cleveland); Chester, Pennsylvania (a historic city between Philadelphia and Wilmington); and East Providence, Rhode Island (a historic city but functional suburb of Providence). All except Pritchard and East Providence have lost substantial portions of their populations since 1960, and many struggle with aging, substandard, and substantially blighted housing stock that dates back to the cities’ role as residential bedroom communities for inner city manufacturing jobs.43 With rising crime, blight, and unemployment, these places have “small-town budgets and big-city problems,” as novelist Philipp Meyer put it.44 Like the legacy cities discussed above, these suburbs are part of a larger pattern. In a national study of 4,066 American suburban governments, the authors classified 168 as “distressed,” as indicated by high rates of poverty, unemployment, and foreclosure.45 These household measures translated into signs of citywide economic distress: Among this pool of 168 distressed suburbs, a full 162 of them had slower economic growth and/or slower population growth (or absolute population loss) than median rates.46

Whether a legacy city or a distressed suburb, cities in insolvency programs exhibit striking commonalities. Table 1 presents variables about each city’s demographics and housing markets, and offers a picture of population change over time. One commonality stands out immediately: all but two of the cities that have crossed the line into insolvency are dogged by individual poverty.47 Our national poverty rates are already quite high: 15% of all people, and more than one in five children, live below the poverty line. Yet the median poverty rate for these twenty-eight cities is more than double that: 31% of all people, and 44% of children. In ten cities, more than half of all children live below the poverty line.48 The statistical definition of poverty helps to highlight the concentrated poverty captured in this data: In 2010, the federal poverty line was $11,139 for a one-person household, and $22,113 for a four-person household with two children.49 In California, with its unusually high cost of living, the poverty rate in the listed cities indicates an even worse standard of living. Yet the median poverty rate among the four California cities still places more than 25% of all people, and 35% of children, in poverty.50

A relationship between poverty and insolvency is not inevitable, because city insolvency is defined by city budgets, not household variables like unemployment rates and per capita incomes. In theory, city and household variables might diverge—cities in fiscal crisis with falling rates of per capita spending might not be poor cities, as defined by the economic status of individual residents. Corruption or mismanagement (such as the junk bond investments that led wealthy Orange County, California into bankruptcy in 1994) can explain a tight fiscal belt. Yet it is more often the case that insolvent cities are populated by insolvent households, because the faltering fortunes of a city’s residents immediately impact the public budget. Climbing rates of local unemployment, for instance, trigger property tax delinquency and home foreclosures, which in turn cause property values, and thus property tax revenues, to fall.51 A weak local business environment leads not only to employee layoffs, but also to falling sales tax revenue. A recession’s impact on income and corporate taxes collected by the state causes state funding for local governments to fall. Public hardship is thus likely to reflect household hardship. For this reason, it makes sense that most cities aggressively shrinking their governments face high rates of unemployment and concentrated poverty.

Cities in insolvency span a wide range of population sizes—from 15,000 (which I set as the population floor for this project) to about 714,000, with a median of about 47,000.52 Yet if they lack commonality in absolute population size, their population trajectory is similar. Most of these cities are facing either recent or sustained population loss. Many would be classified as “shrinking cities” by land-use planners, i.e., as older cities that have lost at least 25% of their population over the past fifty years (1960-2010) and have high levels of vacant or abandoned structures.53 At least half of the cities on the list have a current population that is less than 75% of what it was in 1960. Some of these losses are hard to conceive: Detroit lost nearly one million residents, dropping from more than 1.6 million to 714,000; Gary’s population fell from 178,000 to 80,000; East St. Louis fell from 82,000 to 27,000.54 In cities in the Sunbelt, population change over that same time period was positive, but the recent period since 2006 has seen very steep losses.55 In San Bernardino, California, for instance, 876 units became unoccupied in just three years (2006-2009), and many of those vacancies were spatially concentrated in particular neighborhoods.56

When people move their homes and businesses out of a city, they do not take their buildings with them. They rarely clear them away either: demolishing obsolete or dilapidated structures to clear lots for future reuse is not worth the costs in a weak real estate market. Indeed, if the market is extremely weak, landowners often choose to write off their losses, simply abandoning their lots or selling them for a song to speculators. Especially in heavy winter climates like those across the Rustbelt, abandoned buildings fare poorly; one urban planner for Detroit estimated that after a home is abandoned in the city, it lasts only about six months before it is uninhabitable from the combined effects of squatters, scavengers who strip it for building materials, and snow load.57 Each exiting resident or business in a weak real estate market thus passes a private bill for demolition to the public, which must handle both the public safety problems caused by blighted buildings and the eventual costs of demolition. When a city cannot keep up with necessary demolition, population losses show up as the rate of vacant housing units on the census. Thirteen cities on the list have vacancy rates above fifteen percent. In East Cleveland, one-third of the housing supply is vacant. Detroit has 78,000 abandoned and blighted structures which will carry an average demolition cost of $8,500 per structure, as well as 66,000 blighted vacant lots.58

A weak market that causes an oversupply of housing is a self-perpetuating cycle, because vacancies create further drag on land markets, which in turn drag down property tax revenues that could be used to maintain public safety and keep up with demolition costs. Median home sales prices in the listed cities in 2013 are all below the national figure of $174,000. Only the cities in California, Massachusetts, and Rhode Island even break $100,000 for median sales prices. In thirteen of the listed cities, the median home sales price is below $50,000; in eight of those cities, it is at or below $30,000.59 Falling home values dramatically undermine household economic security and creditworthiness, which, alongside a weak employment market, can drag families into poverty.

Poverty and population loss also reinforce fiscal insolvency. Both poverty and population loss hit government revenues directly, as declining wealth and a declining number of city taxpayers produce lower revenues to fund current services and keep up with past debt. Service quality, public safety, and local quality of life deteriorate while rates of taxation and stigmatization rise, creating a population drain that leaves the city with those residents who are the poorest and least mobile, thus least able to afford private substitutes for public services like afterschool care, elder care, personal security, or transportation. A sliding population means that there are fewer taxpayers to fund debt incurred by past populations, including pension costs. For instance, the ailing city of Hamtramck (a small carve-out within Detroit’s borders) has lost 60% of its population since 1930; its current expenditures cover only 90 public employees compared to 252 retirees.60

A city’s carrying costs for basic public safety services also rise alongside intensifying poverty and blight. Table 2 captures crime rates in the listed cities, and an unfortunate pattern emerges: most of the listed cities have rates of violent crime, property crime, and arson that are higher than national averages. For many listed cities, this excess is by orders of magnitude. Violent crime rates exceed five times the national average in six cities; arson rates exceed five times the national average in five cities. Dilapidated and vacant housing also increase the prevalence of accidental fires, as occupants and squatters improvise wiring fixes and winter heat sources. Given that reporting rates for common crimes, including burglary and robbery, may fall as crime becomes more ubiquitous and police investigative efforts seem increasingly frail or futile, these rates may actually understate the gravity of rising crime.61

Like poverty and population loss, racial segregation is both a characteristic of many cities facing insolvency and a cause for it. While six of the listed cities are more than 75% non-Hispanic white, a much larger share of them (16 of the 28) are majority-minority cities, including eleven cities that are hypersegregated minority cities with non-Hispanic white population at or under 25%. Some of the majority-minority cities on the list, like Chester, East Cleveland, East St. Louis, Inkster, Prichard, and Vallejo, have proud histories as suburban enclaves where middle-class black and Latino families settled in order to purchase affordable, desirable homes in safe areas. These cities, just like the central cities on the list, suffered from long-term white flight as white households self-segregated into suburbs with fewer minority families, and public and private investments in new suburbs continued to grow. Suburbanization and white flight left behind segregated enclaves of diminished economic and social capital, where aging housing and schools further depressed housing values.62 Most recently, these cities were hit extremely hard by subprime lending. Empirical evidence has shown that such high-cost, high-risk loans were concentrated in minority neighborhoods for reasons beyond class and creditworthiness. In high-income, predominantly African-American communities, only about 71% of home refinancing for African-American borrowers earning at least 120% of area median income was done with prime loans, compared to about 83% of refinance loans for lower-incomewhite borrowers living in predominantly white and lower-income neighborhoods.63 Among low-income households of all races living in low-income communities, 10% of home purchase loans were subprime, compared to 18% of loans for equivalent African-American households in low-income neighborhoods.64 These contrasts were even more stark for refinance loans: 27% of refinance loans to low-income borrowers in low-income neighborhoods nationwide were subprime, but 42% of the loans sold to low-income African-American borrowers living in low-income neighborhoods were subprime.65 Long histories of racial discrimination—from racially restrictive covenants to white flight to a persistent discriminatory mortgage lending—are important causes of urban decline in many majority-minority cities, including the intensification of concentrated poverty and population loss.66

Poverty, population loss, and racial segregation account for only some of the fiscal pressures on the twenty-eight insolvent cities. All of these cities face something of a perfect storm—extreme exposure to these factors plus an array of additional pressure. Researchers at Moody’s Investors Service, who closely monitor local finances, have classified the outlook for local governments as negative for five consecutive years; they cite slow economic recovery, sagging property tax and state aid revenues, and elevated pension and healthcare costs as primary causes.67 Below, I go through these explanations, as well as some additional issues, to understand the roots of local fiscal crisis in general and for these cities in particular. Necessarily, these are generalizations and themes based on analysis across cities, rather than individualized accounts of each of the twenty-eight research cities’ fiscal histories. Each one has its own history, and some of these histories have been told elsewhere with tremendous depth and care.

Fiscal crisis in the dataset cities is both cumulative and episodic: It reflects the acute shock of the recent recession delivered to places that, as discussed, were weakened by systemic decline over several decades. The economic downturn (2007-2012) hit cities with a double blow of reductions in state aid as well as property taxes, their two largest revenue sources. Fiscal year 2010 was the first time since 1980 that local governments faced cuts to both revenue sources.68 These sources of revenue account for about 65% of local government income, and they are expected to remain down through at least 2014.69 State tax revenues plunged during the recession, and states passed that pain on to local governments with $12.6 billion in reduced state aid in 2010.70 Some cuts have been especially severe; in Rhode Island, for instance, 2013 state aid to non-education local governmental entities was only 23% of the 2007 amount.71 State aid to local governments is vulnerable to falling levels of federal aid to states; for that reason, reductions in federal spending that improve the federal credit rating are “credit negative” for local governments’ credit ratings.72 Sequestration, fiscal cliffs, and any other drawdowns of federal spending mean local fiscal losses.

Meanwhile, the plummeting housing market meant that property tax revenues to cities decreased by $11.9 billion from 2009 to 2010, and by another $14.6 billion from 2010 to 2011.73 Between 2007 and 2011, home prices across the country fell by nearly 20%, and 1.5 million homes went into default or foreclosure.74 Foreclosures in 2012 remained “stubbornly high.”75 The bottom of the housing market in this recession will show itself for a long time to come in city revenues, because property tax assessment schedules mean that tax revenues lag changes in property valuation by one to three years. Just as assessments were slow to reflect the nadir of the market, so too will they lag the gradual recovery in housing prices.76 In all states, the infrequency of assessments means that property tax revenues will lag recovery by two to three years. In addition, many states (including California and Michigan) have anti-tax laws that control the appreciation rate of land for property tax assessment purposes. This means that, for assessment purposes, the unusually high number of properties that were sold or foreclosed at the bottom of the housing market will retain their depressed valuation until the time of next transfer. The housing market crashed particularly hard in poor cities, because subprime lending disproportionately affected poor neighborhoods and middle-class neighborhoods of color. Spatially-concentrated lending patterns triggered spatially-concentrated foreclosures, which in turn caused rising numbers of vacant and neglected homes as well as downward pressure on remaining residents’ housing values.

In the research cities, housing market losses during the recession were even more dramatic than the national average. The Sunbelt post-industrial cities of Vallejo, San Bernardino, and Stockton revived temporarily from long-term challenges during the sharp ascent of housing values in the 2000s, which turned out to be more of a bubble than a recovery. Due to their long-term structural challenges and high rates of poverty, these cities depended too heavily on property tax revenues and housing industry employment, and their neighborhoods were devastated by concentrated subprime and predatory lending. Stockton, for instance, held the ignominious title for the second highest foreclosure rate in the country in 2011.77 Median home prices there slid from $380,000 to $133,000 between January of 2006 and January of 2013, and had only climbed back up to $155,000 by September 2013.78 The city “teeter[ed] on the verge of bankruptcy” in 2010 and 2011 as property tax revenues sagged, and sales tax and use tax revenues plummeted 30% from 2006 levels.79 The California cities, however, were not the only ones that suffered from subprime lending, foreclosures, and falling home values. During the same period, median home sales prices in Detroit also fell more than 60%, from about $76,000 to $25,500, and had risen back to only $26,900 by September 2013.80

In the midst of falling revenues, service needs have also risen due to faltering household income and employment.81 The country saw a fourteen percent increase in the number of persons living below the poverty line between 2007 and 2010, driving up demand for public services.82 Approximately two-thirds of the finance officers in the country reported that public safety costs went up during the recent recession.83 While county governments in most states provide and administer most health and safety net assistance—like food stamps, indigent health care, child protective services, and so forth84—cities bear some of the costs of poverty through public safety resources, demand for public goods, and unpaid liability for taxes and user fees.

Whereas some local fiscal woes reflect the acute fiscal impact and particulars of the present recession, many are related to long-term structural constraints on older cities. Loose rules about the formation of new municipalities facilitated the incorporation of new suburbs, which competed for residents and private investment and drew tax dollars into new public service territories and school districts.85 Springfield, Massachusetts, for instance, became unable to rely on its own tax base, because so much wealth had moved out of the city.86 The cities that were left behind increasingly functioned as “reservations for the impoverished, with expanding slums and a diminishing middle class.”87 In some sense, all twenty-eight cities have that problem—population losses, rising levels of local poverty, and an inability to pay the bills based on locally generated revenues. But the metaphor also captures the particular dynamic evident in the older manufacturing cities in the group like Springfield, Detroit, Flint, Pittsburgh, Reading, Johnstown, and Altoona.88 Each of these cities is losing population in absolute numbers within a metropolitan area that is still growing economically and that is stable or growing in terms of population. These cities contain a decreasing share of their metropolitan population—the city of Detroit is home to just 17% of the population of Metro Detroit, and just 6% of its combined city-suburban tax base.89 Pittsburgh, which has about half the population it did in 1960, lies in a metropolitan area with a stable or growing population, such that the city’s share of its metro population has fallen from about 22% in 1960 to 11.5% in 2010.90 Cities that have been losing residents for so long thus have faced the dual blows of weakening property values and tax revenues along with the drain of mobile capital, as well as dramatic class polarization between the oldest cities and their suburbs.

The presence of assets and incomes capable of contributing to public services through taxes is the most fundamental limitation on revenue generation. Much less significant determinants of municipal revenues, but nonetheless important, are legal constraints on the available methods of local finance. Tax reforms that constitutionalized strict limits in most states on how local governments raise revenues have been squeezing the public sector for two decades.91 Cities have limited flexibility in generating alternative sources of revenue; state law largely controls eligible sources of revenue and withholds self-governance.92 For cities with a healthy tax base, those constraints do not matter as much—a low rate of taxation is adequate if the asset taxed is valuable and spending needs are low. For asset-poor cities, however, these constraints allow local governments limited flexibility to raise revenues in creative ways, such as using payroll or commuter taxes to claim revenues from persons who use the city (and thus, its services) during their working hours.93 Few states have permitted any degree of involuntary tax-sharing agreements among newer suburbs and older cities, thus blocking regional distribution efforts. Such constraints create asynchronous private and public economic costs and benefits. That is, a metropolitan area’s private economic spheres may be highly interdependent (for instance, with high numbers of suburban residents who commute to central city employment), but the metropolitan area’s public economic life may still be independent, because only the suburb can draw tax revenues other than sales taxes directly from these residents.

If suburbanization is a historic cause for decline, pensions are a new one. Pension debt overhang has been built across recent decades, but it was aggravated and illuminated by the recent recession. Even with the recovery of pension assets on the stock market and the passage of legal reforms that require more cautious pension fund valuation going forward, a worrisome number of local budgets are dragged down by unfunded liabilities for pensions and other post-employment benefits. In a study of 61 large cities across the country (including the most populous city in each state along with all other cities with more than 500,000 people), the Pew Charitable Trust found that the cities collectively faced more than a $217 billion gap between funded and unfunded liabilities for retiree pensions and health care.94 The pensions gap was unevenly distributed: 24 of the cities were at least 80% funded, while others were funded at lower levels, including four cities funded at or under 50%.95 Funding for retiree health care was nearly universally dismal; only Los Angeles and Denver had funded at least 50% of their health care liabilities (with Washington, D.C. nearly there at 49%).96 While the recession led to drops in funding levels of about five percentage points, unfunded liabilities could not be traced to the recession alone.97 The extent of the pension liabilities faced by some of these cities raises concerns that those cities will become tomorrow’s insolvencies. Detroit was the only city included in the Pew analysis that is currently insolvent, but the lowest performers in the Pew study belong on “watch lists” of cities in fiscal distress.

The pension problem boils down to several specific causes of unfunded pension and retiree liabilities: (1) the rising costs of retiree health care, due to both increased longevity post-retirement and rising health care costs; (2) unaffordable contracts and promises;98 (3) imprecise and excessively optimistic accounting methods;99 and (4) management failures, including underfunding. A fifth critical factor applies to the research cities: a shrinking population necessarily causes a pension debt overhang created by having fewer taxpayers to sustain retirement commitments made by a larger past population for a larger past workforce. This issue is taken up in more depth in Part IV. Apportioning blame among these factors is beyond the scope of the current discussion, but suffice it to say that cumulatively, pension woes are a relatively minor cause for fiscal stress in many financially troubled cities, as compared to overall financial management problems (including the pension bond deals described below) and weak local economies.100

There may be an important and understudied sixth cause of pension-related fiscal stress as well: the desperate restructuring of pension obligations through derivatives and other “creative” financial instruments designed by investment banks and sold to cities. In Detroit’s case in particular, the city’s pension problems were made significantly worse by a debt deal that sought to restructure the city’s pension liabilities in 2005. In that deal, Merrill Lynch, UBS, and other banks sold Detroit swaps and other complex financial instruments to fund the city’s pension liability—debts that turned out to be closer to high-risk, high-cost subprime second mortgages than to the sensible “refinance” the banks described the deals to be. Such deals included trigger clauses that, upon the happening of a stated adverse event (such as the downgrading of the city’s debt), required immediate, sizable payments or the surrender of collateral to swap holders. In the court opinion deeming Detroit eligible for Chapter 9 bankruptcy, the judge described the impact of a 2008 drop in interest rates: “[T]he City lost on the swaps bet. Actually, it lost catastrophically on the swaps bet.”101 Cooked up in 2005, the city now owes as much as $2.8 billion on that deal, more than a fifth of the city’s debt.102

Cities vary in their degree of exposure to these different pension funding challenges, but all such cities face a similar problem from residents’ point of view. San Bernardino’s bankruptcy filing captured this problem. The city had cut more than 250 staff positions between 2009 and 2012, and its service needs were rising due to population growth during the housing boom, rising poverty and unemployment, and gang-related crime.103 Yet the city’s costs per retiree continued to increase—costs that the city had failed to fund as they accrued. “This unfortunate fact,” the city wrote, “has forced the City to reduce staff and services in an effort to balance budgets without receiving any corresponding reduction in its personnel costs.”104 Higher costs, less labor: From residents’ perspective, that statement sums up the pension crisis for all the research cities and many others. And yet its truth offers no easy answers, given that the average pension in California is only $29,000 per year—and a contract promising such payments “can be made cheaper only by breaking it.”105

Beyond poor planning and unrealistic performance models for pension liabilities, the research cities have faced other management problems. These include failure to plan for downturns, staffing challenges, and, in a few cases, self-dealing and corruption. An intensive, qualitative study of four of the high-poverty, majority-minority postindustrial suburbs that have entered insolvency (East Cleveland, Chester, Inkster, and Pritchard) found that management and governance challenges included, among other concerns, “high turnover among city professional staff due to poor working environments and low wages.”106 For cities that have weathered corruption scandals, these problems surely worsen. Camden107 and Detroit, for instance, are more famous for their bad mayors and other exploitative officials than their good ones. Detroit’s infamous Kwame Kilpatrick was a catastrophic mayor for reasons ranging from personal bad behavior to bribery. But from a fiscal point of view, the most expensive mistake Kilpatrick made was the pension bond deal described earlier in this Section—a deal for which he was awarded a regional “Deal of the Year Award” for 2005 by the Bond Buyer, the main news source for municipal bond investors.108 This bad deal and Kilpatrick’s political corruption, however, should not eclipse the city’s other mayors who struggled to do right by their struggling city. Detroit’s first African-American mayor, Coleman Young, for instance, who governed the city for twenty years, was fiscally conservative (even “neoliberal” according to some accounts) and brought the city to its lowest level of debt since at least 1950.109 Young’s administration was memorably symbolic—the first major American city to have a black mayor, arriving at a time of intense racial discord over the nearly all-white police force’s aggressive treatment of black residents and intensifying white flight—and Young had a rhetorical style that did not mince words about racial tensions in the city. In that context, the public habit of blaming the city’s fiscal problems on its first black mayor may say more about white skepticism of black capacity for self-governance than it does about his administration or governance of the city generally.110

Last but not least, a few cities on the list are also facing fiscal distress caused by problematic development projects, including the construction of public facilities by private contractors.111 Harrisburg, Pennsylvania’s descent into insolvency over a private contract to build a trash incinerator is now a cautionary tale describing $282 million dollars of opportunity costs. The city built a trash-to-electricity incinerator in 1972 that began to break down and violate air pollution regulations until the EPA ordered it closed in 2003.112 The city decided to refurbish the facility instead of closing it, and contracted with a private company to do the work—a bad bet, given that the unusually low bid was too good to be true and the company proved to be incompetent and inexperienced.113 Instead of making the facility profitable and providing Harrisburg with a revenue stream, the incinerator burned little more than $125 million of city funding. In 2010 alone, Harrisburg owed $68 million in debt service for the incinerator—more than the city’s typical annual general fund budget of $55-65 million in the 2002-2011 period.114 Pittsburgh, or at least its county, is at risk of following in Harrisburg’s footsteps. The Allegheny County sewer system is under a consent order with the EPA to repair its aging and overwhelmed sewer system, which dumps untreated sewage from the city and its suburbs into the region’s three major rivers every time there is “even modest rainfall.”115 The EPA order requires the regional authority to solve the problem by 2026; the public works project necessary to do so will cost about $2.8 billion.116

The foregoing give some sense of our cities in distress. Even as cities’ fortunes may rise and fall together on the tide of the general economy, the American system of cities has always had strong and weak places, growing and shrinking regions.117 Today’s Silicon Valley and its Information Age kin, like Austin and Boston, are roaring despite the drag of the recent recession. Their growth is reminiscent of Detroit and its family of industrial cities in the 1920s and 1940s, when they fueled the nation with innovation, jobs, and culture—from jazz to Motown, from the first high-rise architecture to our finest urban parks. Growth, those cities learned, is not always a ratchet; yesterday’s urban titans have been “sinking down”118 for decades. Faced with sustained fiscal shortfalls and pressing needs, some cities must turn to legal machinery to manage urban decline.

B. In Law

When a city cannot pay its bills or meet its obligations to creditors, one of three legal systems kicks in, depending on state law: municipal bankruptcy, a state insolvency program, or traditional common law remedies.119 This Section provides an overview of these legal approaches to municipal insolvency.

The first track for dealing with municipal fiscal distress is bankruptcy, offered under Chapter 9 of the U.S. Bankruptcy Code.120 For Tenth Amendment reasons, this option is available only where the state has “specifically authorized” the municipality, or all municipalities in the state, to so file.121 Twenty-seven states permit their municipalities to petition for bankruptcy in some circumstances, but most of these states set very narrow pre-conditions and approval requirements.122 The substance of Chapter 9 is very much in flux. The current wave of Chapter 9 filings from California, Michigan, and Alabama is raising new and difficult legal questions regarding (1) the meaning of fiscal insolvency, an eligibility requirement for Chapter 9;123 (2) the nature of a city’s obligation to negotiate “in good faith with creditors” if such negotiations are practicable and it has not obtained plan approval from a majority of claims;124 (3) the meaning of California’s 2012 statute establishing new pre-conditions for filing Chapter 9;125 and (4) most controversially and consequentially, the status of collective bargaining agreements under Chapter 9.126 Detroit’s bankruptcy filing, which is orders of magnitude bigger than any in history, has the potential to remake the legal and political landscape of these issues.

More broadly, Detroit and the other current bankruptcies will give cities and creditors a better sense of the consequences of municipal bankruptcy. Cities already have a pretty good sense of how painful it is to try to forestall bankruptcy. As explored here in Part II, avoidance means austerity measures such as slashing cuts to services and widespread employee layoffs; emergency asset sales that, because they are so rushed, may yield lower dollar amounts than the full value of the property; and high-cost, high-risk credit deals with investment banks. Cities also know some of the punishing downsides of bankruptcy that have made Chapter 9 so rarely used: a bankrupt city loses the ability to borrow; it may hurt other municipalities’ ability to borrow in its state or region; the filing is stigmatizing for the city, making it harder to retain and attract businesses and residents; it is terribly expensive in legal and administrative fees; and it is politically damaging, if not disastrous, for sitting officials.

Cities do not, however, have as good a sense of what lies on the other side of bankruptcy: whether they will be able to restore an acceptable level of services, whether they will be able to attract competent employees, what it will take to recover their creditworthiness, and so forth. That means that creditors are still learning too: they have to adjust their expectations on whether states and federal governments will bail out insolvent cities; unions and public employees have to learn how much to trust deferred forms of compensation like pensions and retirement health care; and bond markets have to adjust how they think about the credit risks of lending to municipalities.

State municipal insolvency laws and programs, which at least twenty-three states have formally put in place, provide an alternative to municipal bankruptcy, and thus a reassurance to creditors that the state will avoid rewriting municipal debt agreements under Chapter 9.127 State insolvency laws, which can be generally applicable or ad hoc legislation, call for intervention by the state in local fiscal affairs (commonly called a receivership) during a period of distress or emergency.128 State supervision varies widely in terms of the state’s proactive monitoring and auditing of local finances, the procedures and management of the state intervention, and the terms and circumstances of the state’s withdrawal.129 Typically, municipal insolvency legislation identifies economic criteria or other triggering conditions for intervention. Upon satisfaction of those pre-conditions, a state financial board or state-appointed receiver is authorized to gather information about the city’s financial condition, to manage its debt or guarantee the city’s loans, and to manage the city’s finances through a recovery plan.130 State programs vary widely in the amount of control wielded by the state; from “oversight” programs with weak authority to intervene in cases of fiscal distress to “control” programs with strong intervention authority.131 In stronger systems, the receiver may be empowered to raise taxes and user fees, cut or contract out services, liquidate assets, and approve or negotiate collective bargaining agreements.132 While receiverships were traditionally coupled with state funds to help fund services and stabilize credit through grants, loans, or loan guarantees, state budget stress and weakened political will to “bail out” municipalities have meant that some states are providing less fiscal relief.133

The final category of law that has evolved to address municipal fiscal meltdown is the default position of “traditional creditors’ remedies” where bankruptcy or a receivership program is not in place.134 If a city cannot pay a creditor, that creditor can simply take the city to court, bringing a state mandamus action to compel the city to pay its debts. Creditors’ remedies, which can be organized and enforced through a judicial receivership, can include the sale of city property not in public use (i.e., property owned in a proprietary capacity rather than active public use) or the compulsory levy of new taxes.135 Judicial receivers do not have the power to impair the city’s contractual obligations, but they can stay proceedings against a municipality while it comes up with a plan for paying its debts.136

It would be sensible if the choice among Chapter 9, a state insolvency program, and a judicial receivership depended on the nature of the city’s fiscal distress. That is not the case, however, because states rarely offer more than one of the three systems to manage insolvency. The choice among them reflects a range of issues related to politics, history, and ideology. For instance, this choice implicates both local autonomy (how much independence and discretion will local governments have?) and state governance (is the state willing to fund staffing and administrative costs to monitor local finances?). It reflects state lawmakers’ views on contagion effect theories positing that any write-down on municipal bond debt will drive up the costs of borrowing for all other municipalities in the state. Choices among insolvency regimes also reflect different views about why cities in a particular state have floundered, diverging roughly into mismanagement explanations (including corruption), political theories (including excessive rent seeking by special interests), and socioeconomic decline theories (emphasizing urban poverty and suburbanization).137 Historically and ideologically driven views about the predominant cause of insolvency in a particular state inform whether decisionmakers seek to make insolvency a punishment, a quarantine, or a safety net.

The cities covered in this study have all crossed the legal line into one of these systems of law. Three of the four California cities on the list filed for bankruptcy as permitted under state law, after each city followed the prescribed procedure of pre-bankruptcy negotiations and findings. The fourth city, Atwater, declared a fiscal emergency as required by these procedures, and started down the road to a Chapter 9 filing. Pritchard, Alabama also filed for Chapter 9 protection. Michigan and Rhode Island have formal state receivership programs in which all of the listed cities are participants; and in each state, one city (Detroit and Central Falls, respectively) went past a receivership and into bankruptcy.138 Illinois, Indiana, Massachusetts, New Jersey, Ohio, and Pennsylvania have formal intervention programs for municipal bankruptcy, but none of their struggling municipalities have entered bankruptcy.139 The City of Harrisburg did file for Chapter 9, but the state acted to block the filing and the judge determined that the city was thus ineligible for Chapter 9—a sequence that reiterates the state gatekeeping function in accessing Chapter 9, regardless of municipal will or depth of deficits.140

When cities are scrambling to avoid these programs and managing affairs once inside them, how do local governments and governance change? Understanding these adaptations is a first step to thinking about how cities can manage fiscal distress strategically and responsibly.

II. shrinking government

Referring to former workers in the auto industry, the head of a Michigan-based career center recounted:

The hardest thing for many auto workers who’ve been doing the same job for 25 years or so to accept is that instantly, permanently, their standard of living has been ratcheted down 80 percent . . . . You may have been making $25 an hour making widgets for years, but now your skill set means you’re worth $8 an hour.141

That fall—experienced by individual households across the country—is also evocative of the depopulation, revenue losses, business closures, and physical ossification that industrial cities have been experiencing since the 1950s. Cities that once symbolized American prosperity now symbolize decline.

What does it look like to go from prosperity to poverty for a city government? Long-term decline and acute recession mean less money in city coffers, and lower revenues necessarily mean less purchasing power for a city government or a growing overhang of debt, or both. One way or another, sooner or later, the government will have to get smaller. How they do so is a critical issue.

For one thing, as legal scholar David Skeel has argued, the public response to severe fiscal crisis can look a great deal like an inefficient liquidation. Even though public entities, unlike corporations, are not technically at risk of involuntary liquidation during a period of distress (because receivers and bankruptcy courts have no power to dissolve the city), the desperation to cut costs can lead to the inefficient sale or seizure of assets that will compromise long-term viability for the entity, ultimately making creditors as a whole worse off.142 Skeel tells the story of states’ dramatic downsizing in the recession:

California was poised to sell $1.3 billion of its public properties until Governor Jerry Brown called the sales off. Many states have cut back sharply on public libraries and social programs. These cuts may destroy synergies—such as the networks developed in connection with an antipoverty or prison-release program—in ways that echo, at least loosely, the inefficient liquidation of a business.143

The hasty sale of cities’ physical property assets (like land and buildings) can generate less value than those assets are worth. Deep cuts to key services like schools and public safety can push residents and businesses to exit the city. And in the local context, “synergies” may be far-reaching, such as the interdependence of preschool programs and parental employment, or of youth summer programs and policing. Inefficient sales and cuts may leave less money to pay creditors and fund future services, thus making everyone, including creditors, worse off. Public downsizing may cause human harms as well, especially in a city with rising poverty rates. Residents may abruptly lack access to youth afterschool care or supervised recreation. Public employees can lose their jobs. Falling law enforcement and rising crime creates victims of crime—from home burglaries to assaults to homicide.

With these economic and humanitarian concerns in mind, this Part describes the way that cities navigating insolvency are downsizing. In order to sort through these changes, I offer a framework for categorizing cities’ activities. In my view, which reflects a distillation of ideas that are common across law and theory, local governments are empowered with revenues and coercive authority to fulfill three main purposes: (1) to provide or facilitate services; (2) to hold land and property in the public interest; and (3) to regulate for public health, safety, and welfare. Local governments are also important in fostering democratic participation, but this broad mandate is least malleable during a fiscal crisis and is best left for a distinct exploration of participation and public accountability in the context of rising household poverty.144